Looking Good Tips About Income Tax Spreadsheet

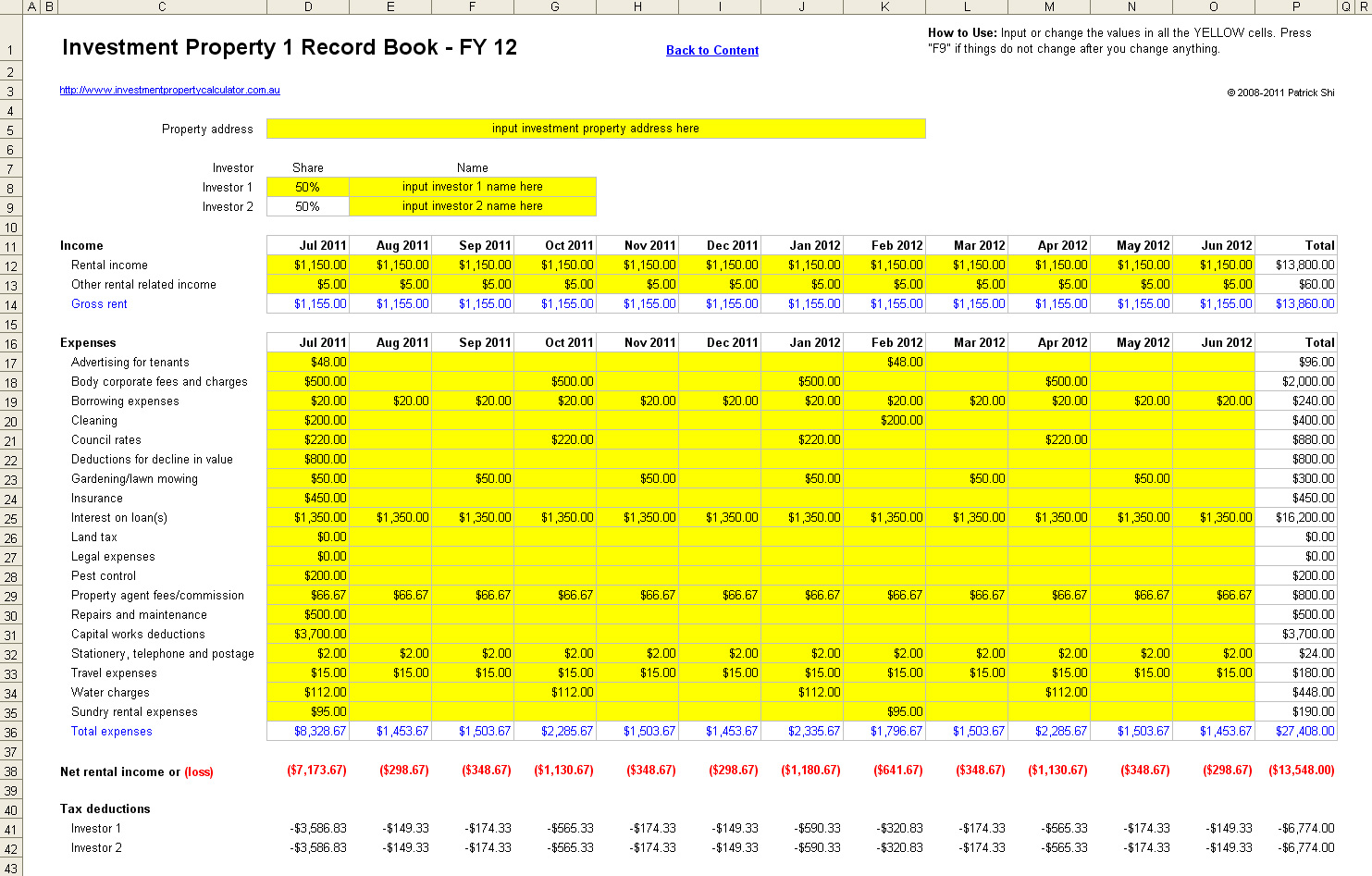

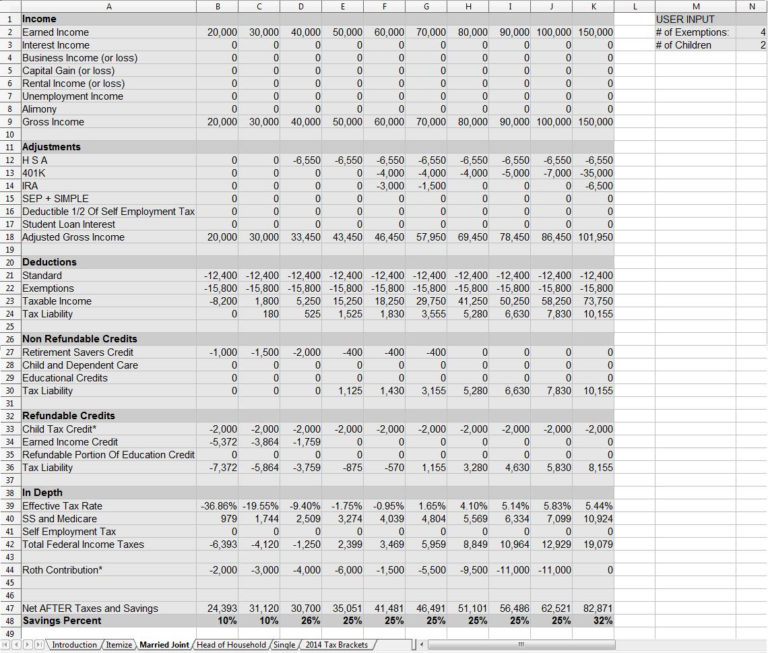

