Out Of This World Tips About Personal Investment Record Keeping Excel

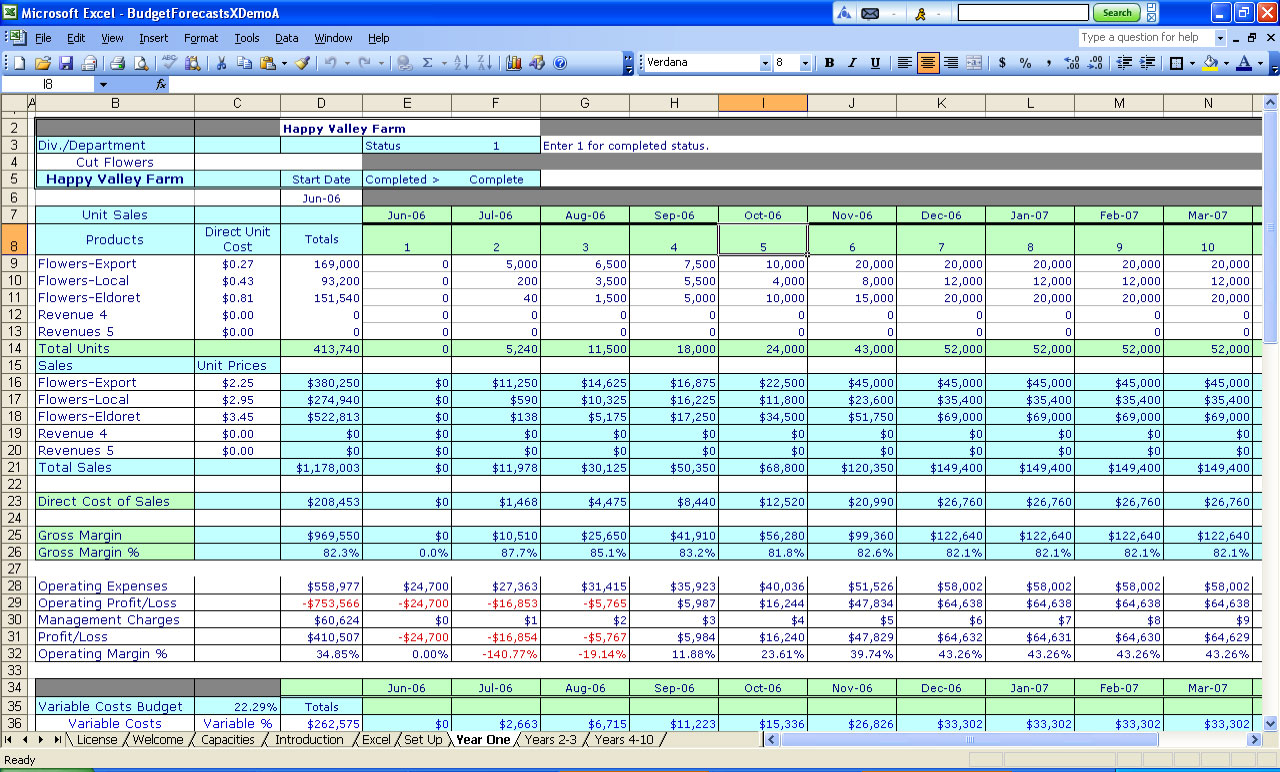

Keeping track of your investments regularly will help you reach your financial goals and mitigate risk.

