Casual Info About Income Tax Calculator Excel Template

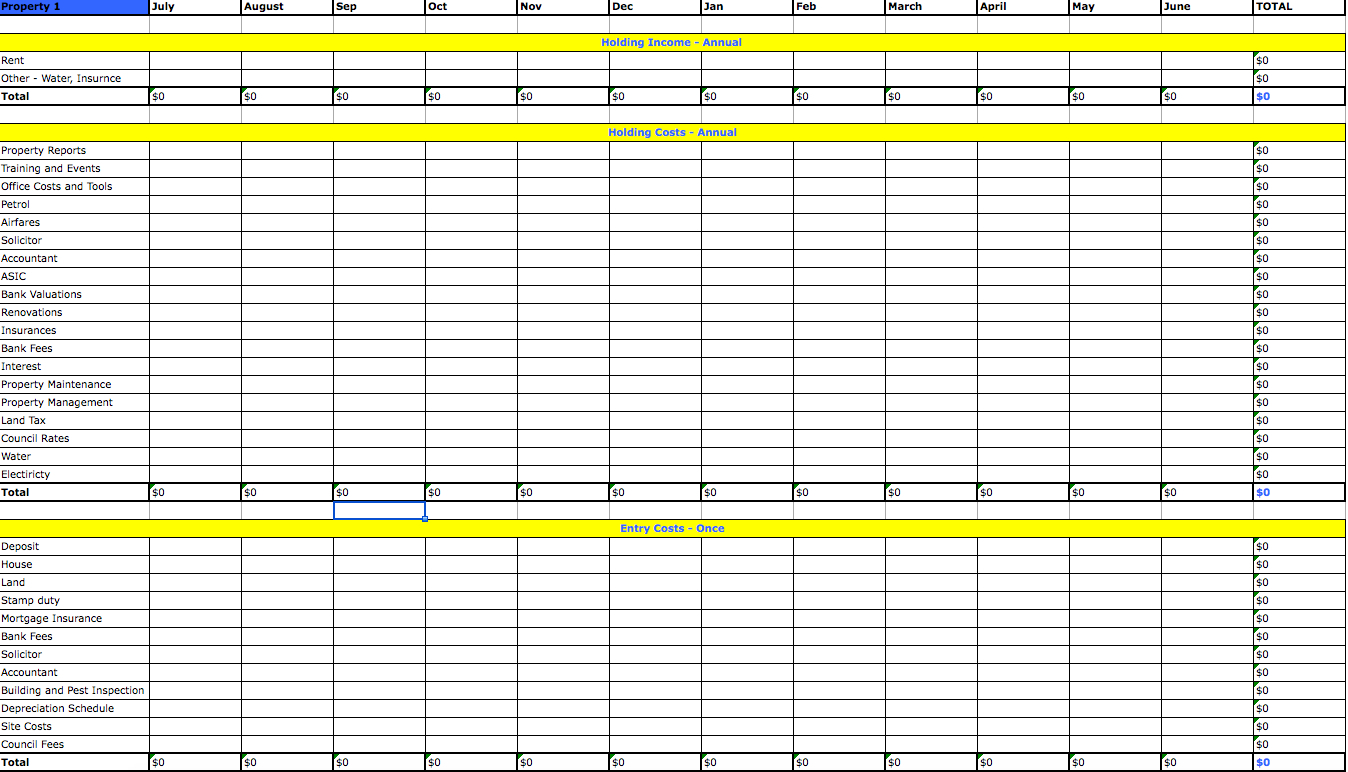

Armed with your transaction records and the tax tracker template provided, you can take the following steps to fill out your income statement:

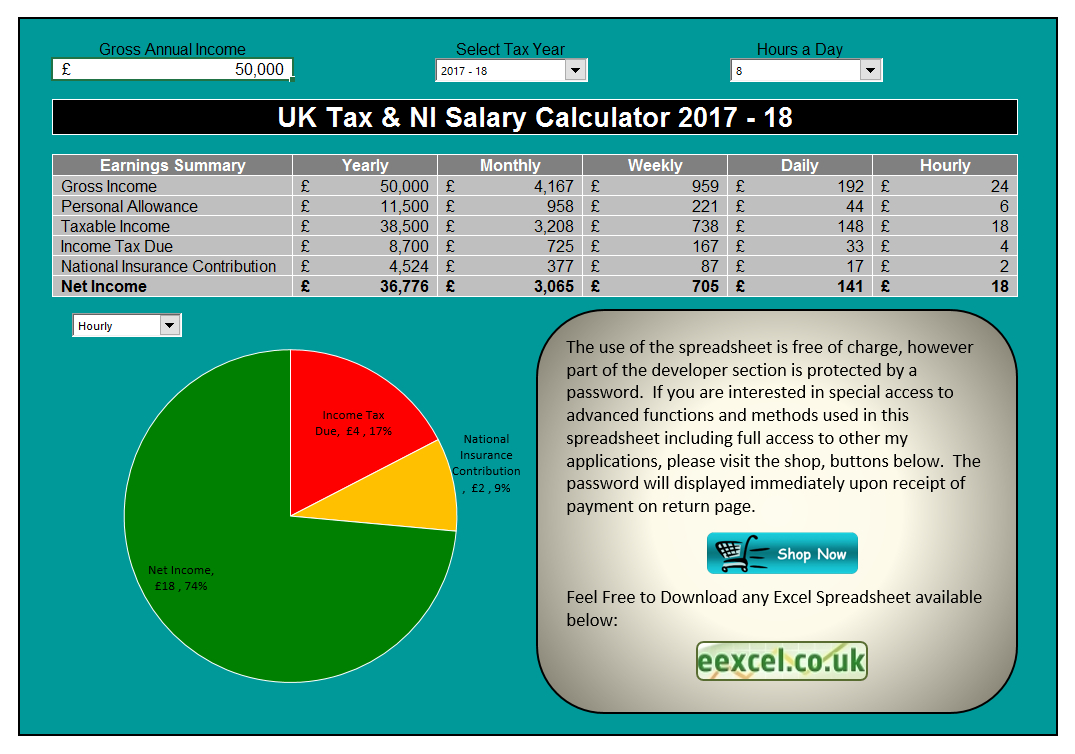

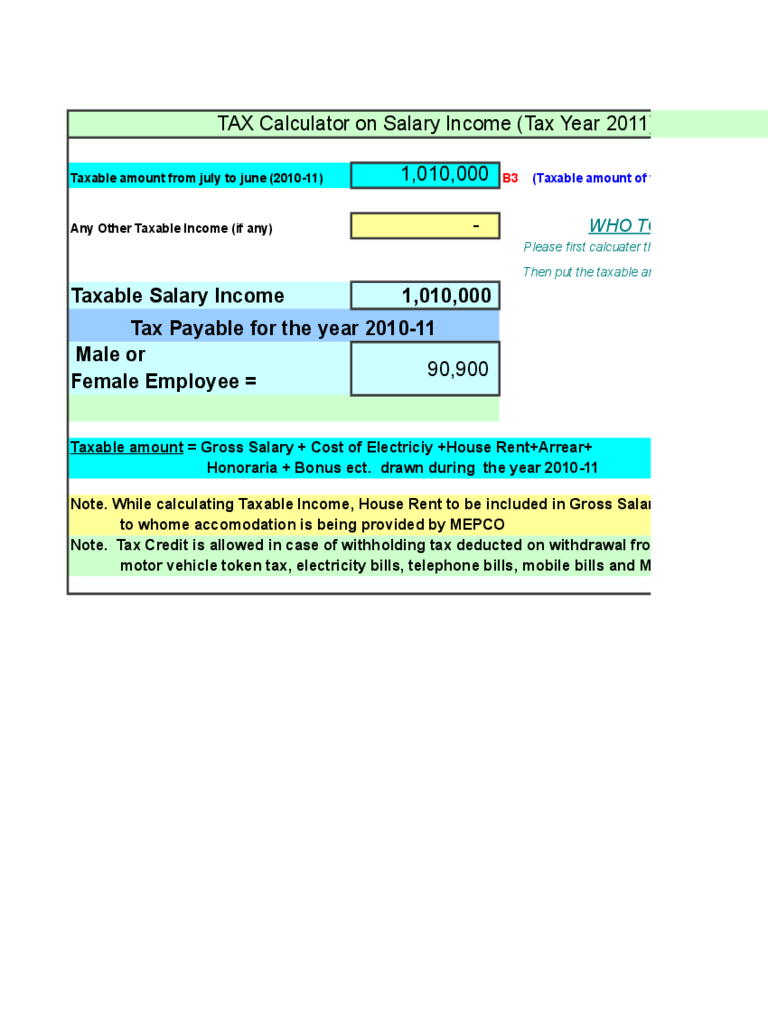

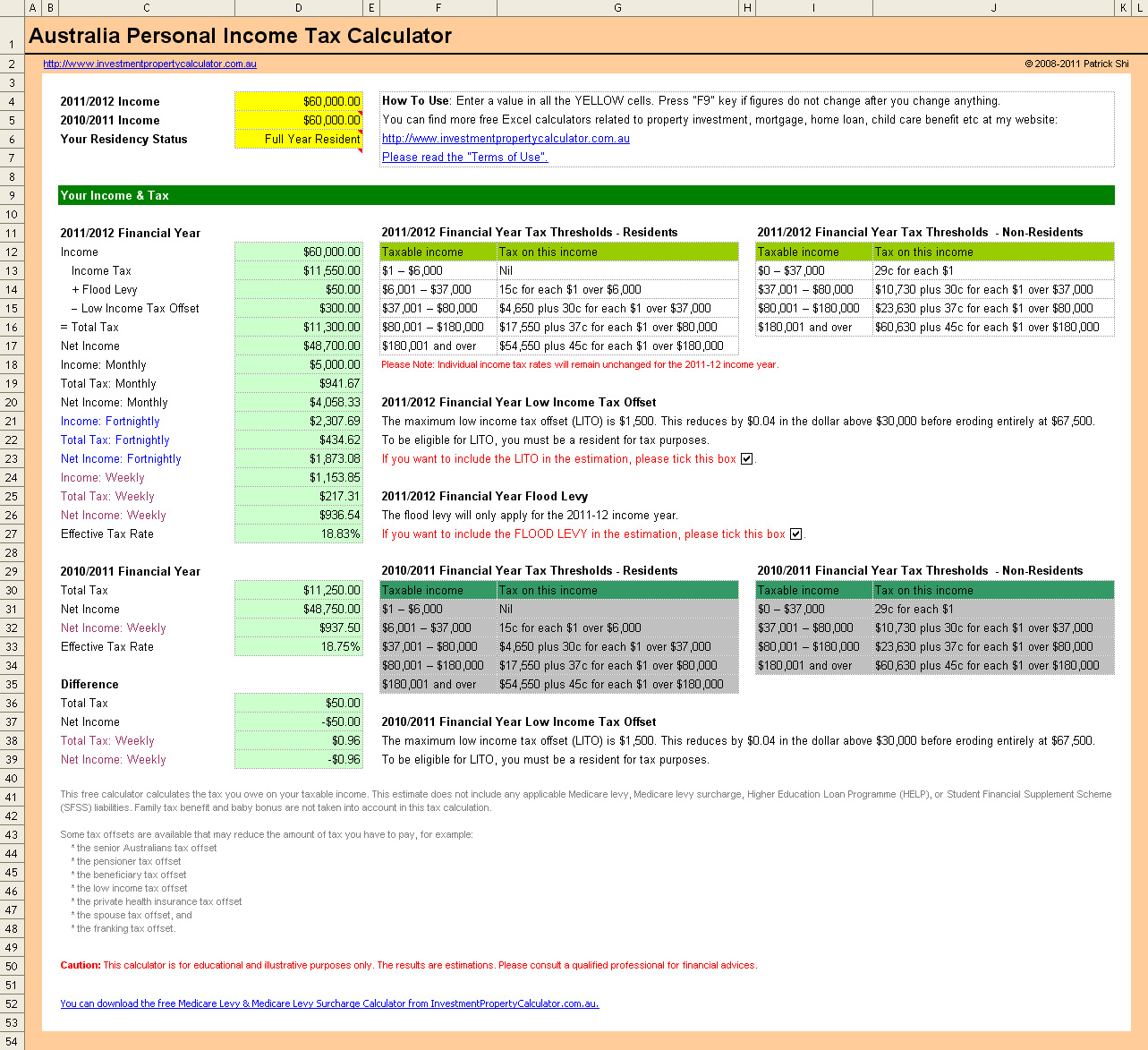

Income tax calculator excel template. You can easily now calculate the tax expenses. The total annual taxable income and whether or not the income from salary exceeds 75% of total. And fill in your income details.