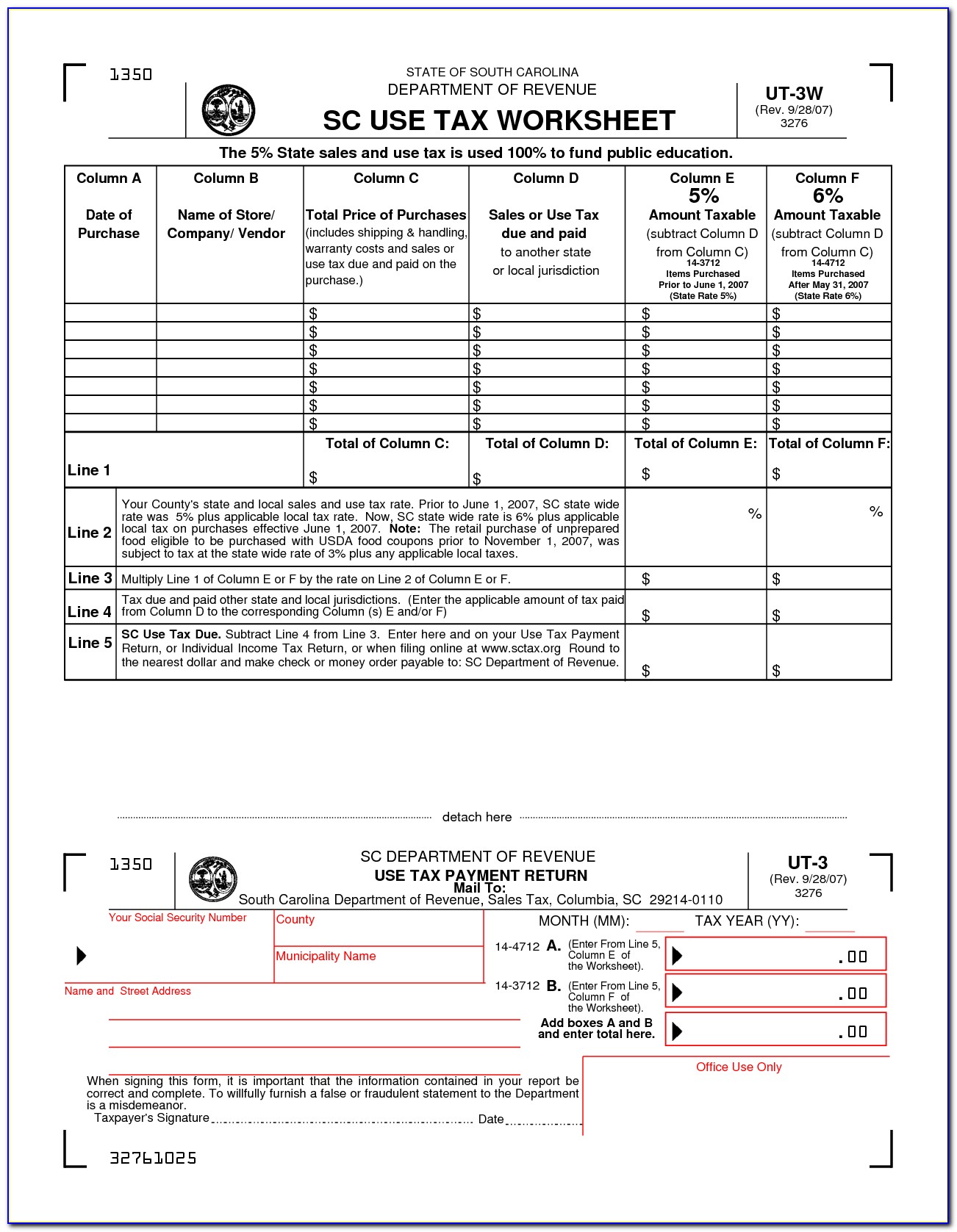

Take a look below at the federal tax schedule for a single filer.

