The Secret Of Info About Financial Ratios Spreadsheet

Learn all key ratios to use to analyze financials ;

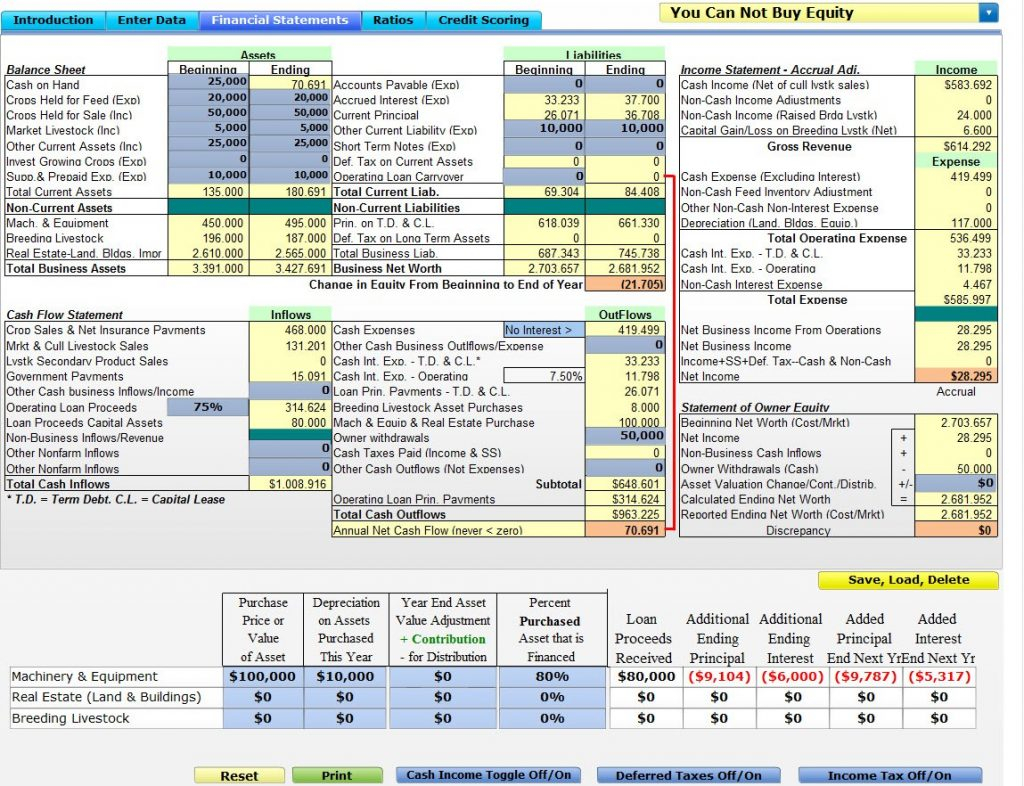

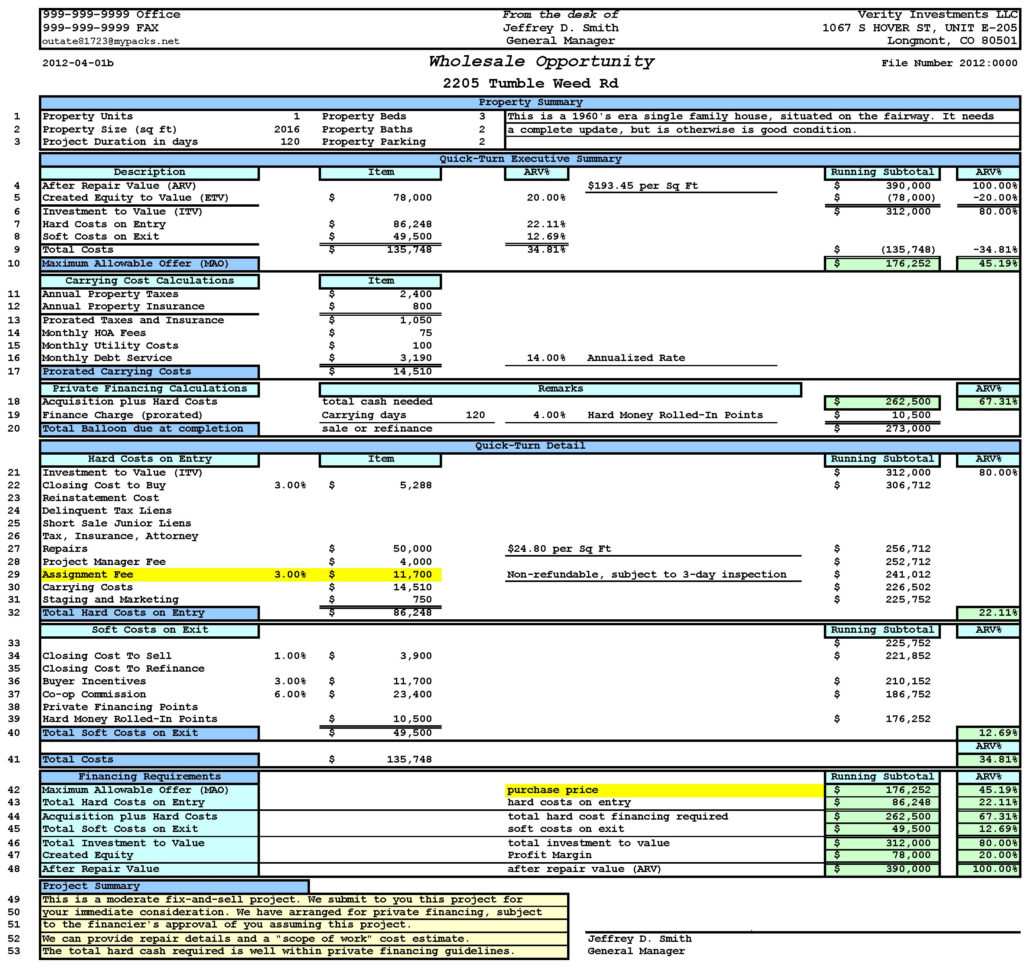

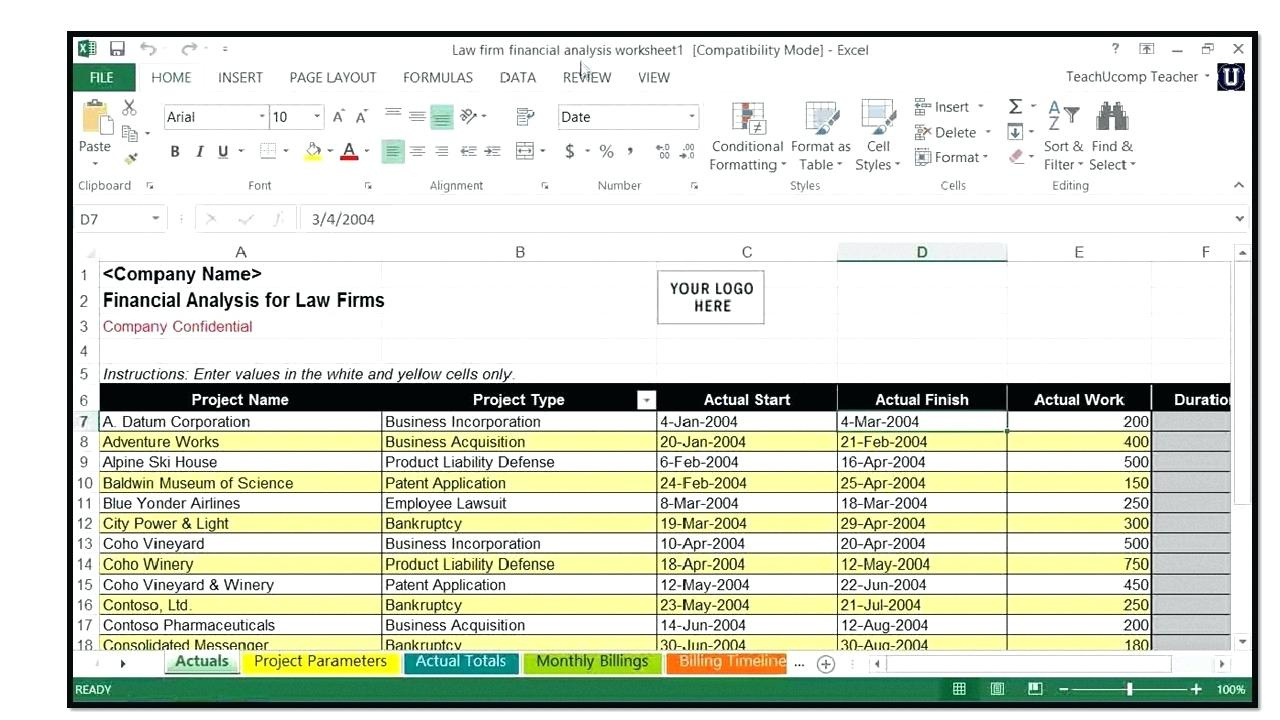

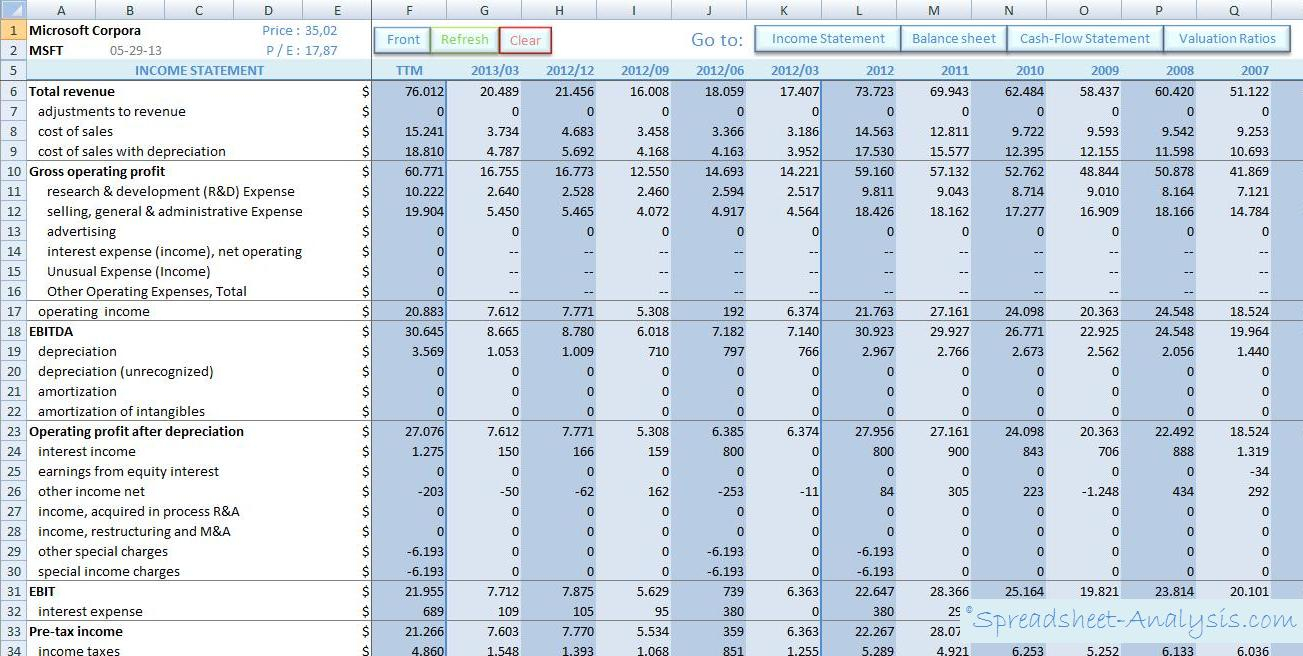

Financial ratios spreadsheet. By gathering lots of financial data about your business in one place, the financial history & ratios template makes it easy to analyze your finances and spot significant trends. It combines the ease of spreadsheet software with complex. This template will help you decide.