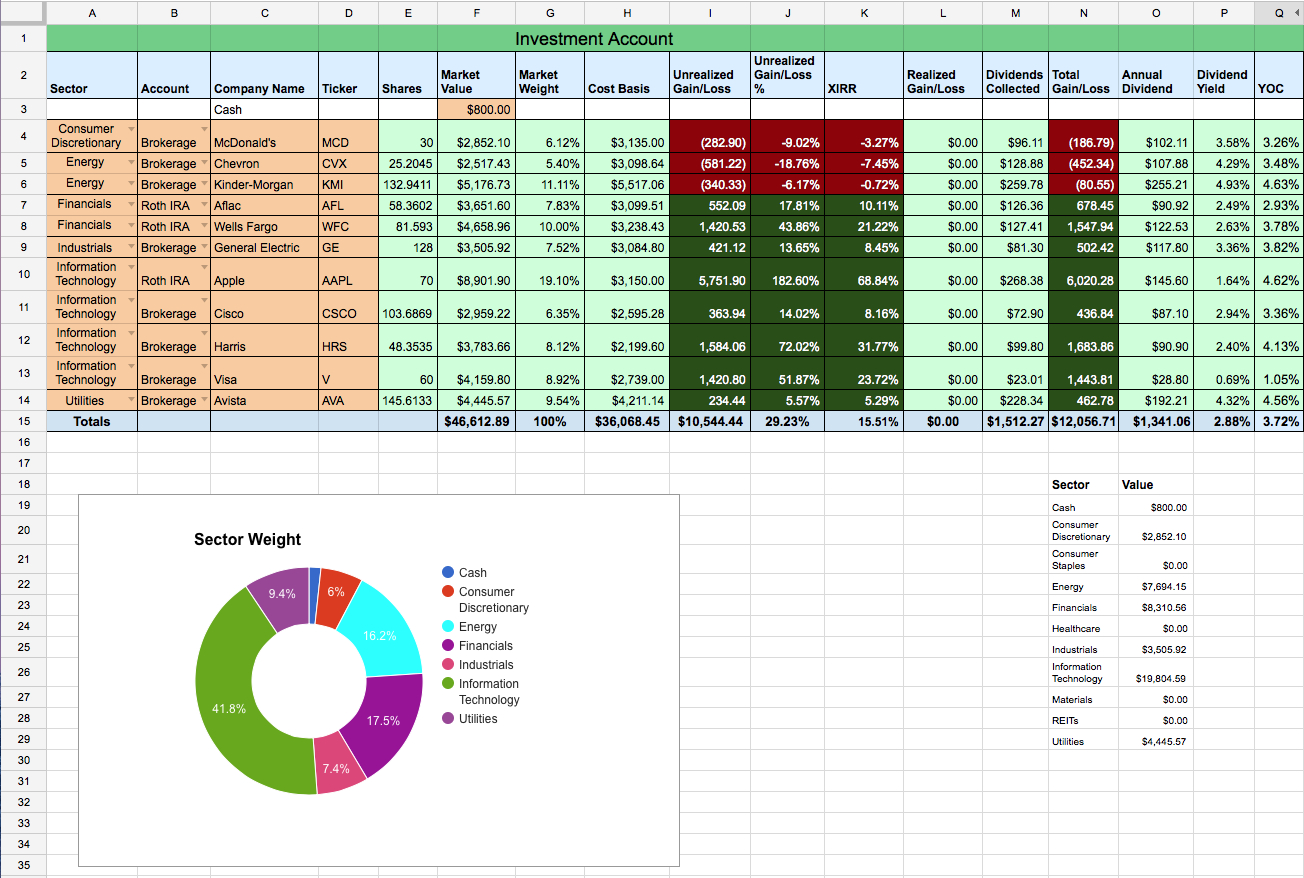

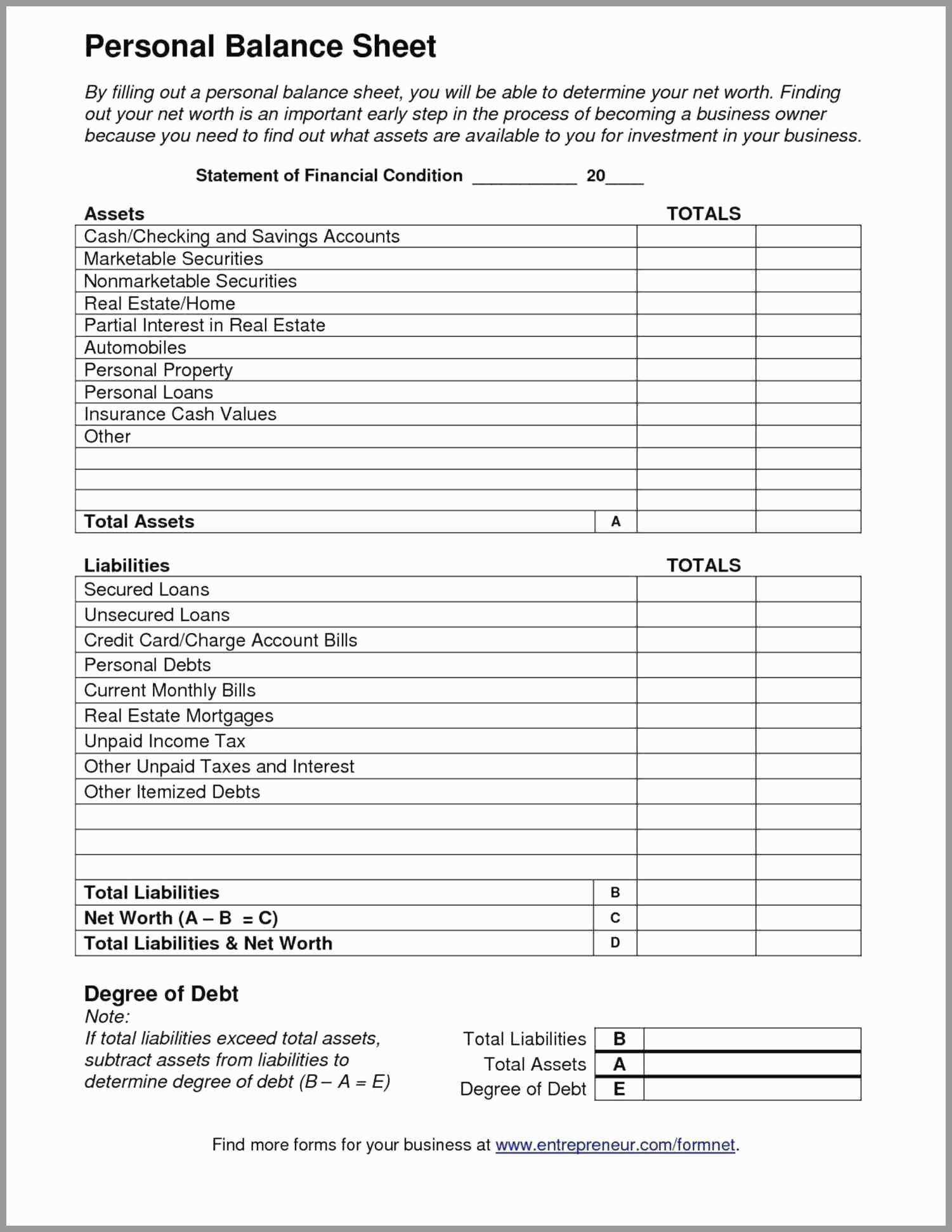

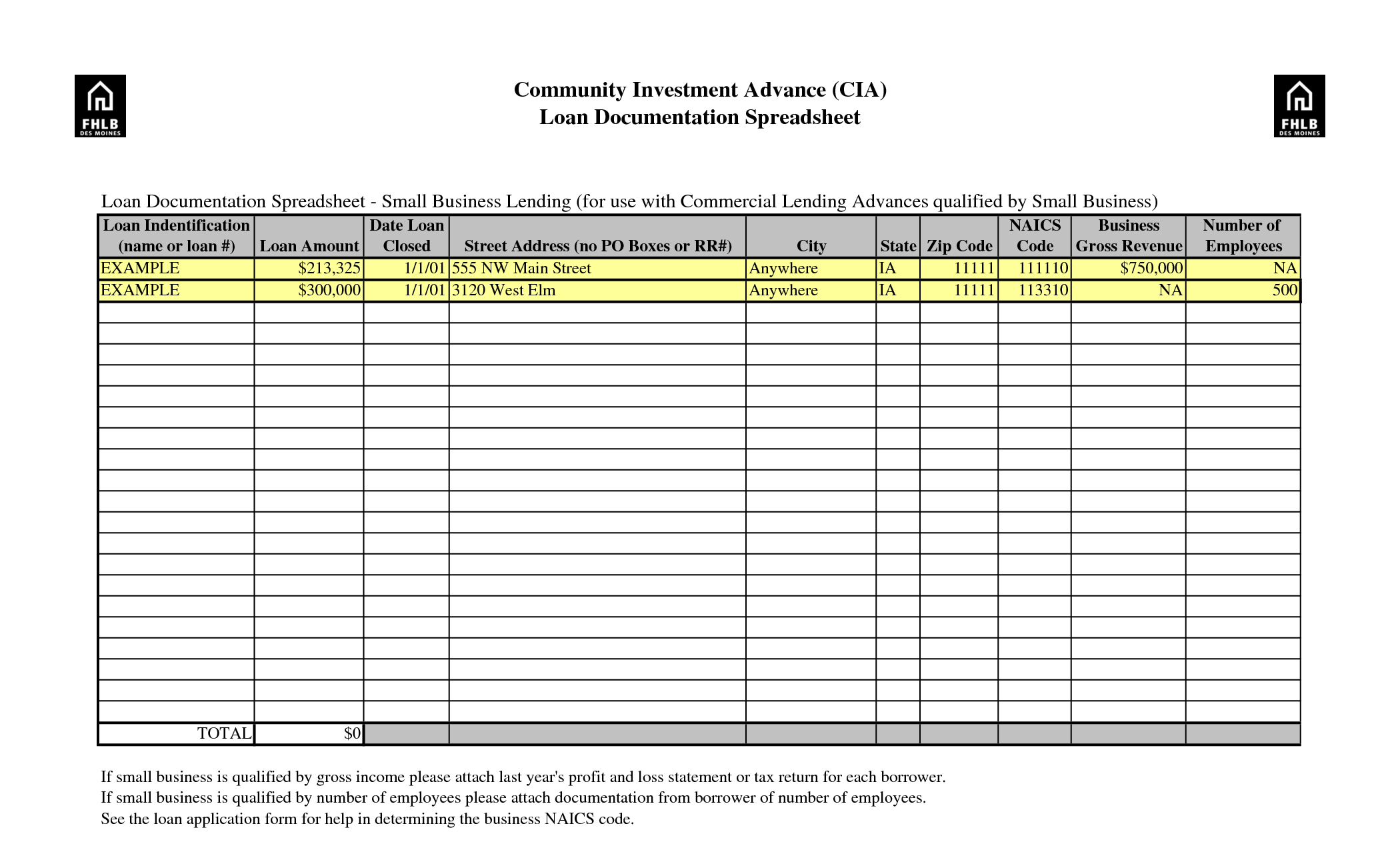