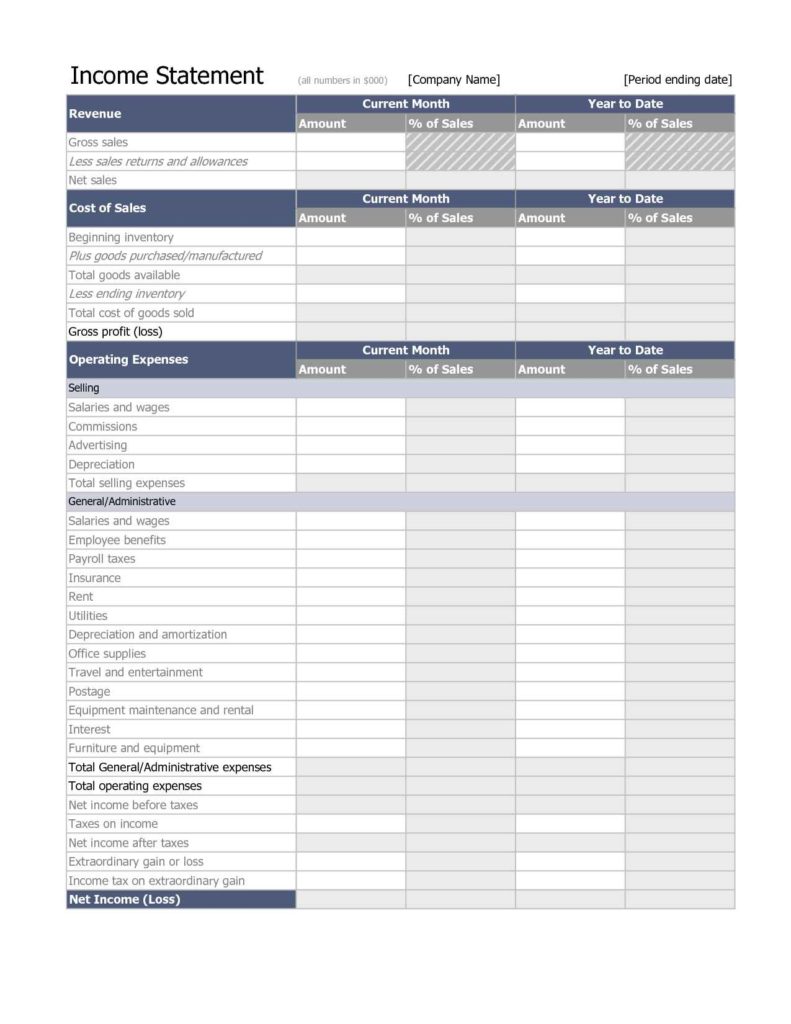

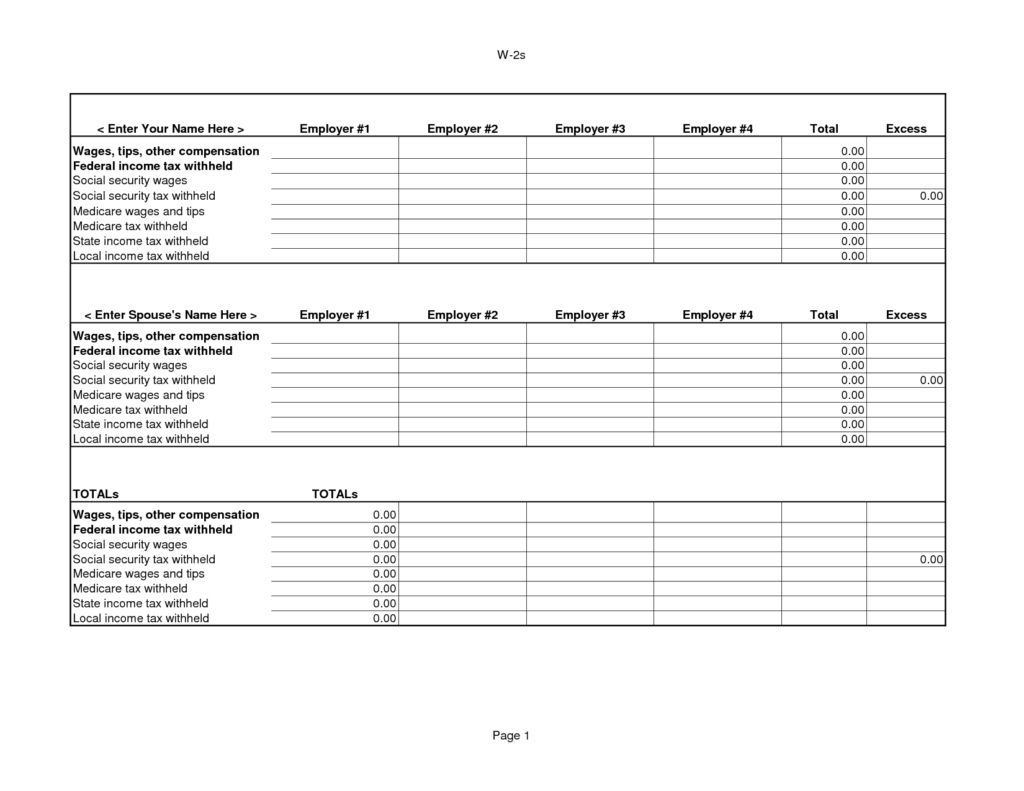

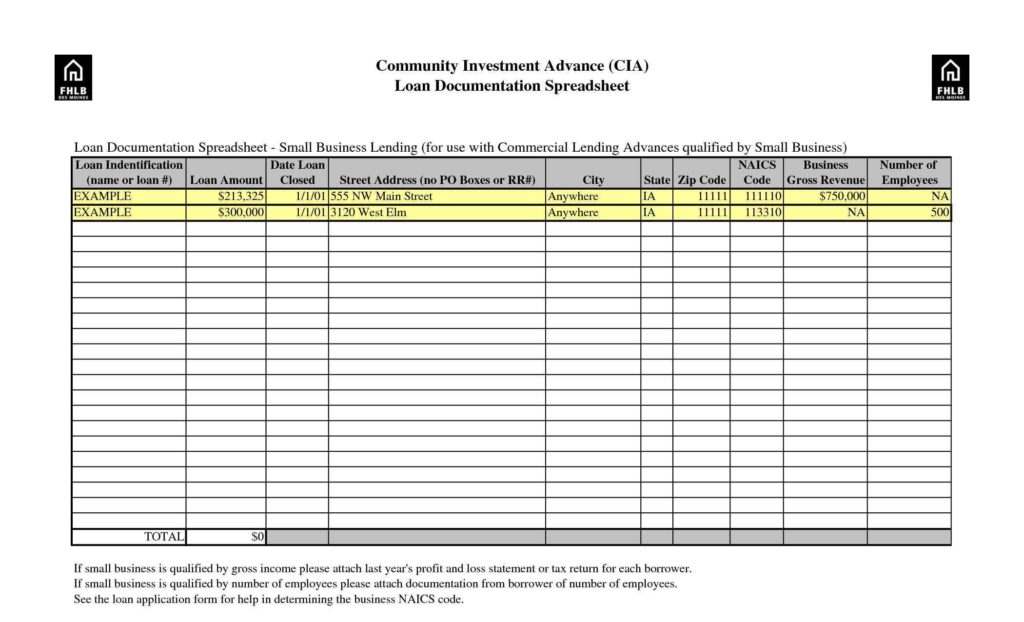

Income tax spreadsheet. If you find this useful please consider making a donation towards my time. Schedule enter filing type,single enter taxable income,$9,700 estimated federal tax,$1,020.00 marginal tax rate,15.00% average tax rate,10.52% schedules,tax. Tax brackets are income ranges for.

