Painstaking Lessons Of Info About Capital Budgeting Excel

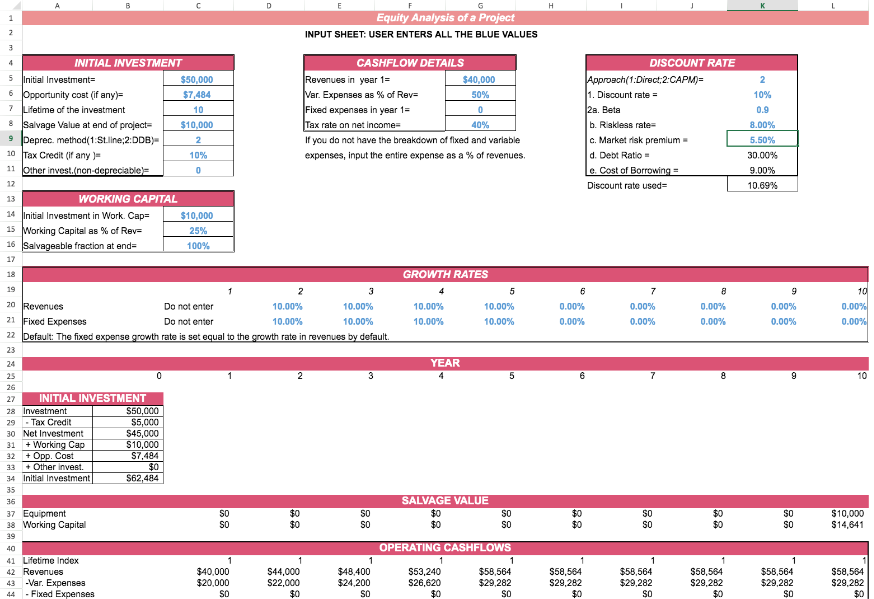

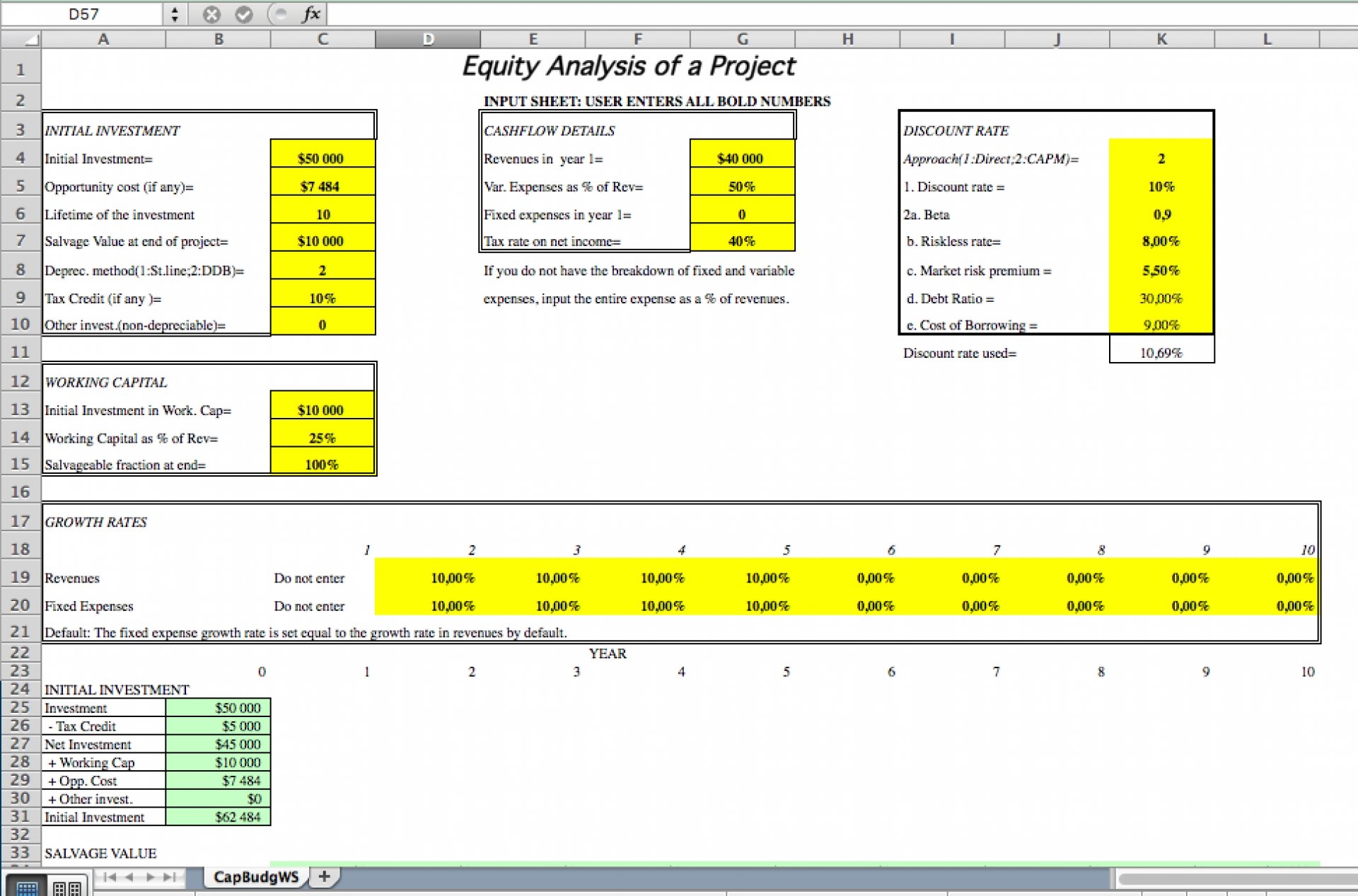