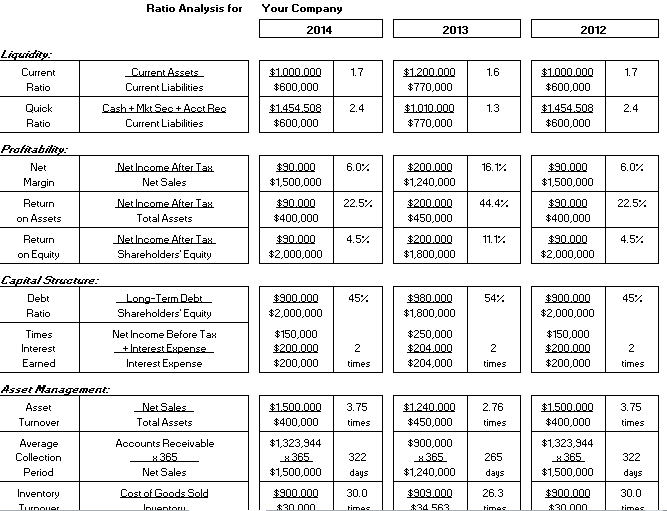

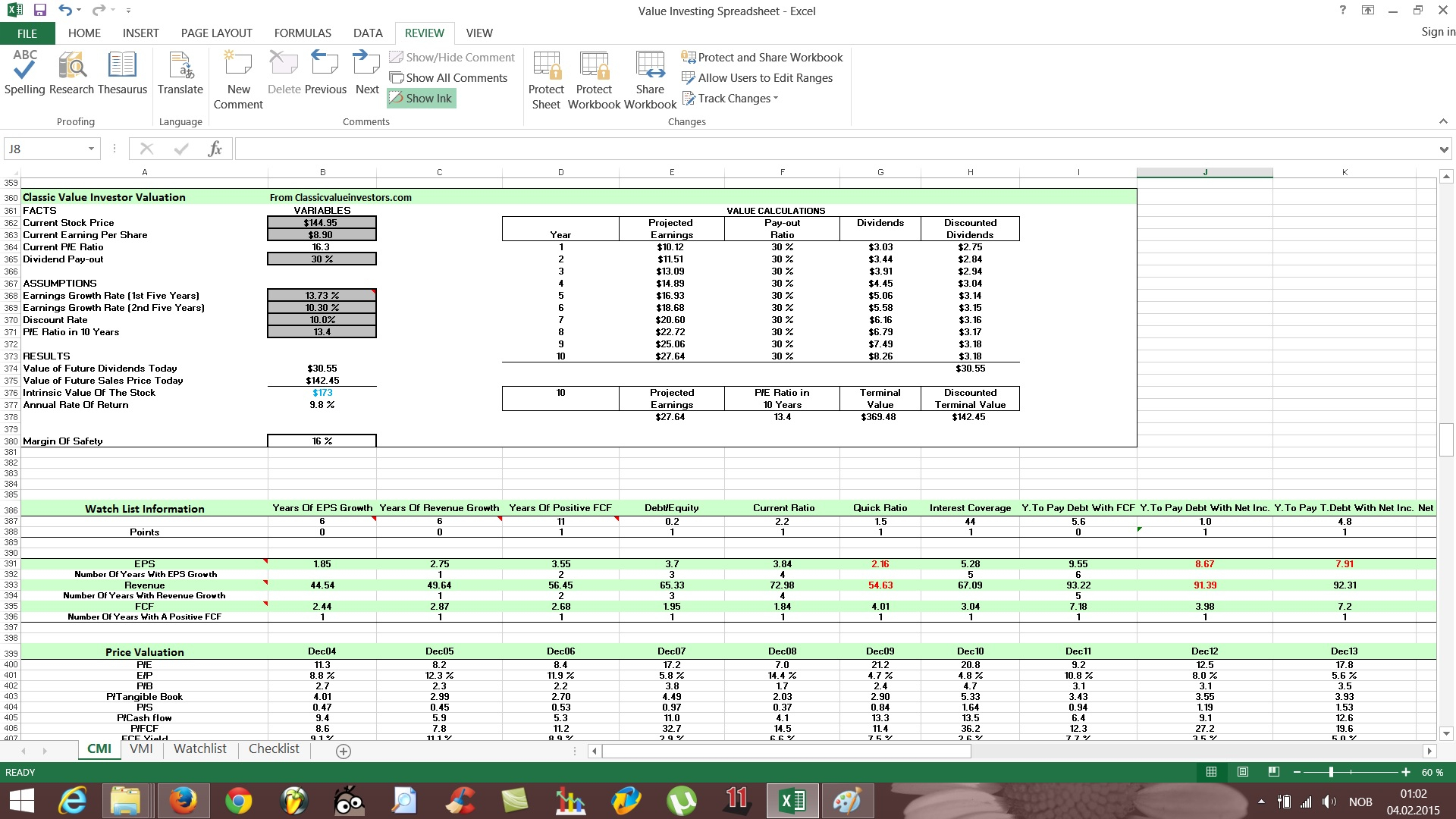

Investors perform financial analysis in one of two broad ways. These financial ratios quickly break down the complex information from financial statements.