There are specific income thresholds at which federal income tax kicks in. The calculator is created using microsoft excel. Federal income tax spreadsheet 1040.

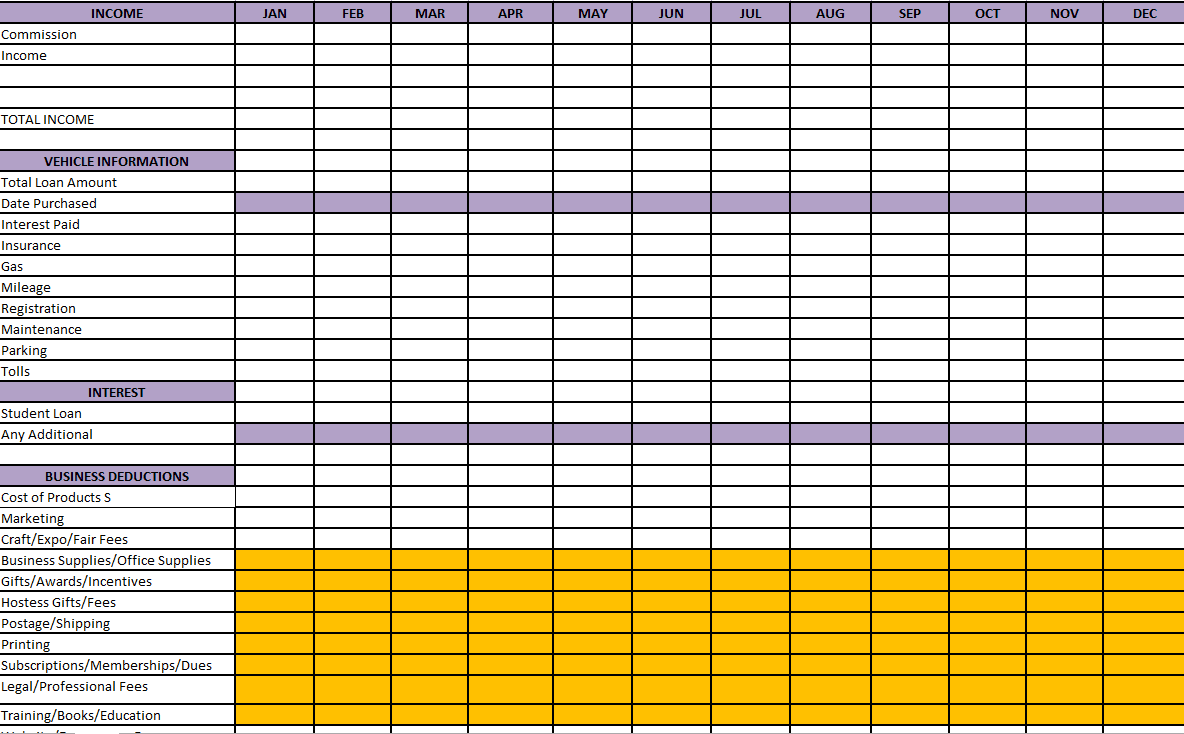

In excel available to download and edit. Microsoft excel spreadsheet for us federal income tax form 1040. Capital gains and losses (along.