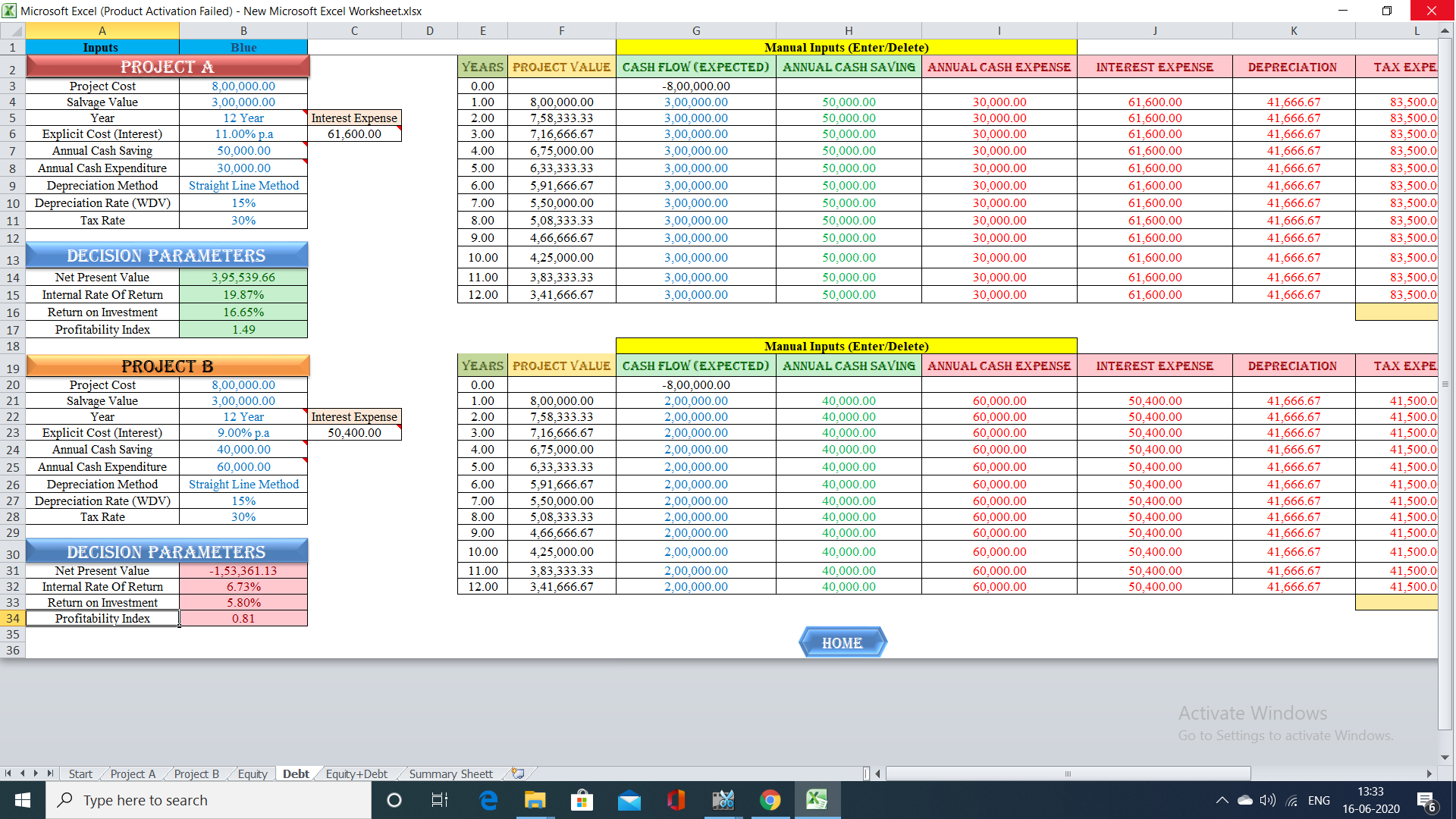

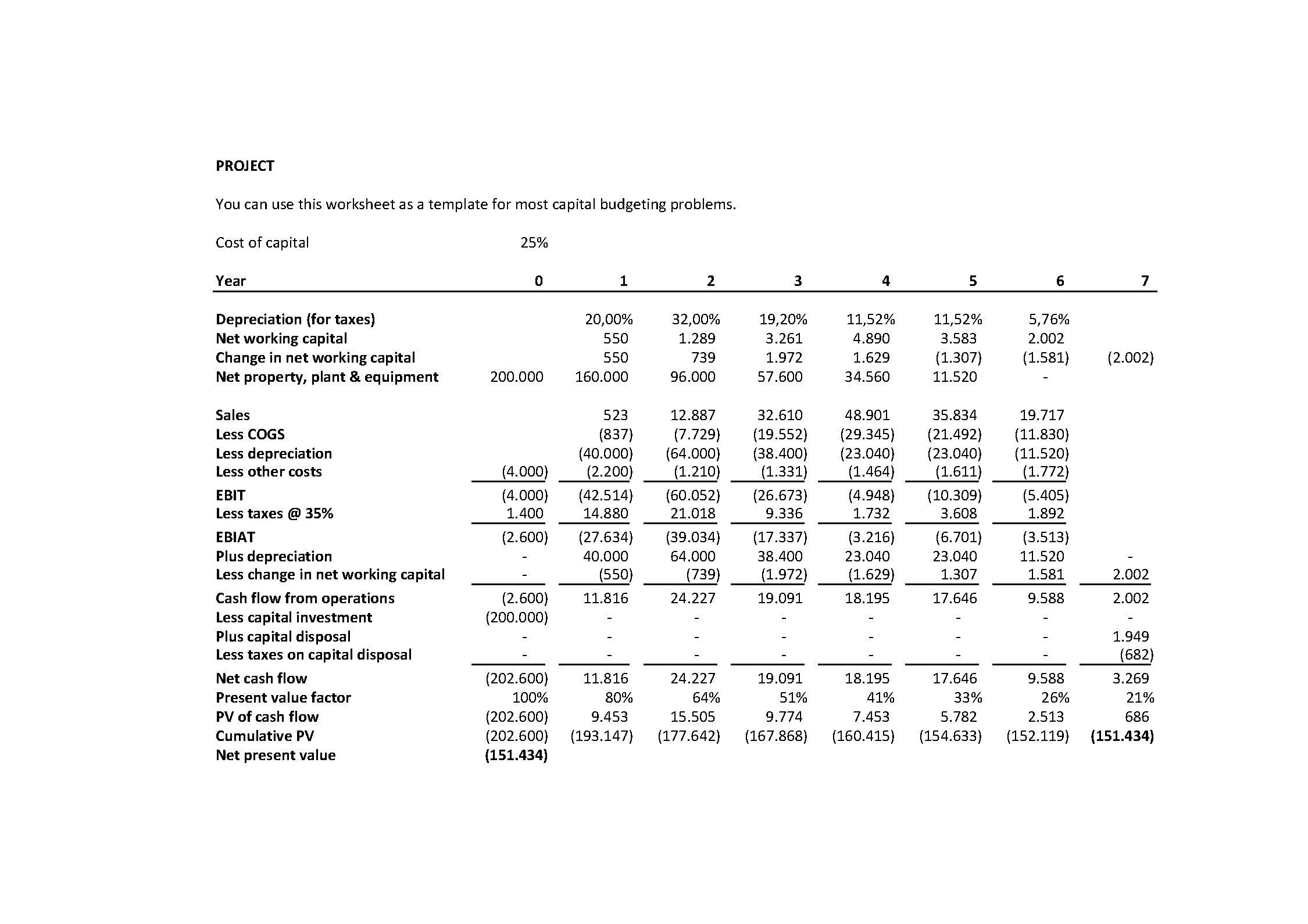

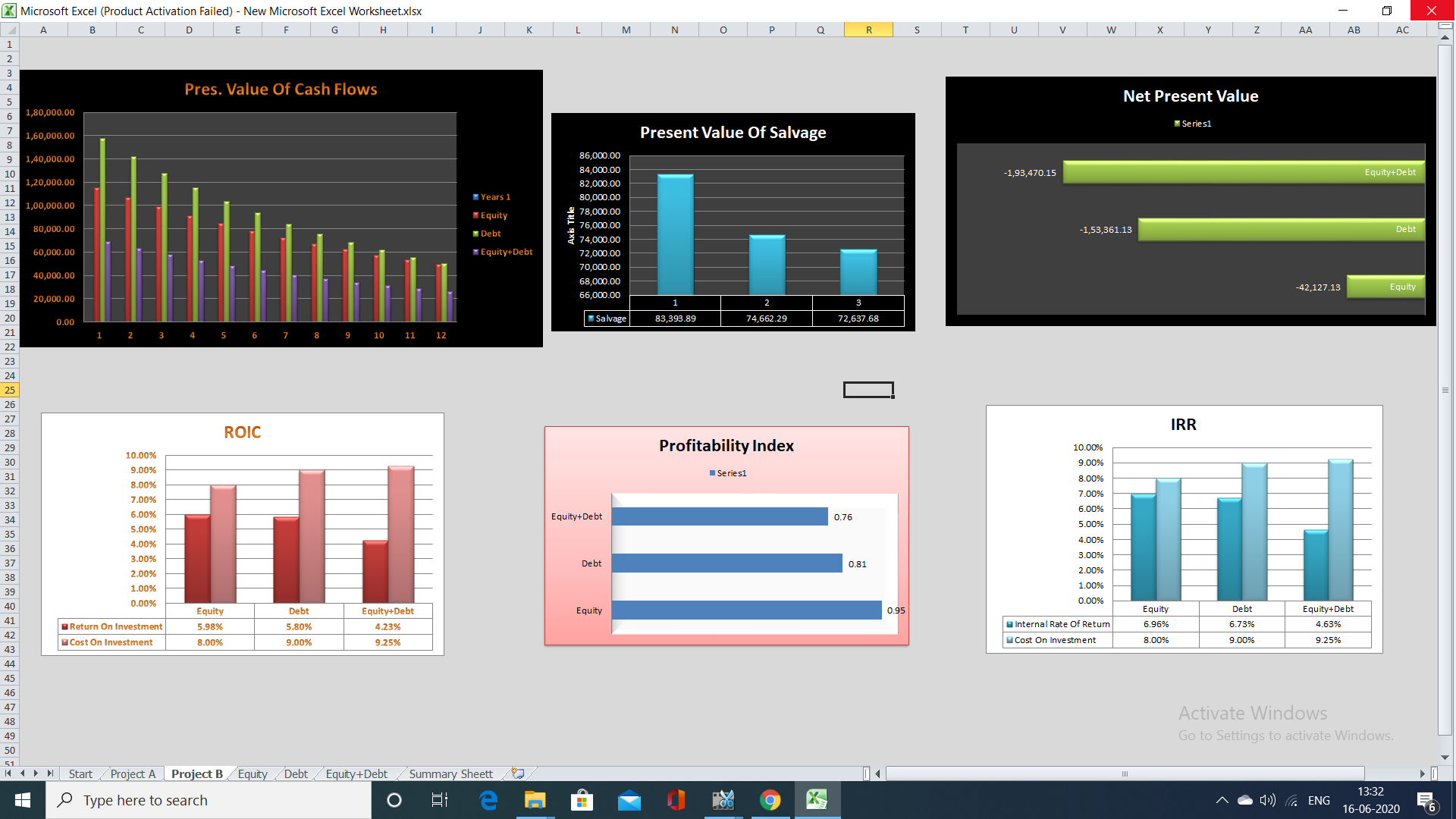

With this capital budgeting excel model, compute the equity analysis of a project by giving data on your initial investment, working capital, growth.