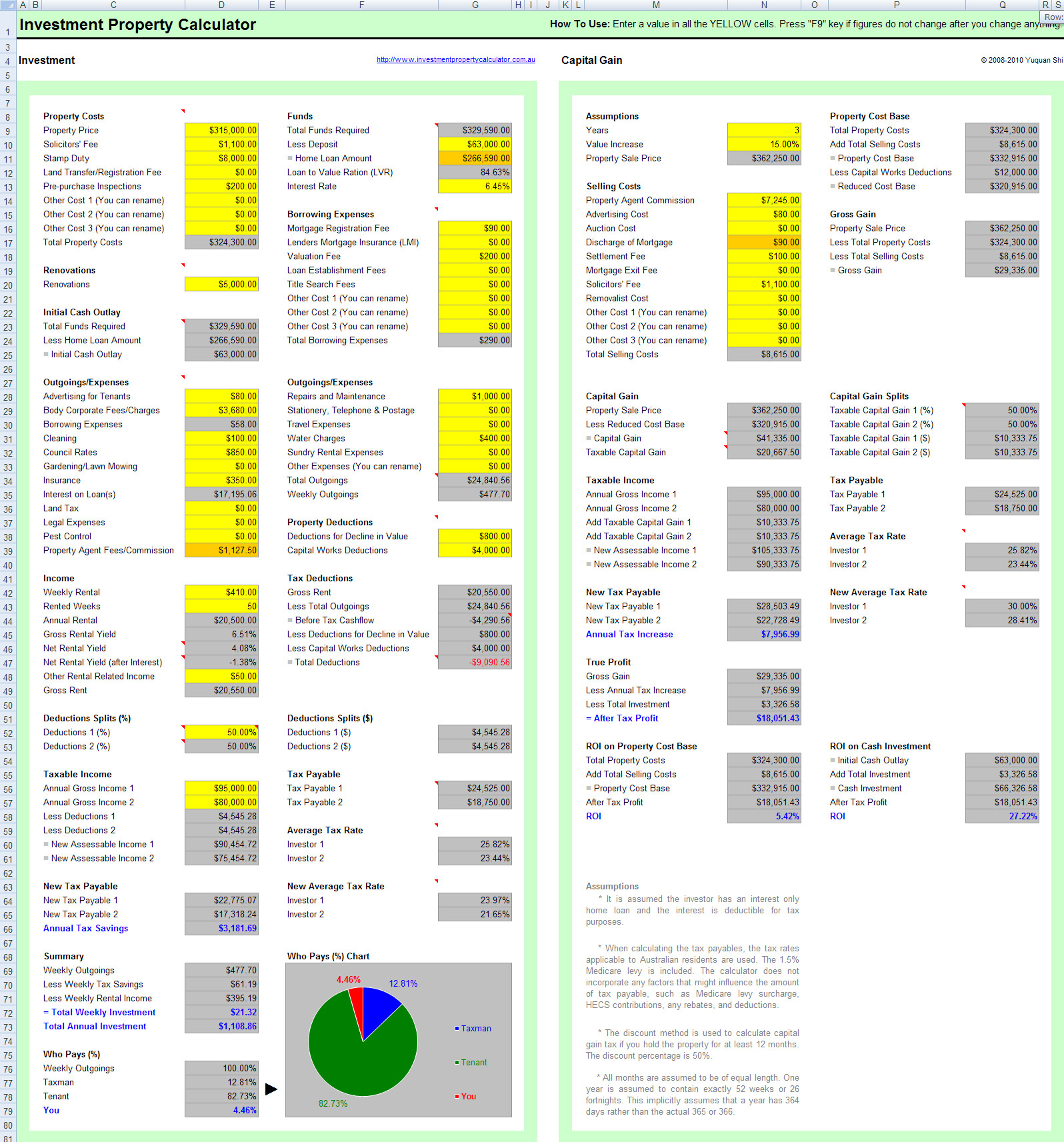

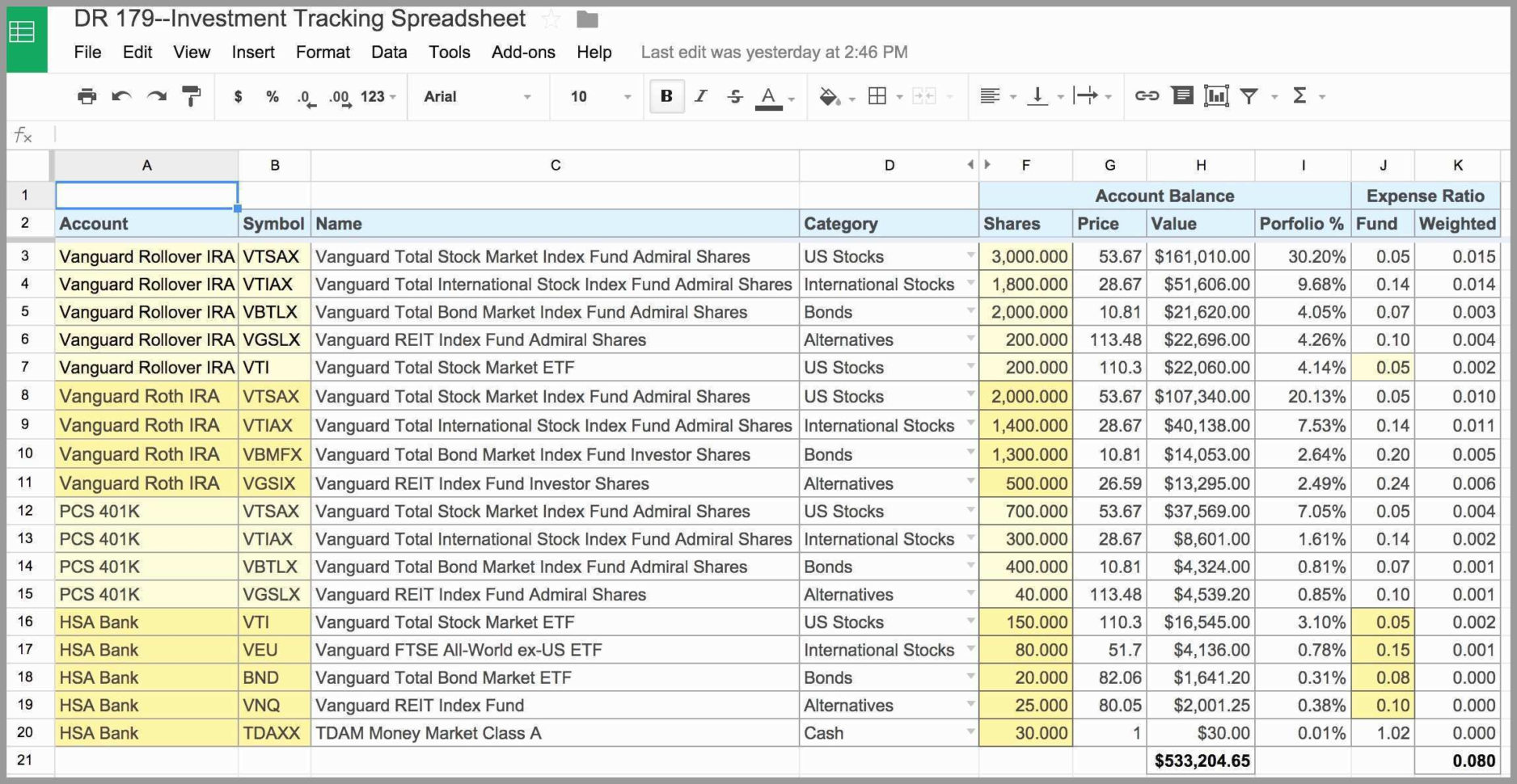

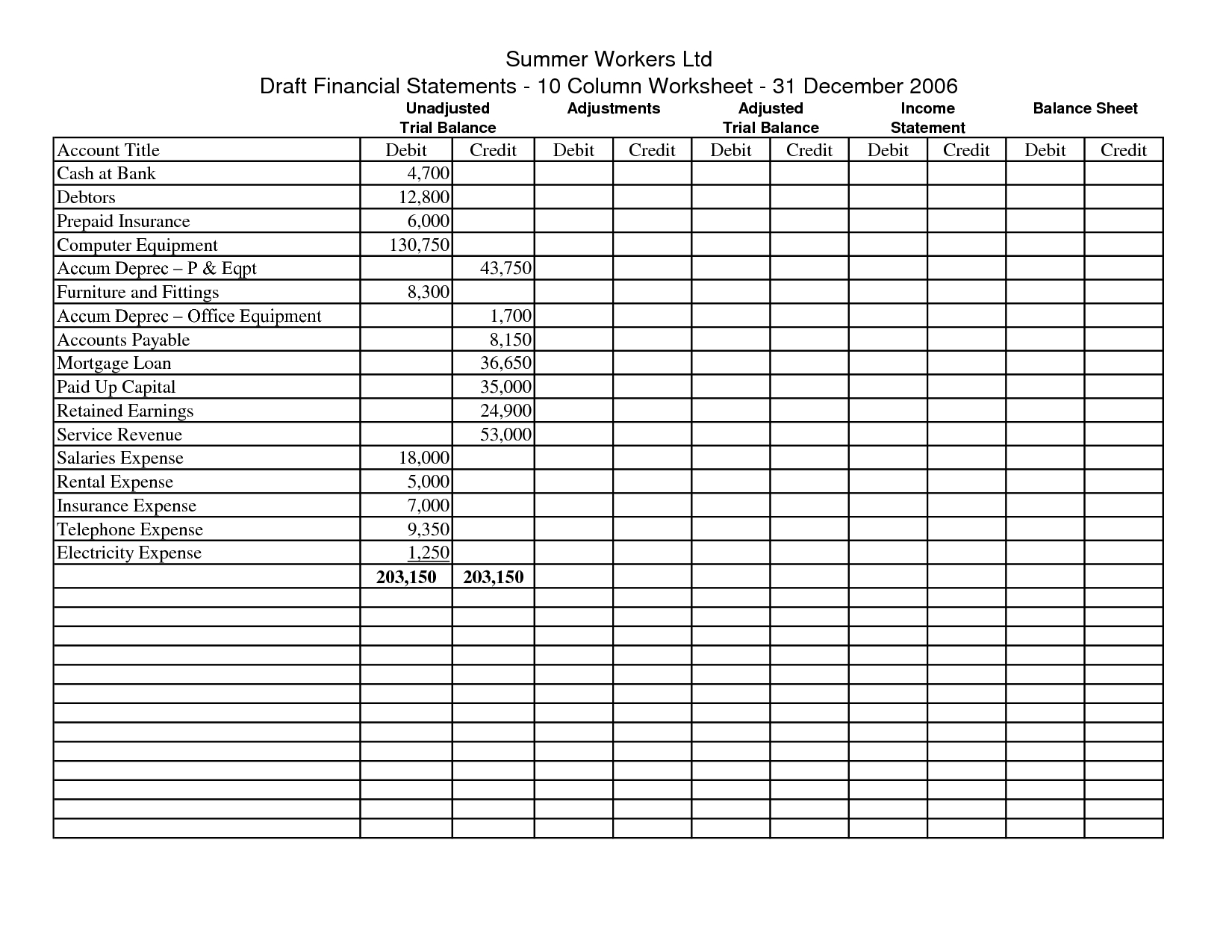