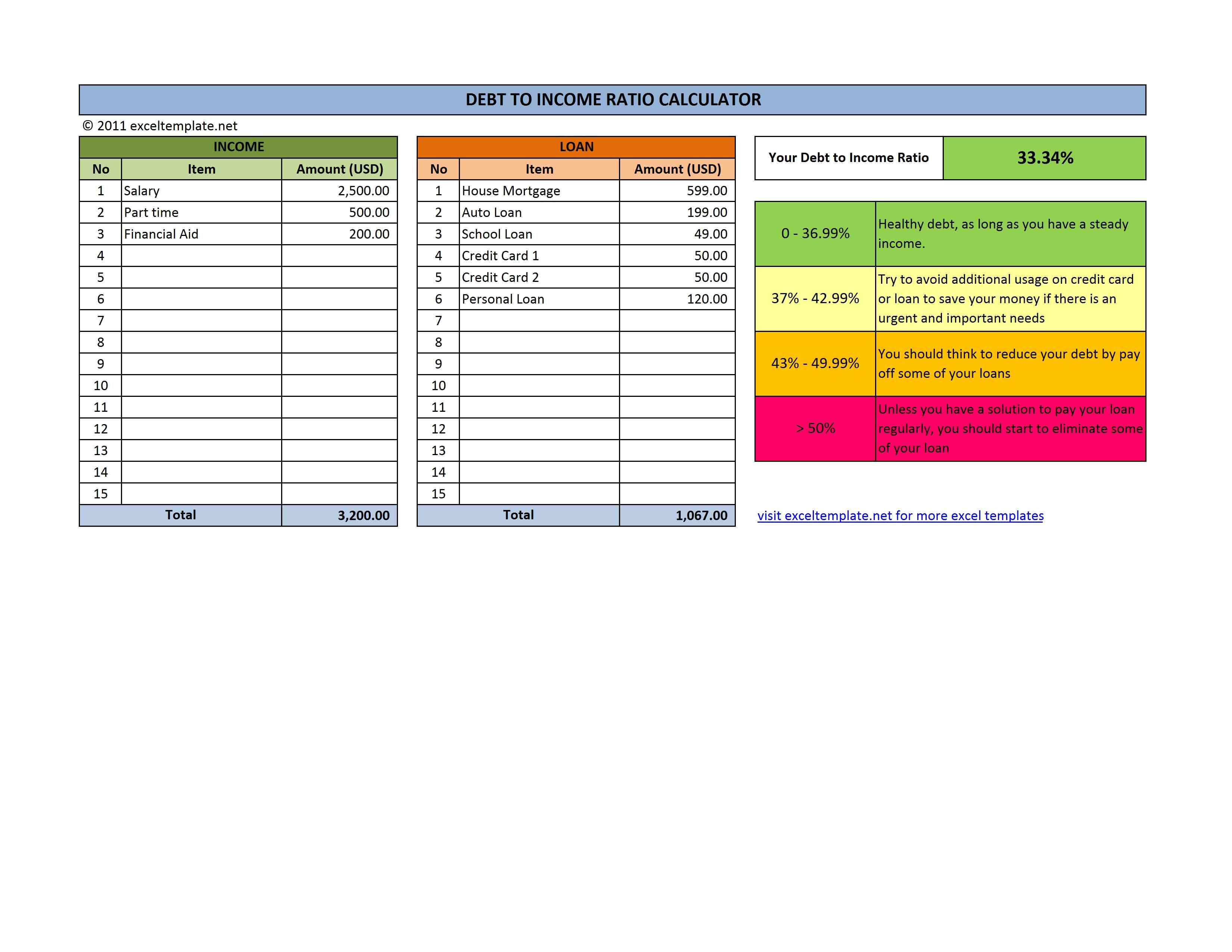

Profitability ratios the elements of the profitability ratio show us the efficiency of that company in using its assets to make a profit. Note that the spreadsheet will not work correctly for evaluating financial companies. The current ratio means that, if necessary, the company could use its current assets to pay off its current liabilities.