How to calculate income tax in excel using if function: A taxpayer have to choose. Agi or adjusted gross income calculator helps you calculate define your tax bracket as well as your tax.

A fixed tax amount imposed on a person’s income by the central government is called. This excel calculator will help you in finding the difference of tax amount between old and new, with 3 case studies. This is a federal income tax excel template.

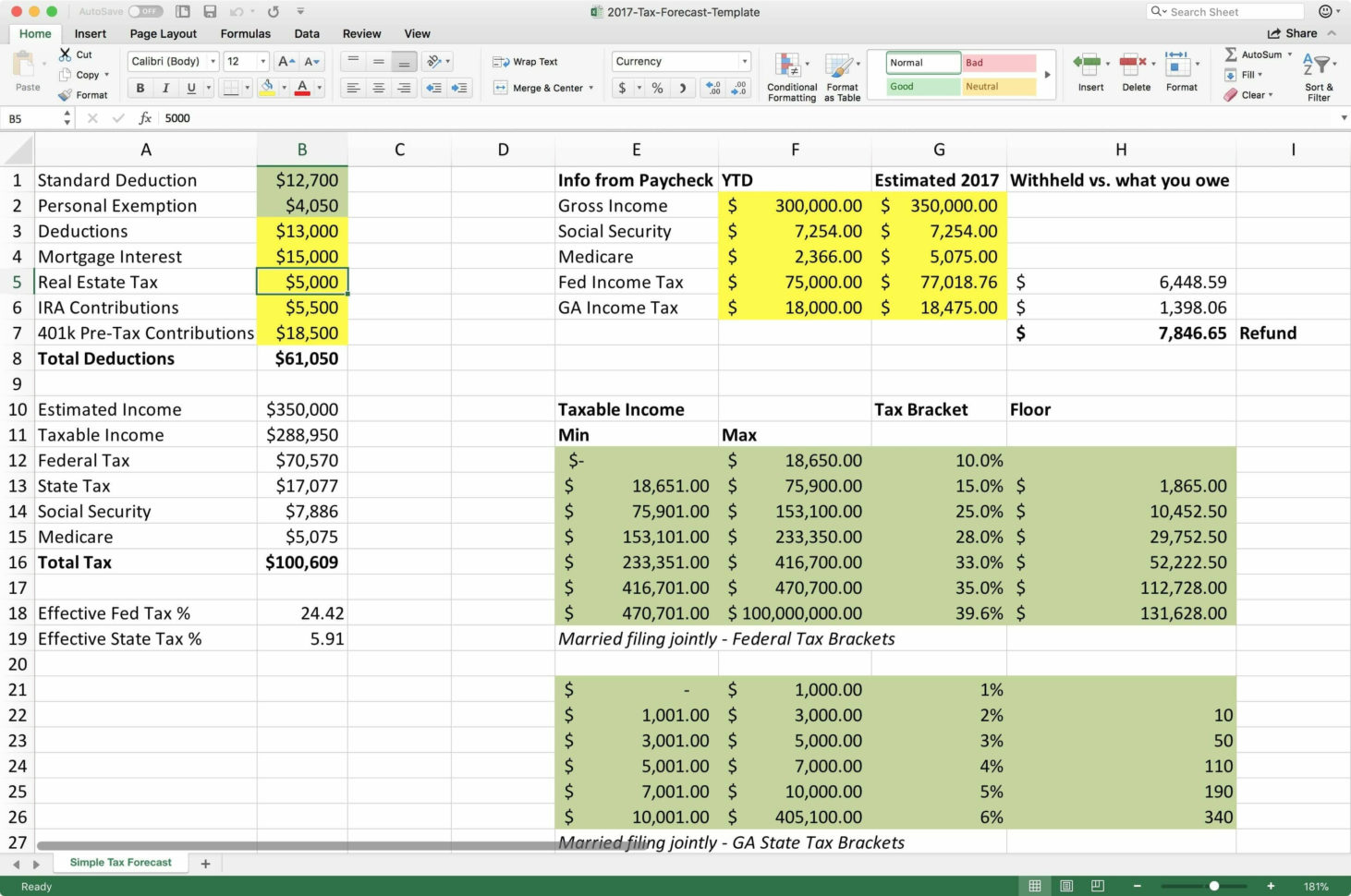

Excel tax expense statistics template this excel tax template is used to analyze the tax expense statistics. Income tax calculations template. Simple tax estimator is an excel template to help you compute/estimate your federal income tax.