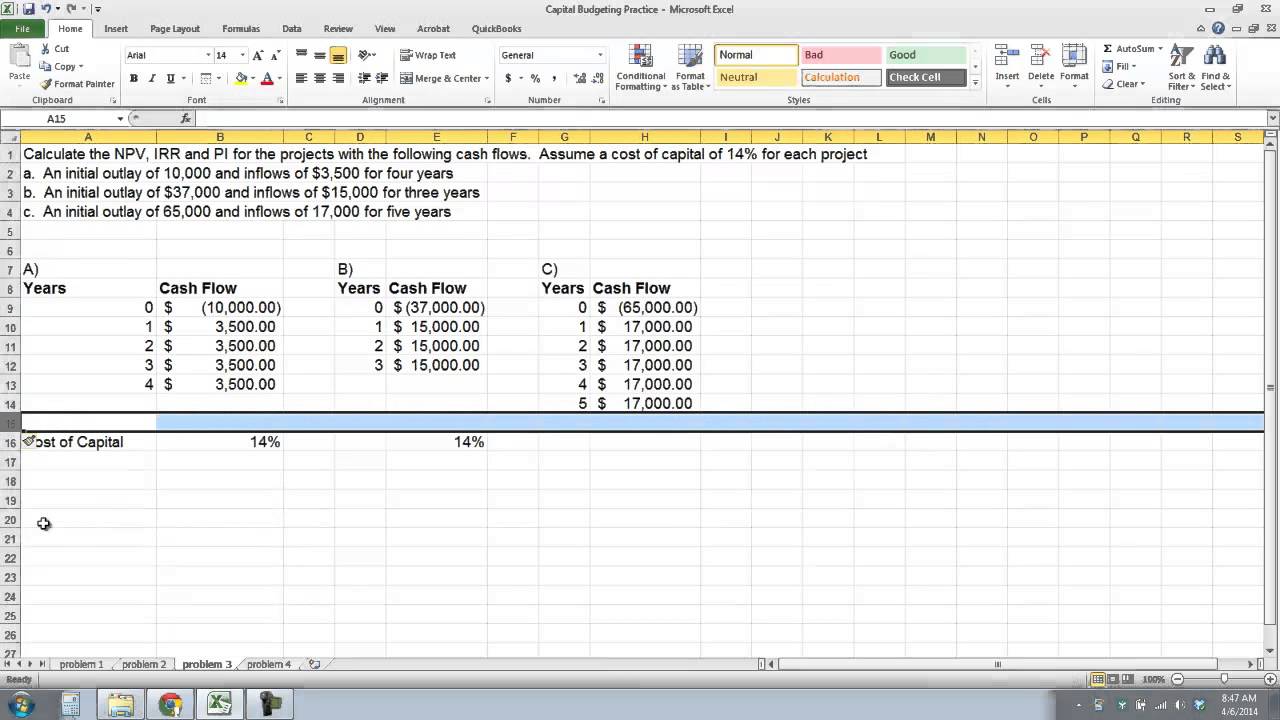

Capital budgeting excel. What is capital budgeting? Capital budgeting is a process that businesses use to evaluate the potential profitability of new projects or investments. How to create capital budgeting in excel introduction.