Download template how financially healthy is your business? Ci offers a financial ratio analysis spreadsheet that aids in collecting the needed data and calculating the ratios. Built by expert financial modellers, analysts and finance decision makers.

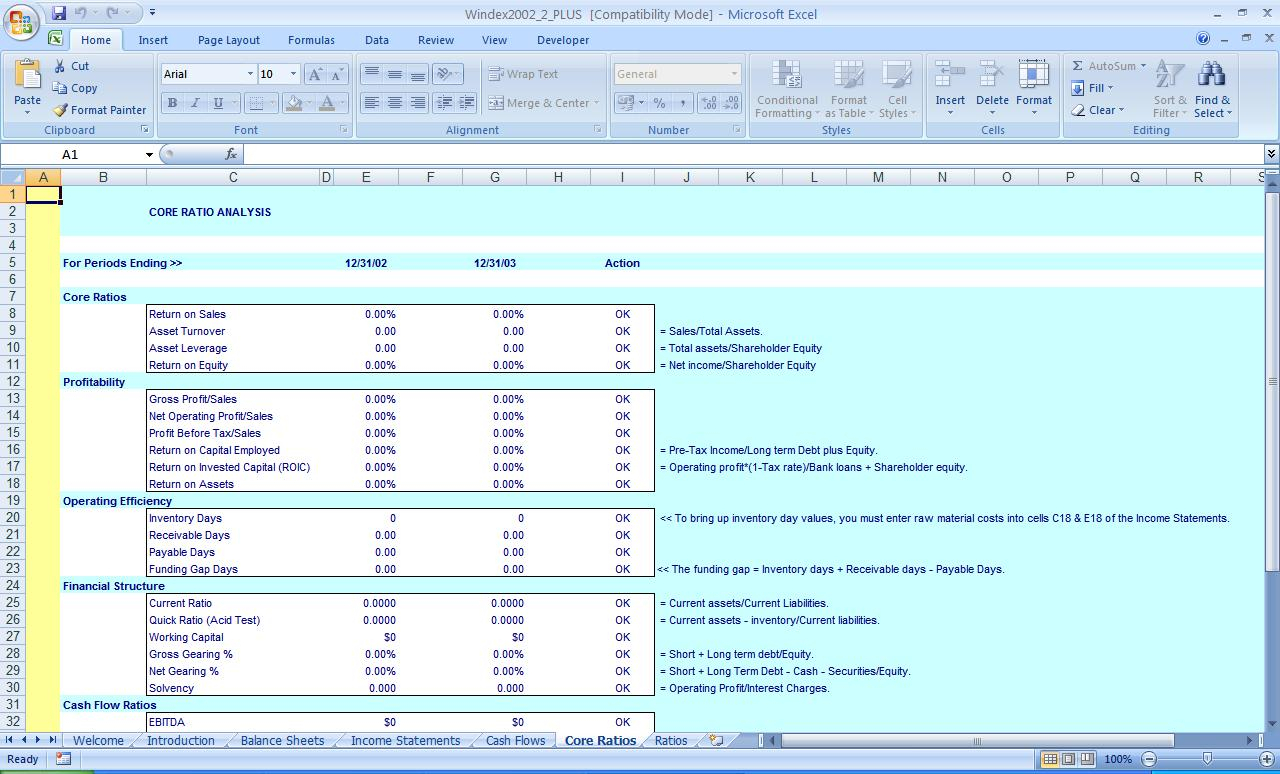

Be an economic analysis superhero; Track company performance determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company. Gross margin, ebitda margin, ebit margin)