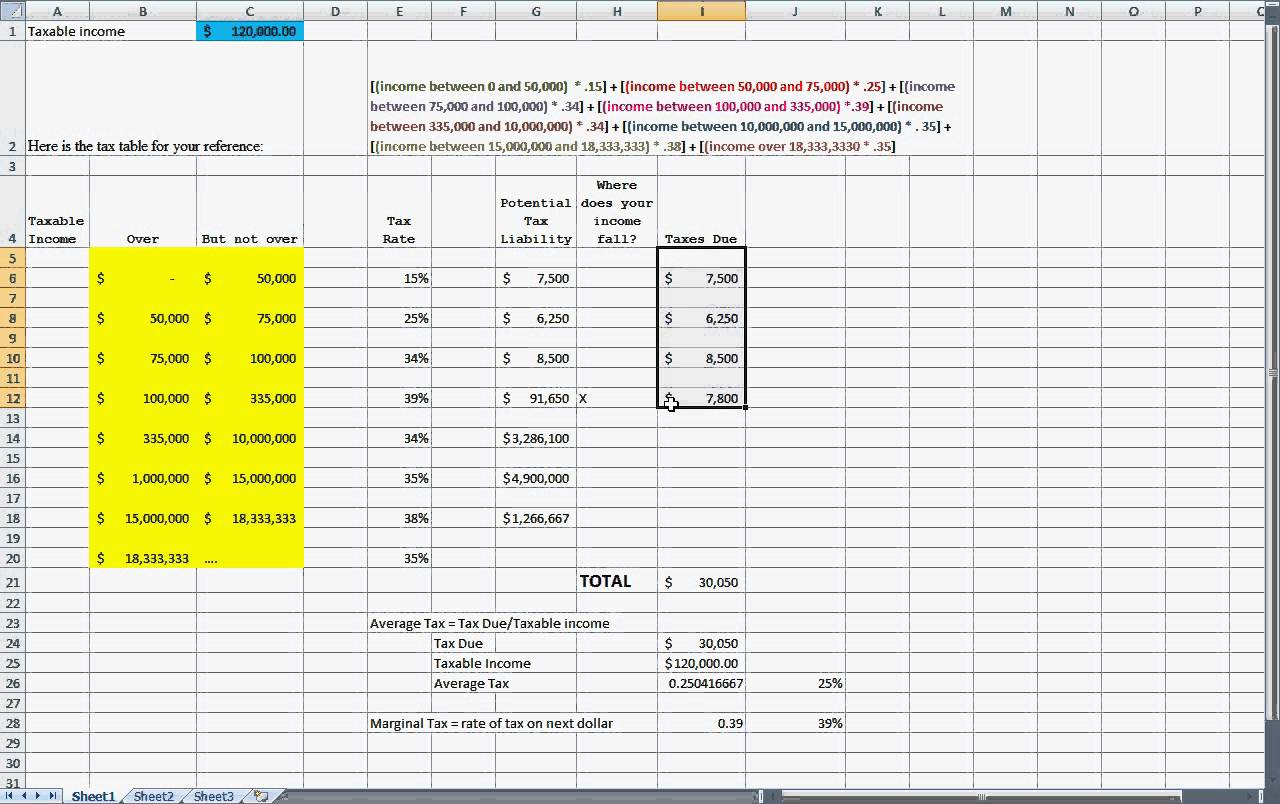

Copy and paste your excel. We want to enter a taxable income and have excel compute the tax amount, the marginal tax rate, and the effective tax rate. Applying income tax formulas and utilizing excel tools such as tax calculator template, goal seek, and solver can simplify and automate the process.

You can use an excel income tax calculator by following these steps: Enter income details the income details required are very simple. This idea is illustrated in the.

Download adjusted gross income calculator excel template. Add your gross income, your total exemptions, and deductions. Perform annual income tax & monthly salary calculations based on multiple tax brackets and a number of other income tax & salary.