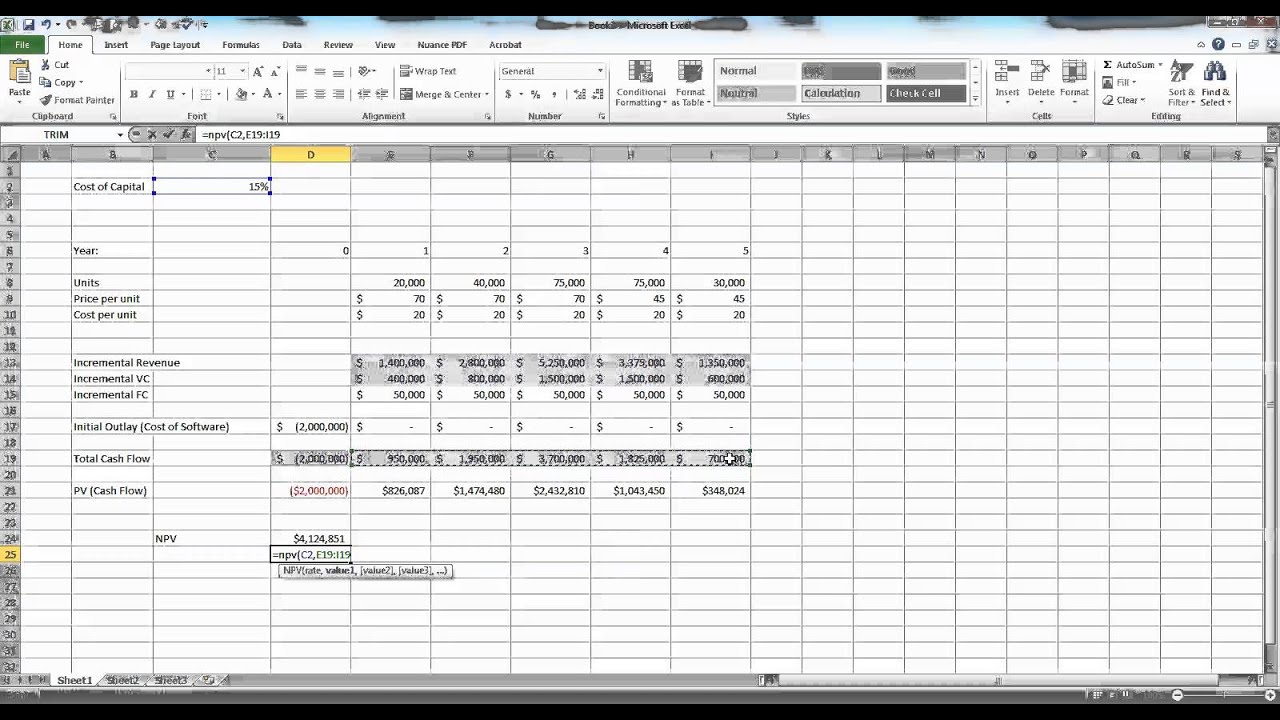

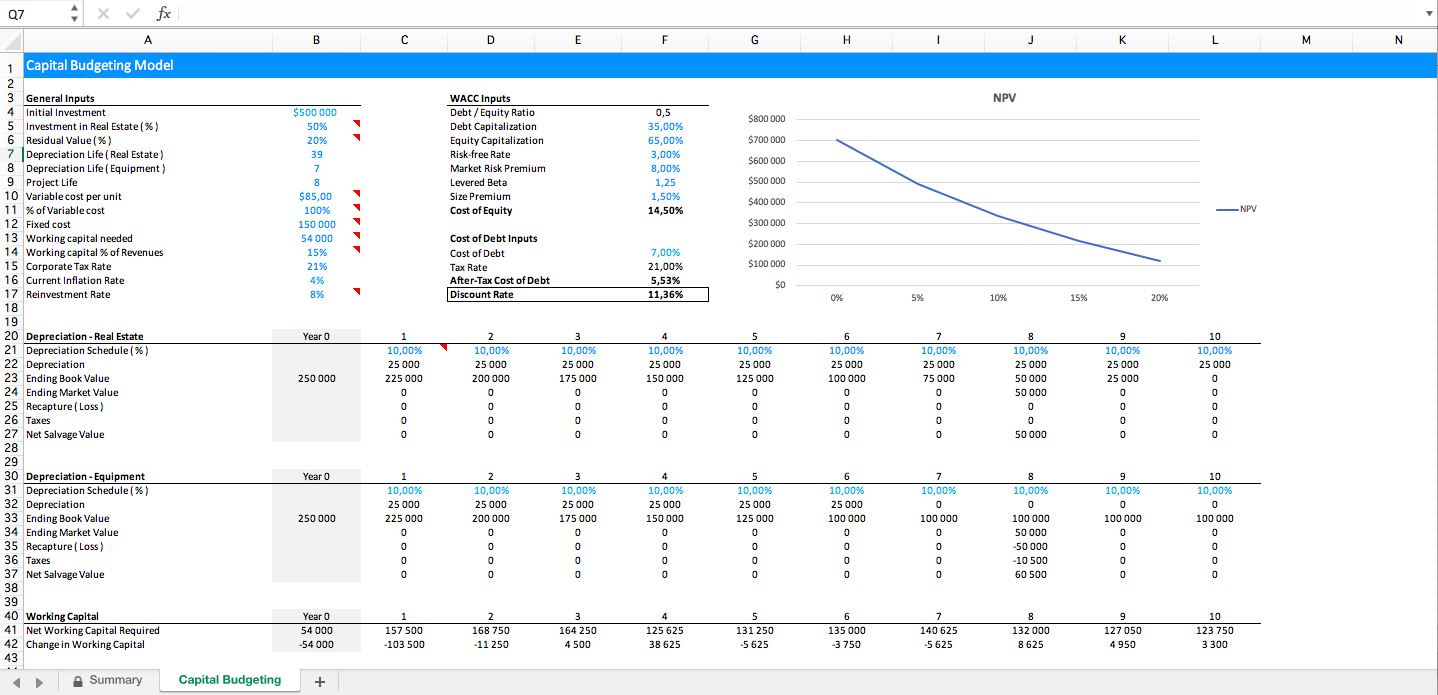

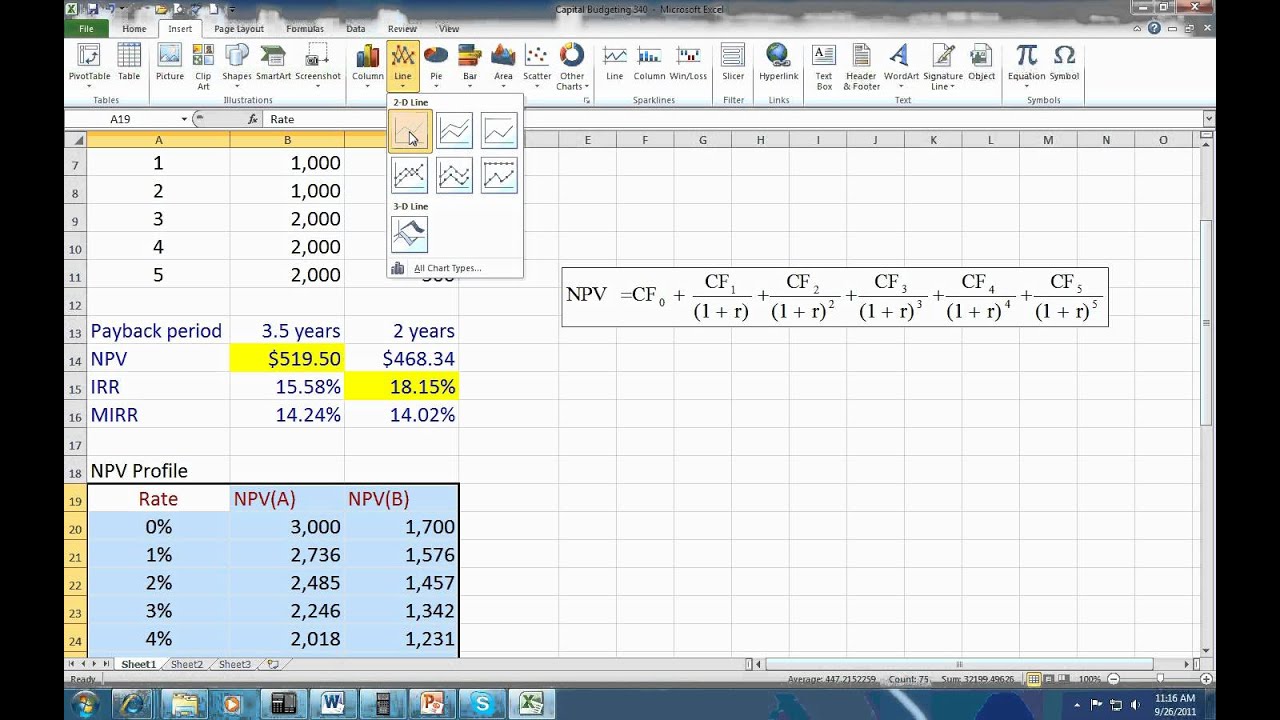

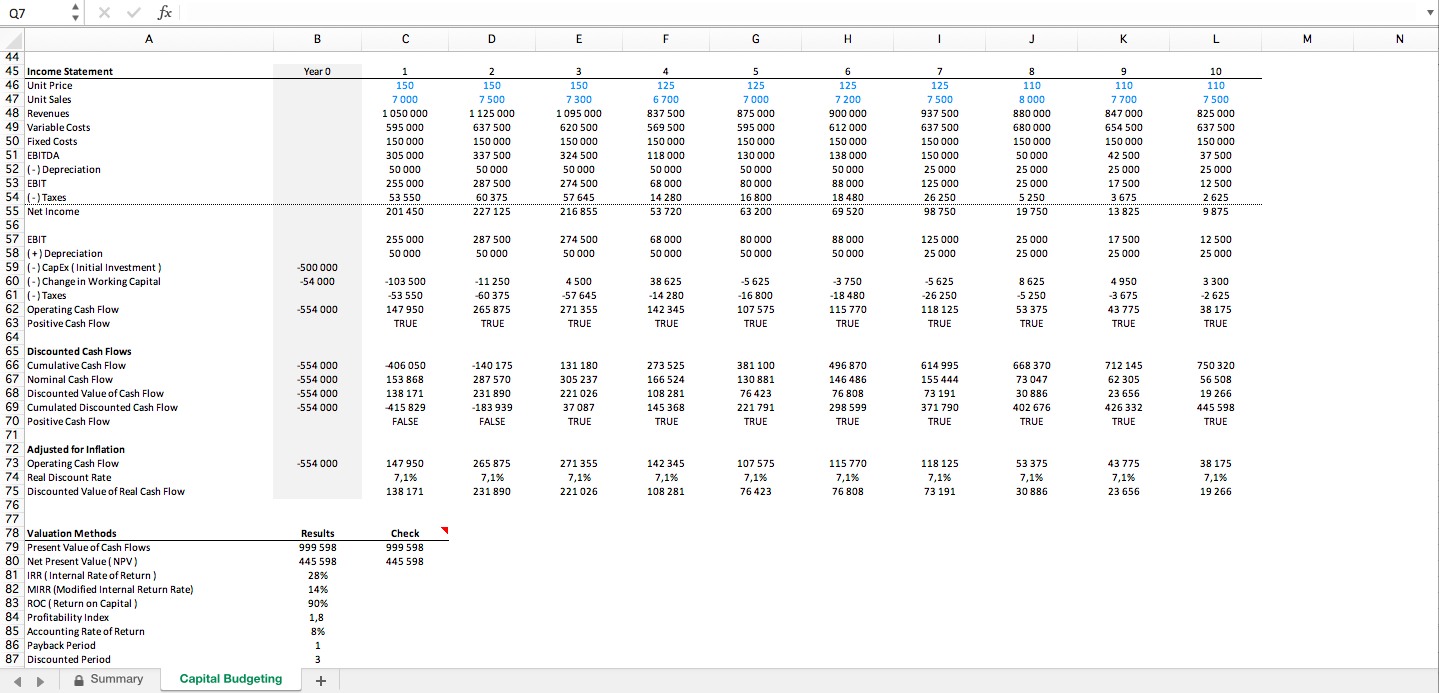

This video explains how you can solve any problem regarding capital budgeting with the help of. This article focuses on the components of a capital budgeting model, such as data tables, cash flow projections, and discounting factors, that. Sensitivity analysis is a method used in financial modeling to.

The data entry worksheet is where all of the information will be input related to future cash flows. This capital investment model template will help you calculate key valuation metrics of a capital investment including the cash flows, net.