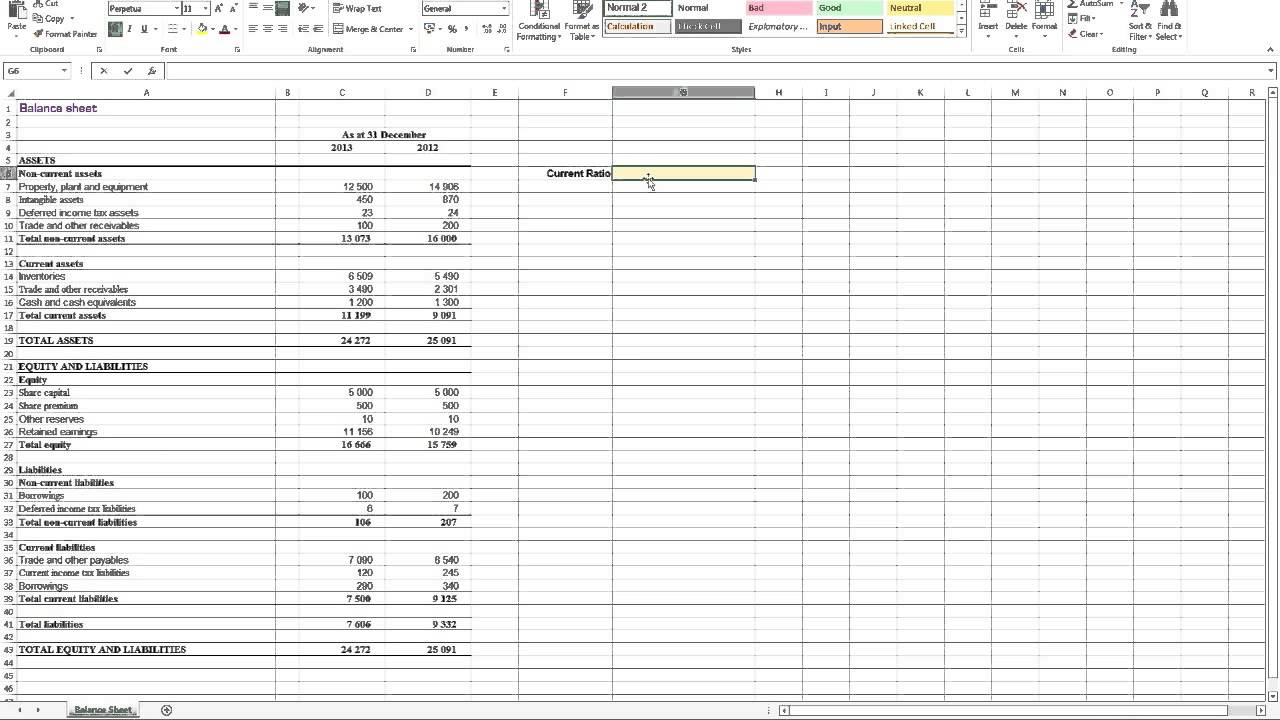

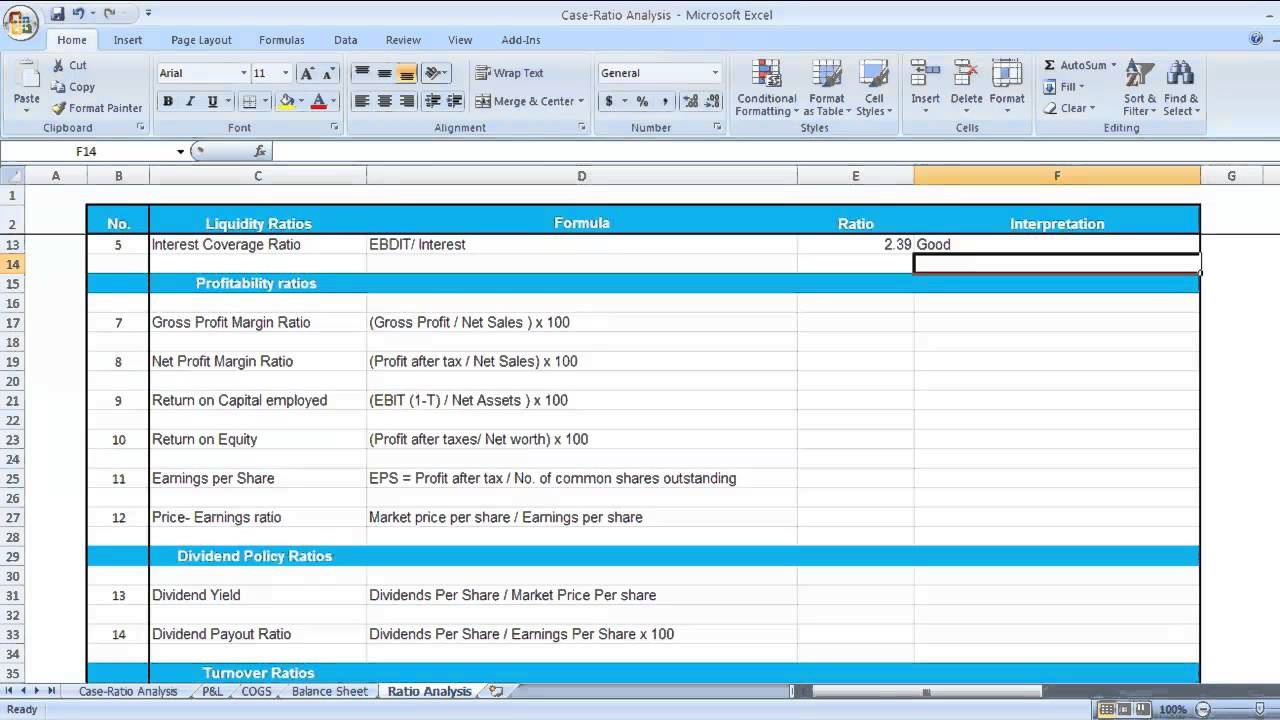

All you need to do is to enter data from your financial statements and the template will automatically calculate the ratios. Gross margin gross margin is the ratio of the difference between sales and cost of goods sold (cogs) with sales. Learn how to calculate liquidity ratios, profitability ratios, efficiency ratios, and more, and understand how these ratios can be used to assess the financial health and performance of businesses.