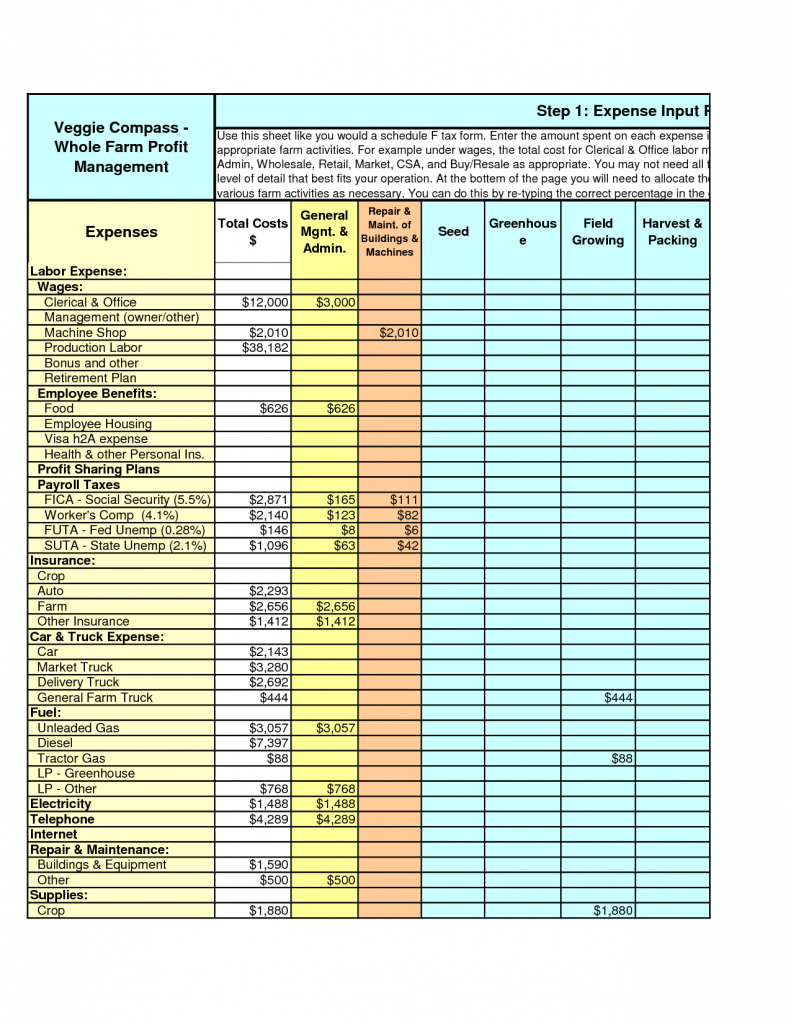

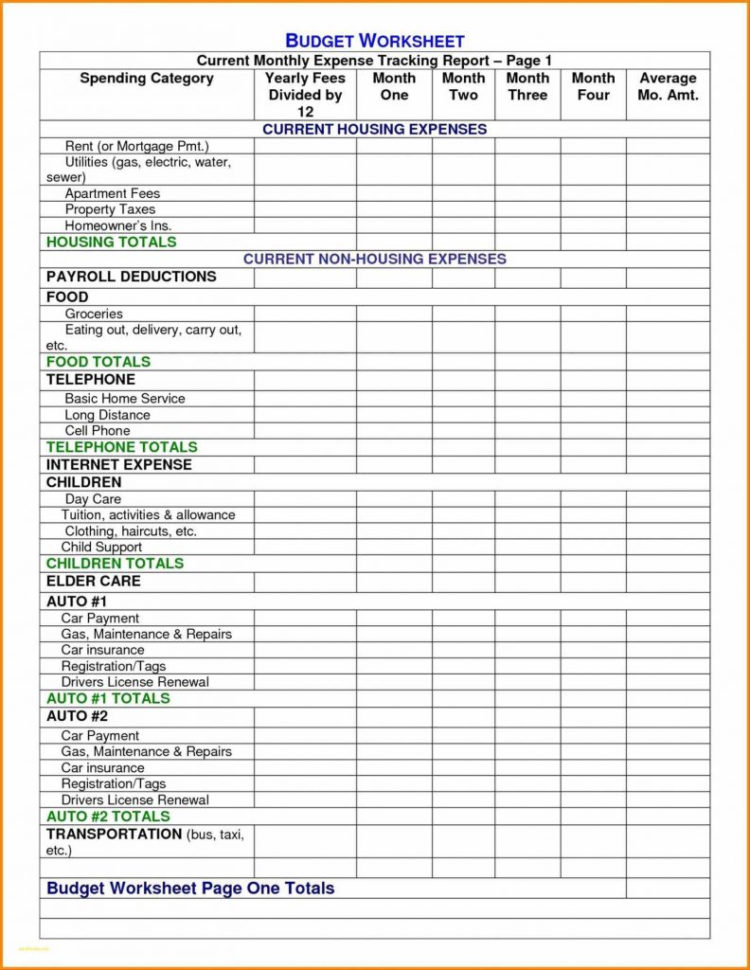

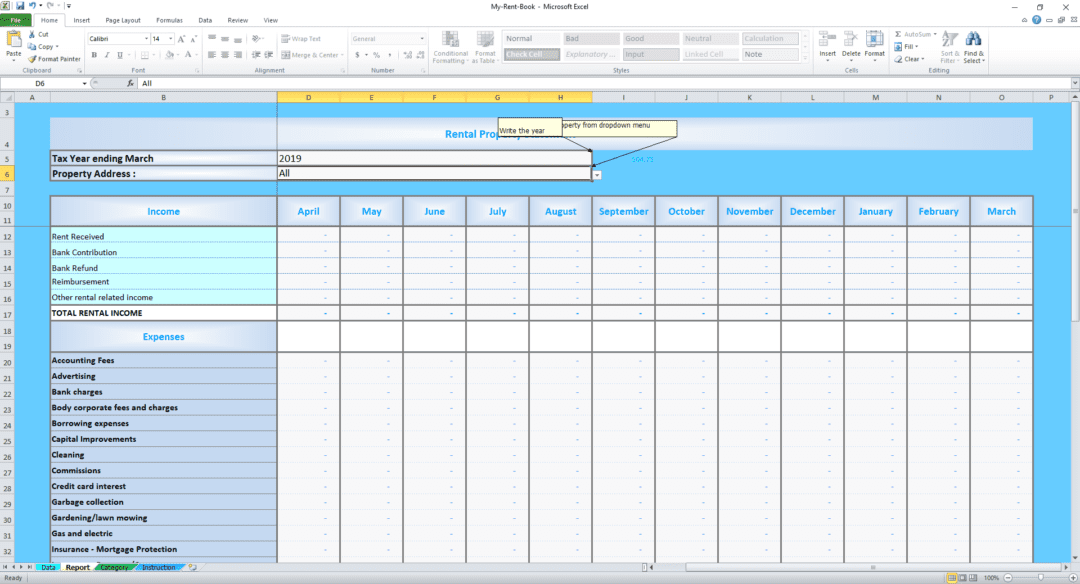

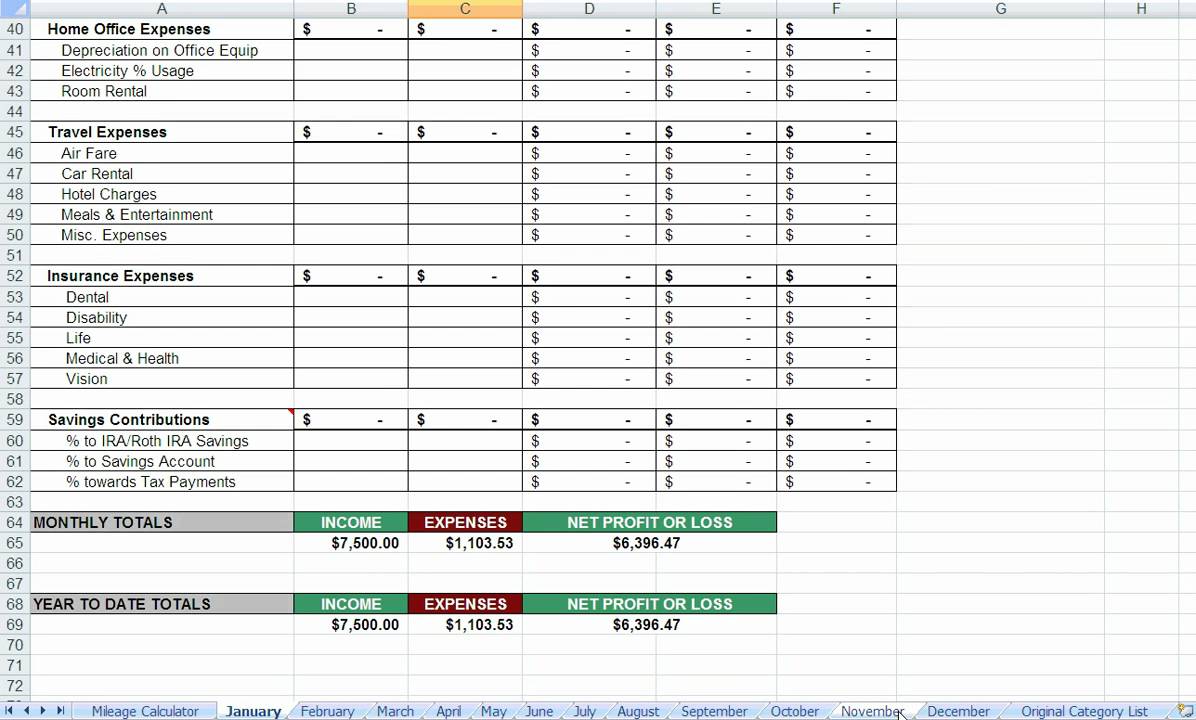

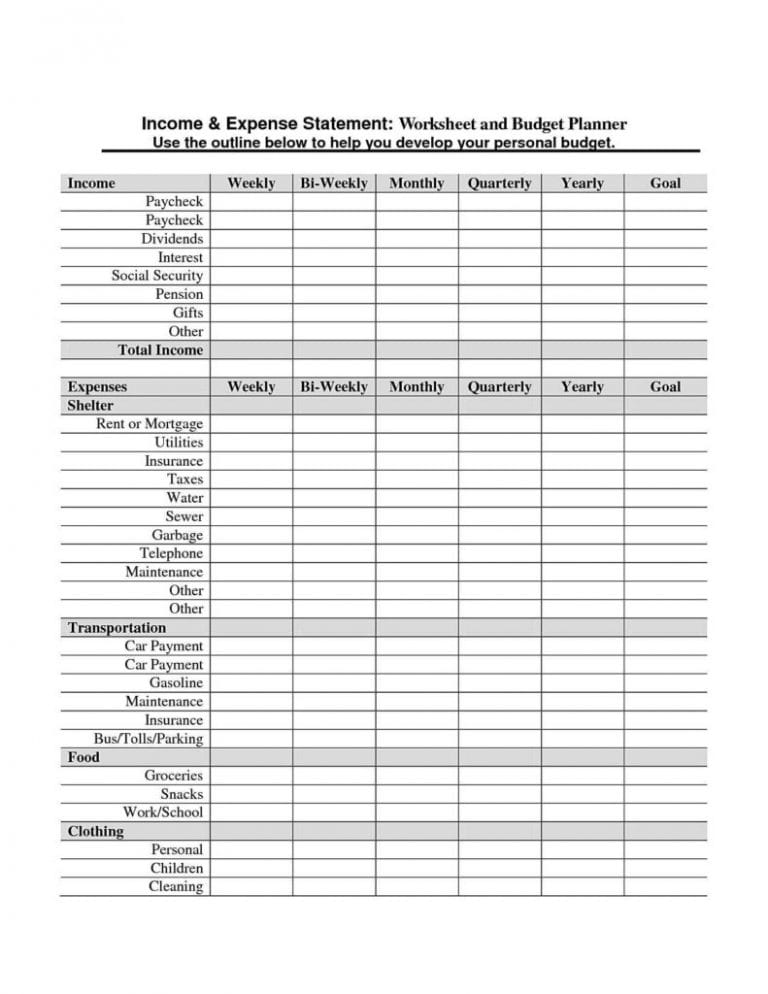

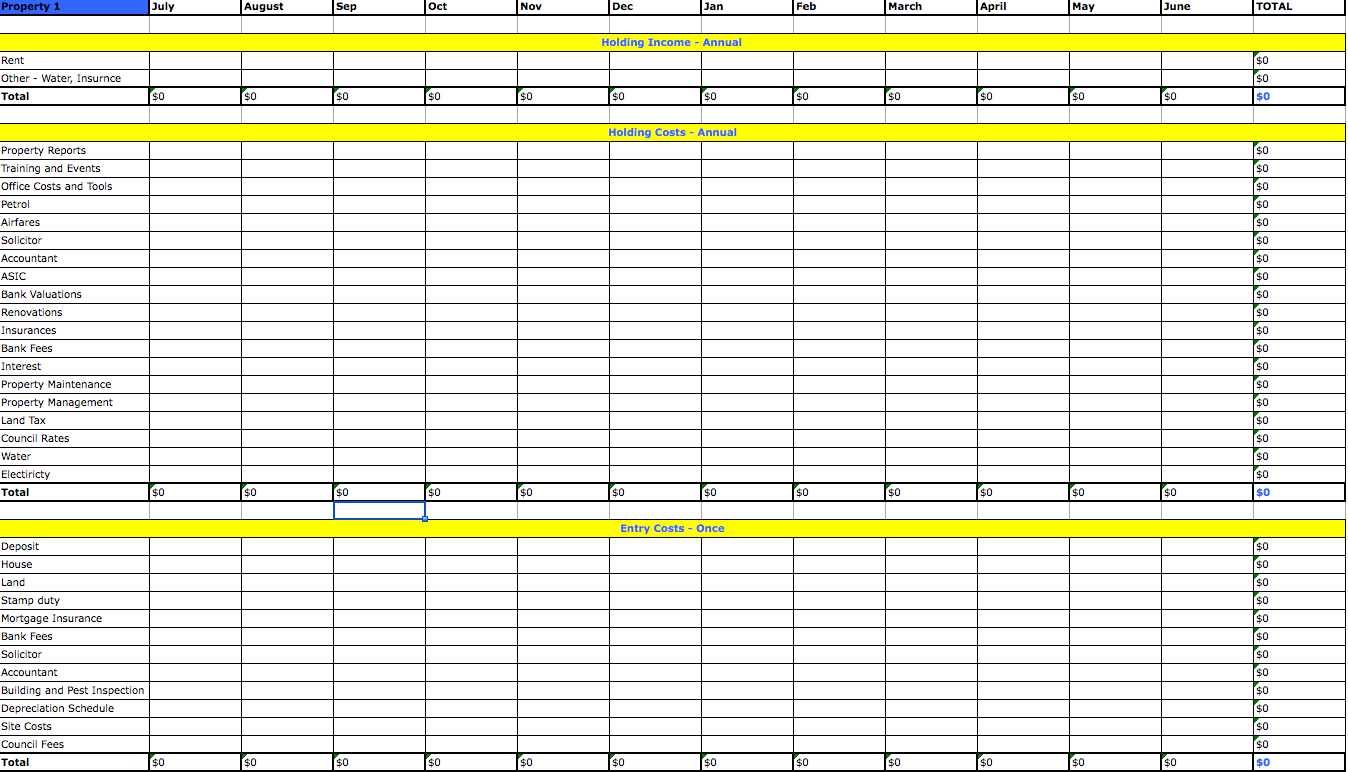

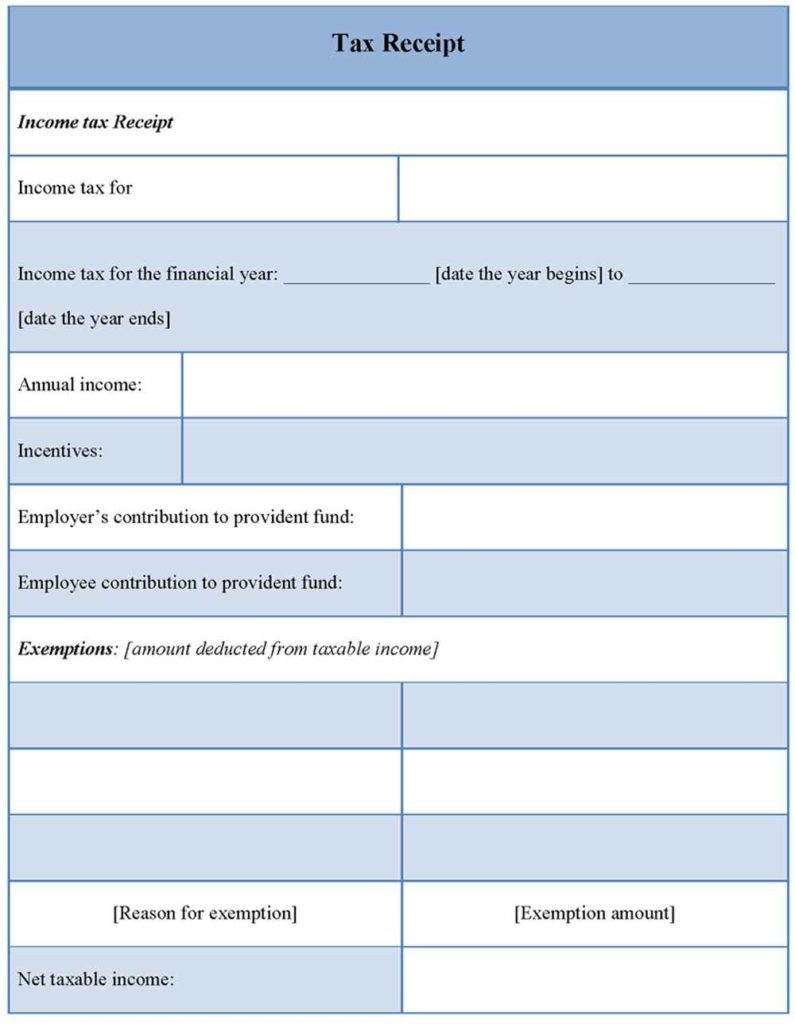

You can add up all of your income and expenses in one place and be well prepared to drop your final numbers into your tax prep software. While a basic budget spreadsheetis great, it is a rather manual process to prepare. These spreadsheets are applicable to residents of the united states who file personal income taxes.

The best free spreadsheet for doing your us federal income taxes! How the south african tax spreadsheet calculator 2024/ 2025 works. Simple excel based formulas and functions are used in creating this calculator.

Budget spreadsheets are a great way to keep track of your finances. 2020 federal income tax form 1040 (excel) 1. This is a comprehensive tax form spreadsheet that has been updated for 2022.

The basic syntax of the. Compile information for your individual tax return with ease using our 2022 tax organizer and spreadsheets. Federal income tax rates range from 10% to 37%.

Complete your us federal income tax form 1040 using my microsoft excel spreadsheet income tax calculator. Perform annual income tax & monthly salary calculations based on multiple tax brackets and a number of other income tax & salary calculation variables. Completing the tax organizer will help you avoid.

Only three criteria: When you receive the spreadsheet download, you need to choose your age (for the relevant. The ‘new’ income tax rate slab for financial year fy 23.

Here, in this case, your income in 2012 falls within the. Income tax is zero (0) up to taxable income of rs.

![Free Tax Estimate Excel Spreadsheet for 2019/2020 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&ssl=1)