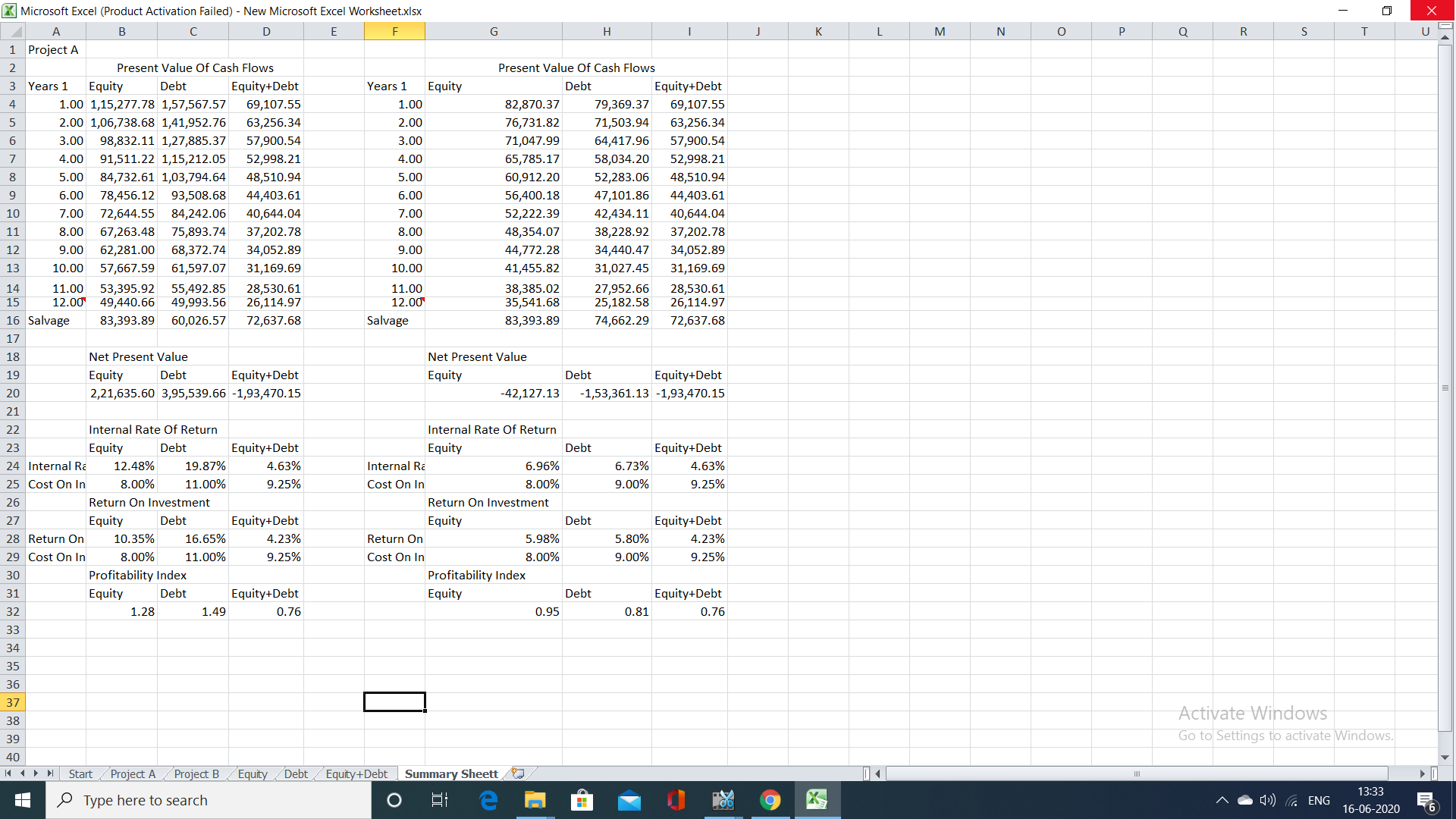

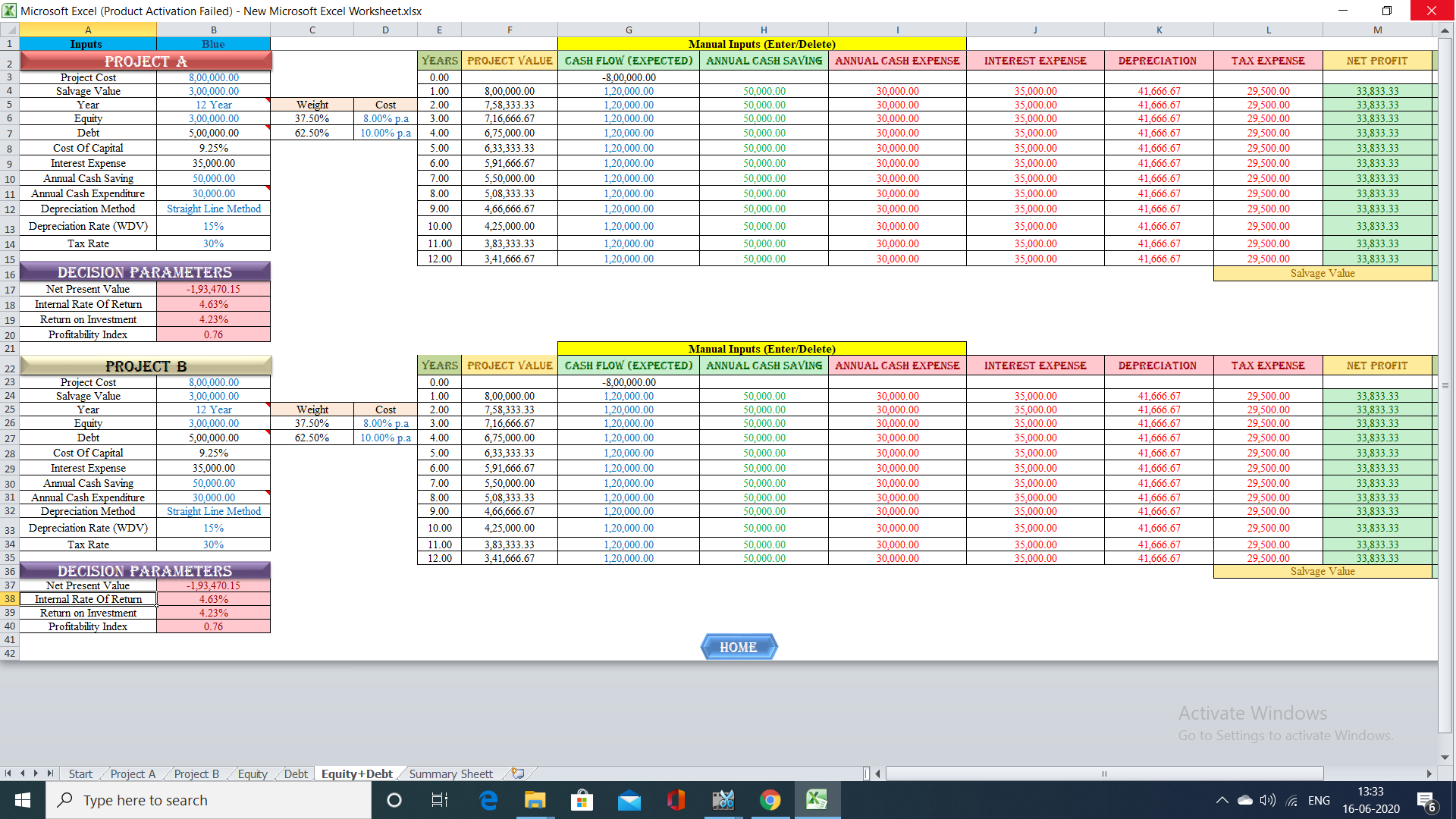

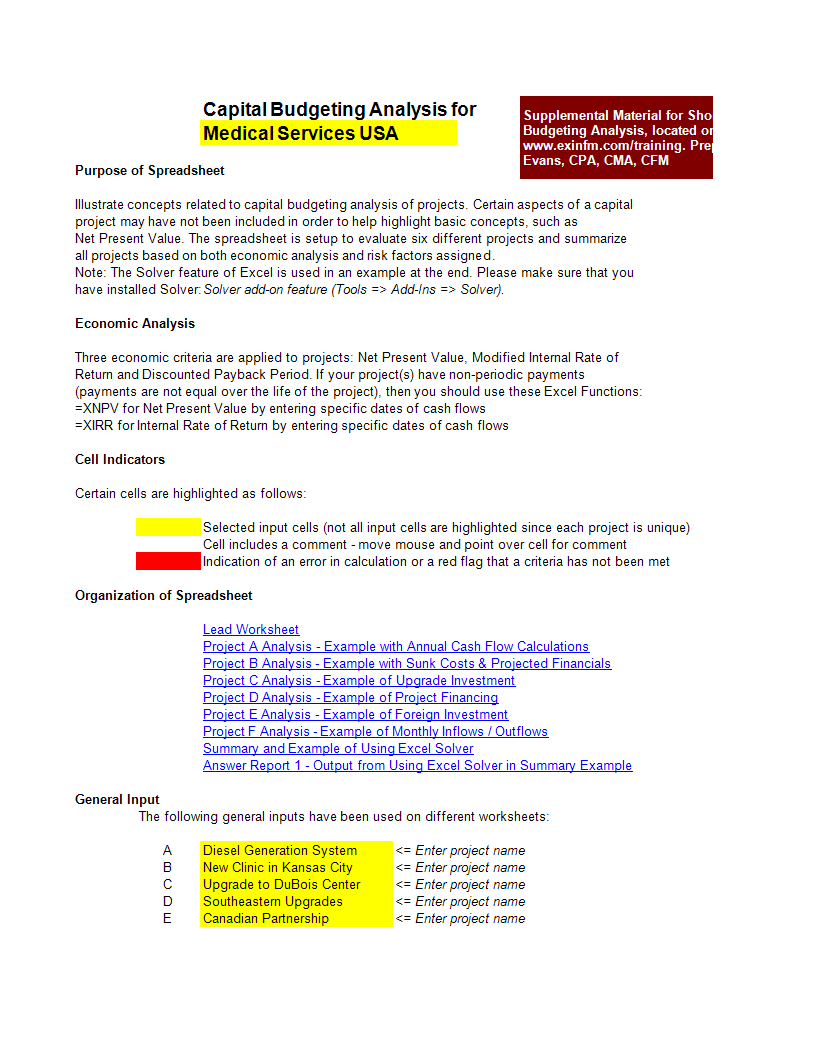

Capital investment model template. This capital budgeting spreadsheet aims to assist investors, managers or analysts in correctly estimating the cash flow in different scenarios and accurately calculating the. This excel model contains three types of methods:

This spreadsheet contains two worksheets. This guide will explain how to perform sensitivity analysis for capital budgeting in excel. It is through capital budgeting that organizations decide what to invest in.

Building effective capital budgeting models for businesses and organizations requires having a clear context and understanding the objectives of the capital budget. The investment might be as simple as a piece of machinery, or as. 1.2k share 89k views 6 years ago microsoft excel hey guys !!!