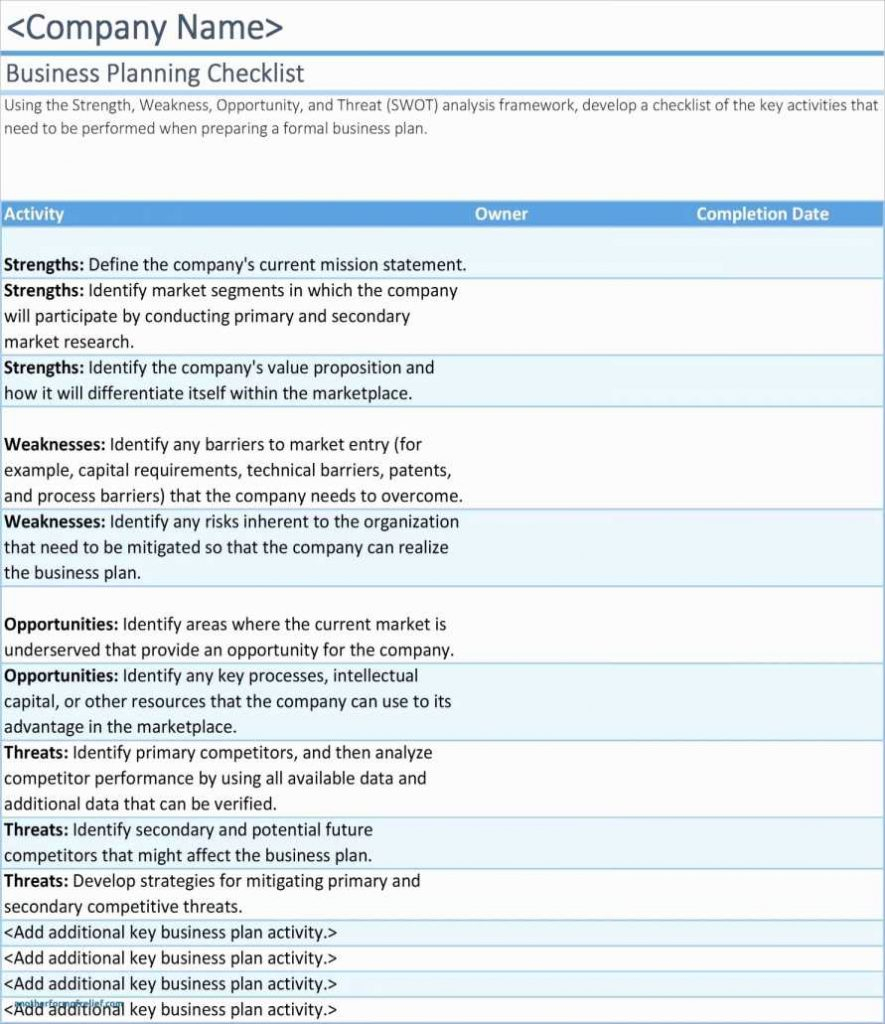

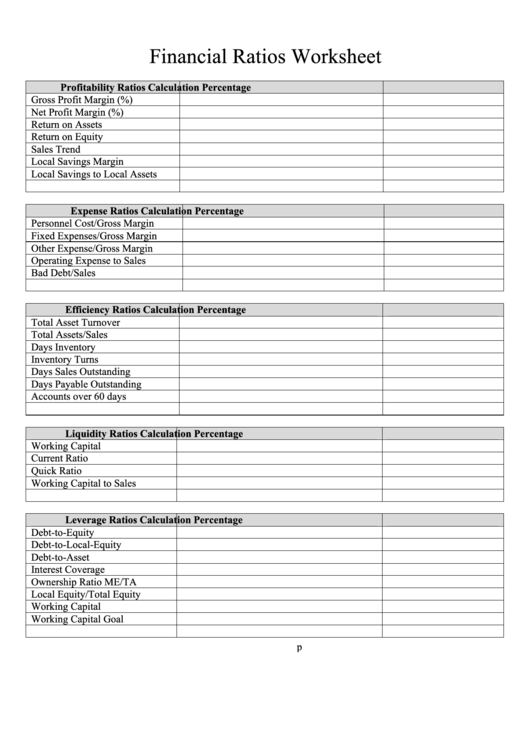

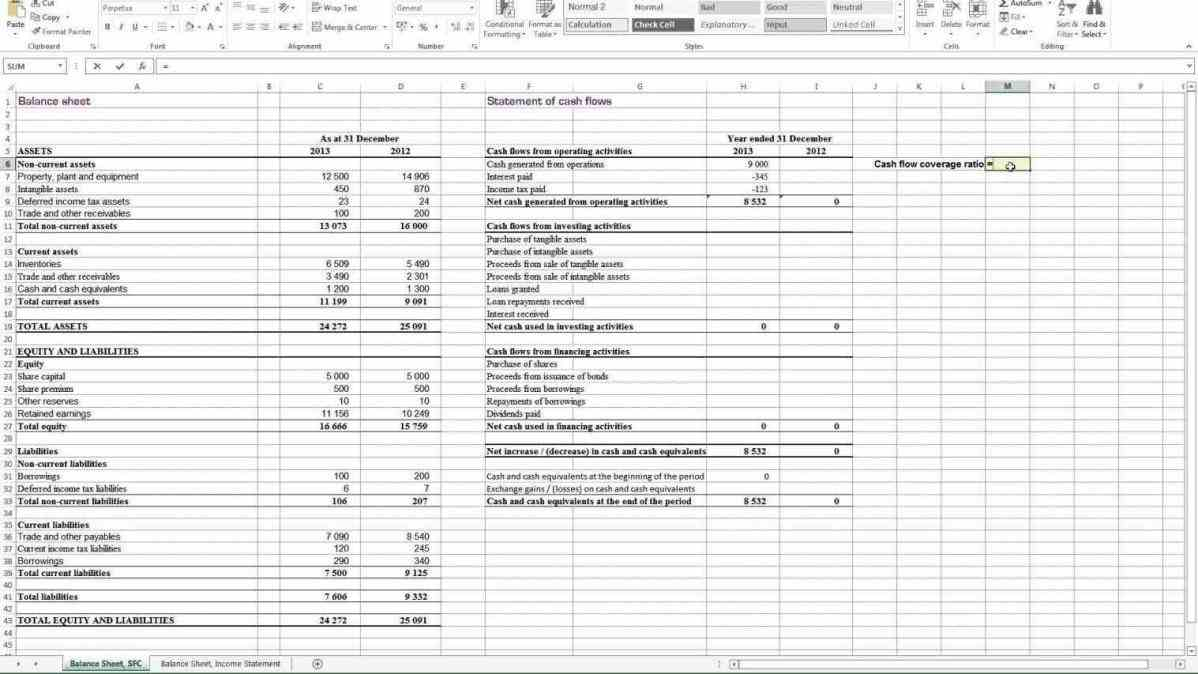

It may begin to pay its bills more slowly. This worksheet will show you the list of all commonly used financial ratios including profitability ratios, efficiency ratios, liquidity ratios, leverage ratios, and coverage ratios, which are calculated using all the worksheets previously built. To conduct a thorough analysis, you may use financial ratios like profitability ratios, liquidity ratios, and solvency ratios.

There are 4 main categories of financial ratios and kpis used by financial practitioners, each addressing a specific question: This financial ratio calculator in excel spreadsheet will help you calculate those important metrics. Ratio definitions, calculations, interpretation, industry benchmarks, and.

Here are five of the most commonly used leverage ratios: Excel template to calculate all ratios;

If a company is experiencing financial difficulty; Here is an excel template with all of the formulas needed for calculating each of the 5 financial ratios: This template includes multiple financial worksheets like a balance sheet, cash flow statement, income statement, and more.