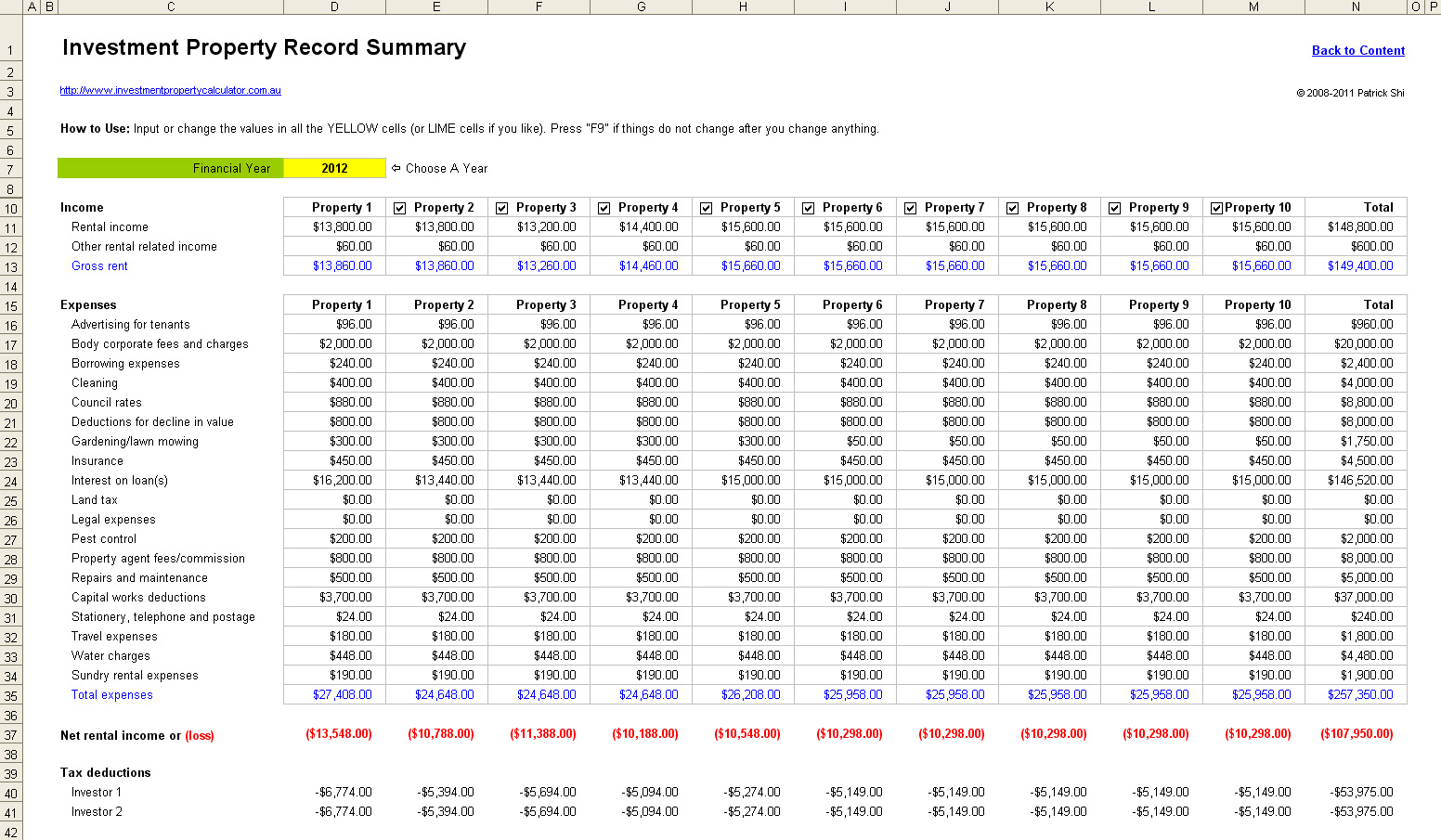

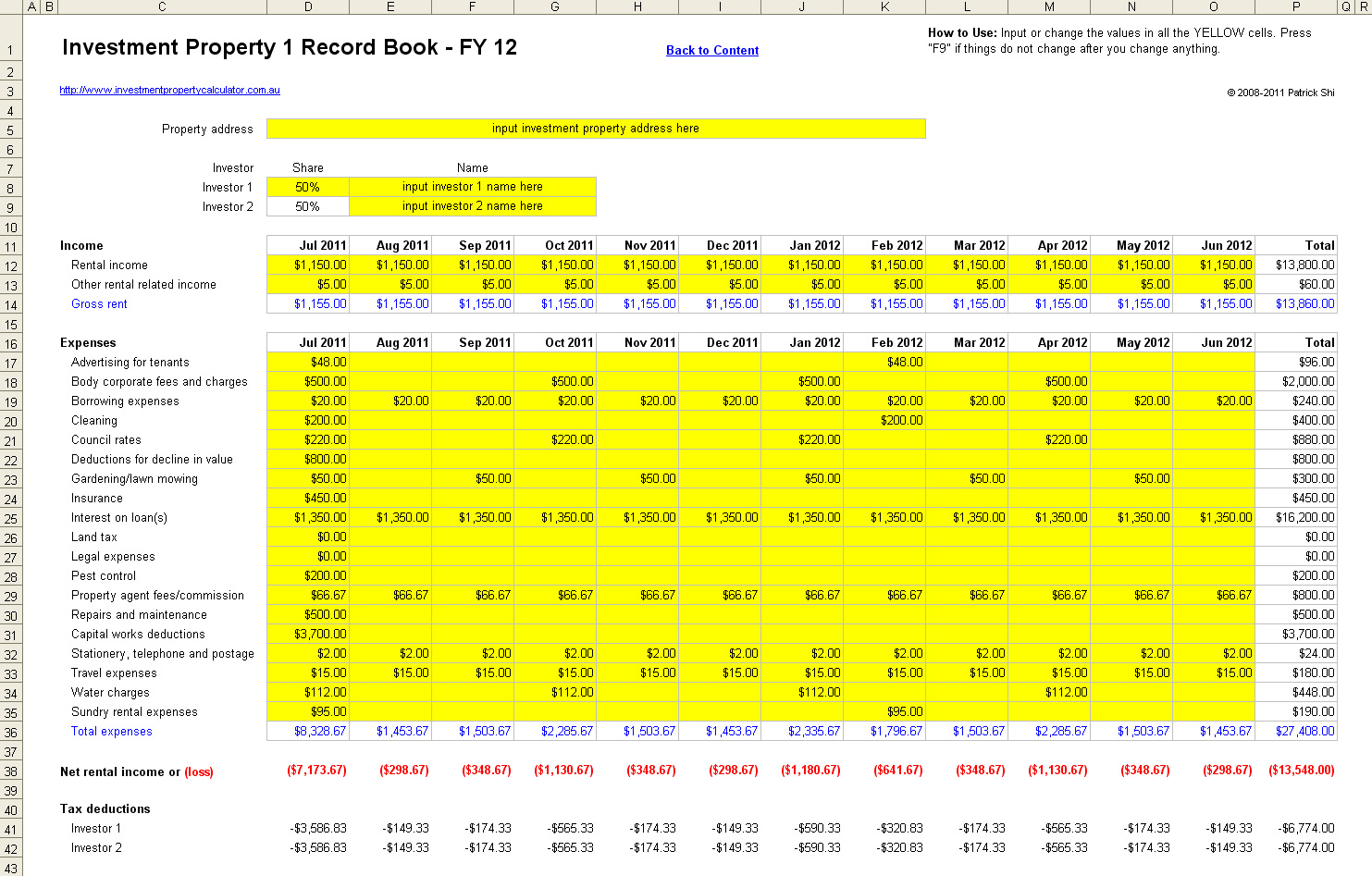

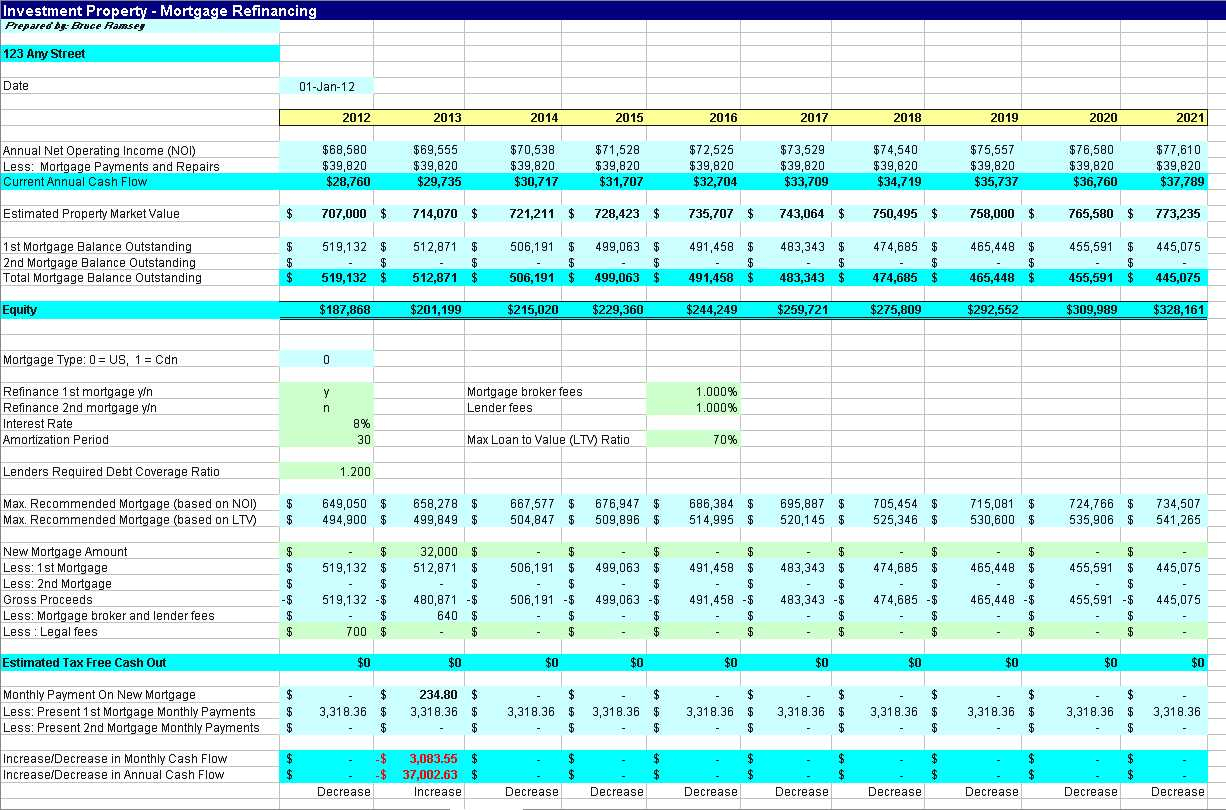

Personal investment record keeping excel. Here’s how to use money in excel to manage your personal finances right from a spreadsheet. Free investment tracking spreadsheet. If you want to take control of your investments and keep track of everything, the best thing you can do is create some kind of investment tracker.

If you prefer using spreadsheets, the best ways to track your investments are through: Want to track your savings goals? Next, you set up columns.

First of all, go ahead and open up a brand new google sheet. By edward shepard on october 4, 2023 a simple investment spreadsheet remains one of the most popular and flexible tools for tracking your portfolio. Thankfully, microsoft excel has many tools that can help you effortlessly track your investments.

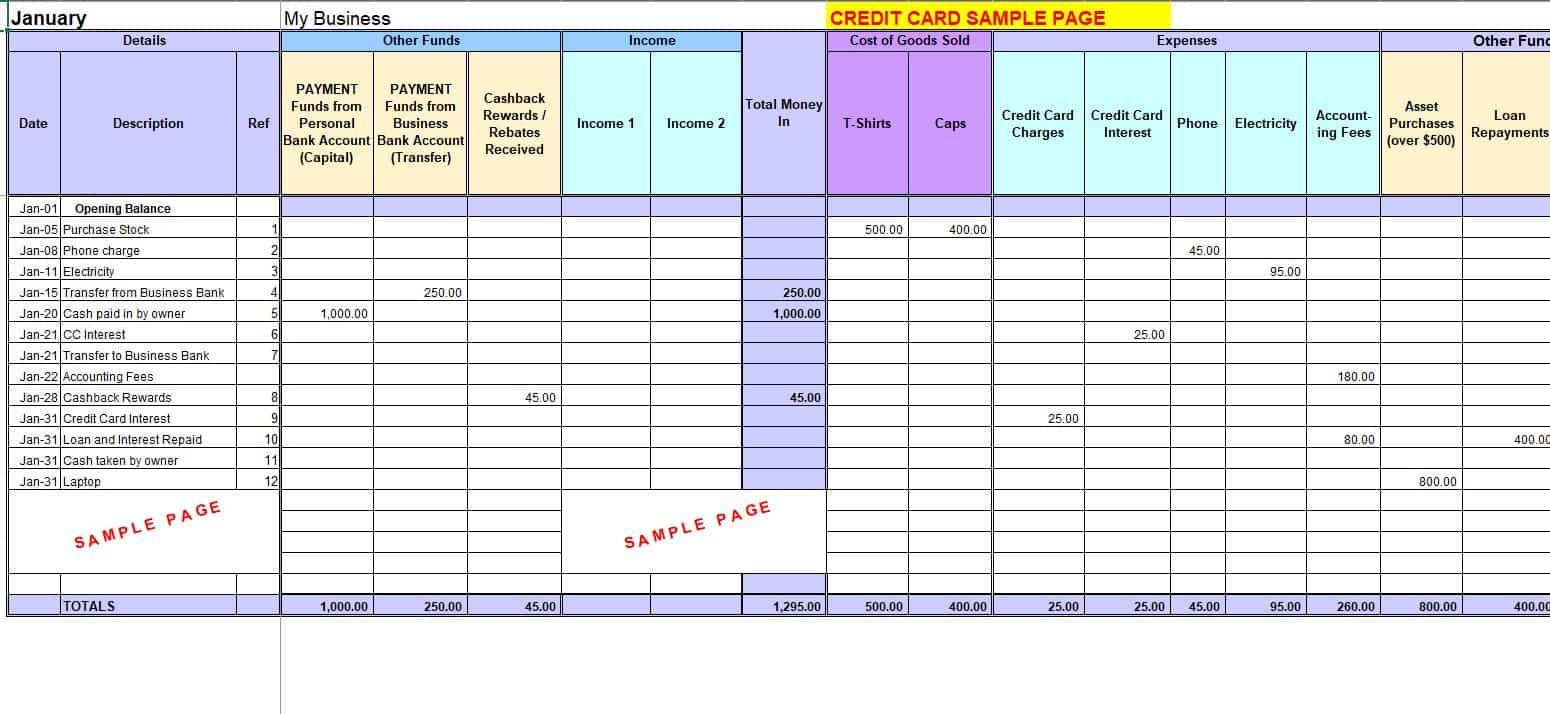

Get money in excel before you can start using money in excel, you. Explore prospective stock investments; Keeping track of personal finances in excel involves creating a structured system to keep track of income,.

Excel offers many ways for users to easily track their. Use them if you prefer the customization. Microsoft excel use this software to keep track of the cost basis of taxes on your.

You can do this by using the sum function, which is one of the. Basically, you give each stock (or bond, etf, etc.) its own row or line. Name it dividend tracking spreadsheet or something else descriptive.

26+ investment tracking spreadsheets (google sheets & excel) personal finance. The first step is to create a formula that will pull up the total amount of your bill from your list of bills on the left side. Here's a tutorial on how to create a savings tracker in excel to track multiple savings goals.

Excel makes it super simple to keep track of your investments.