Awe-Inspiring Examples Of Tips About P And L Excel

The simplified formula is:

P and l excel. January 25, 2022 a profit and loss statement (p&l) is an effective tool for managing your business. Rated 4.48 out of 5 based on 29 customer ratings. In this video you can learn how to create a p&l ( profit and loss) structure in excel in order to prepare your financial analysis or many other business finance/reports.

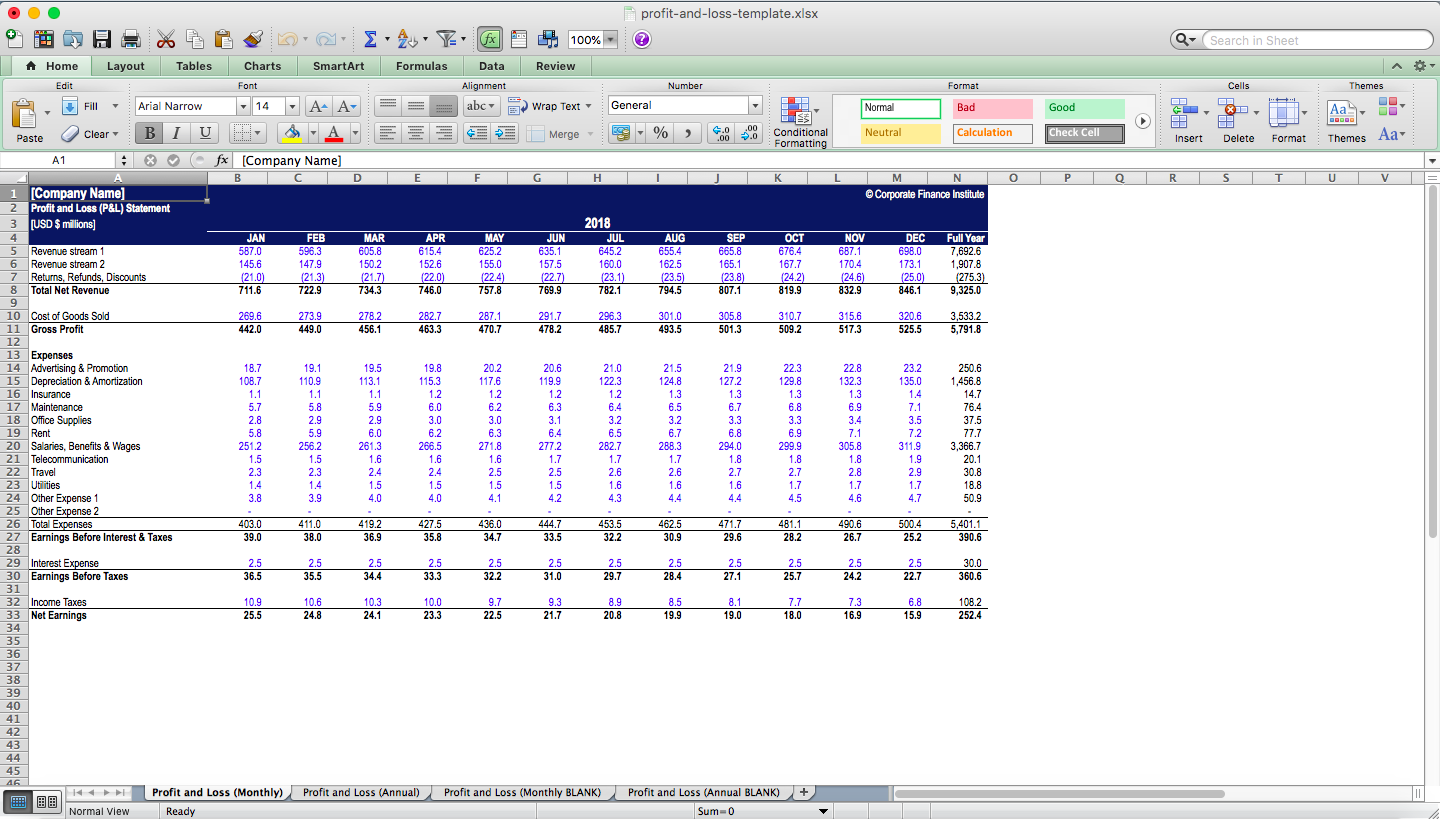

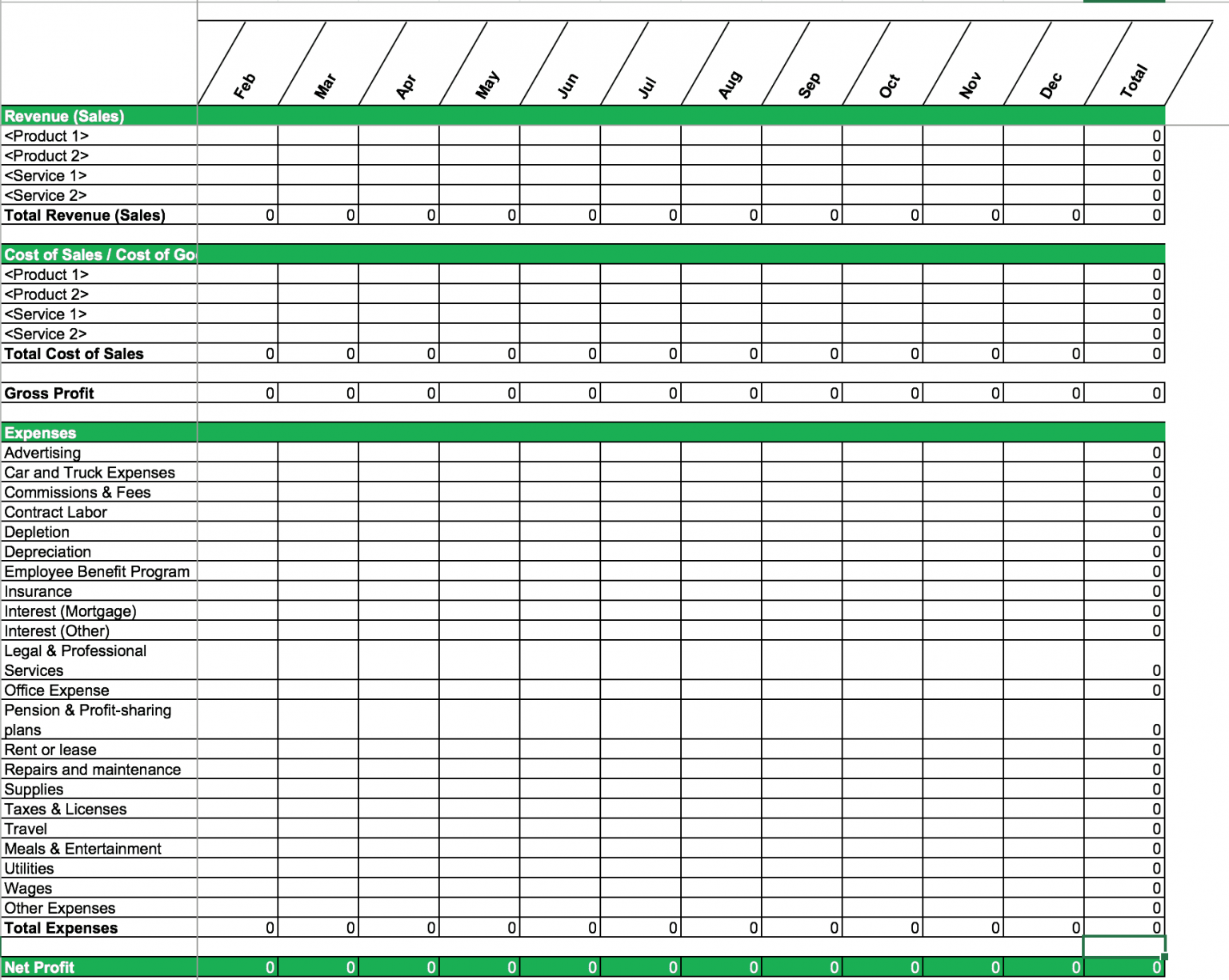

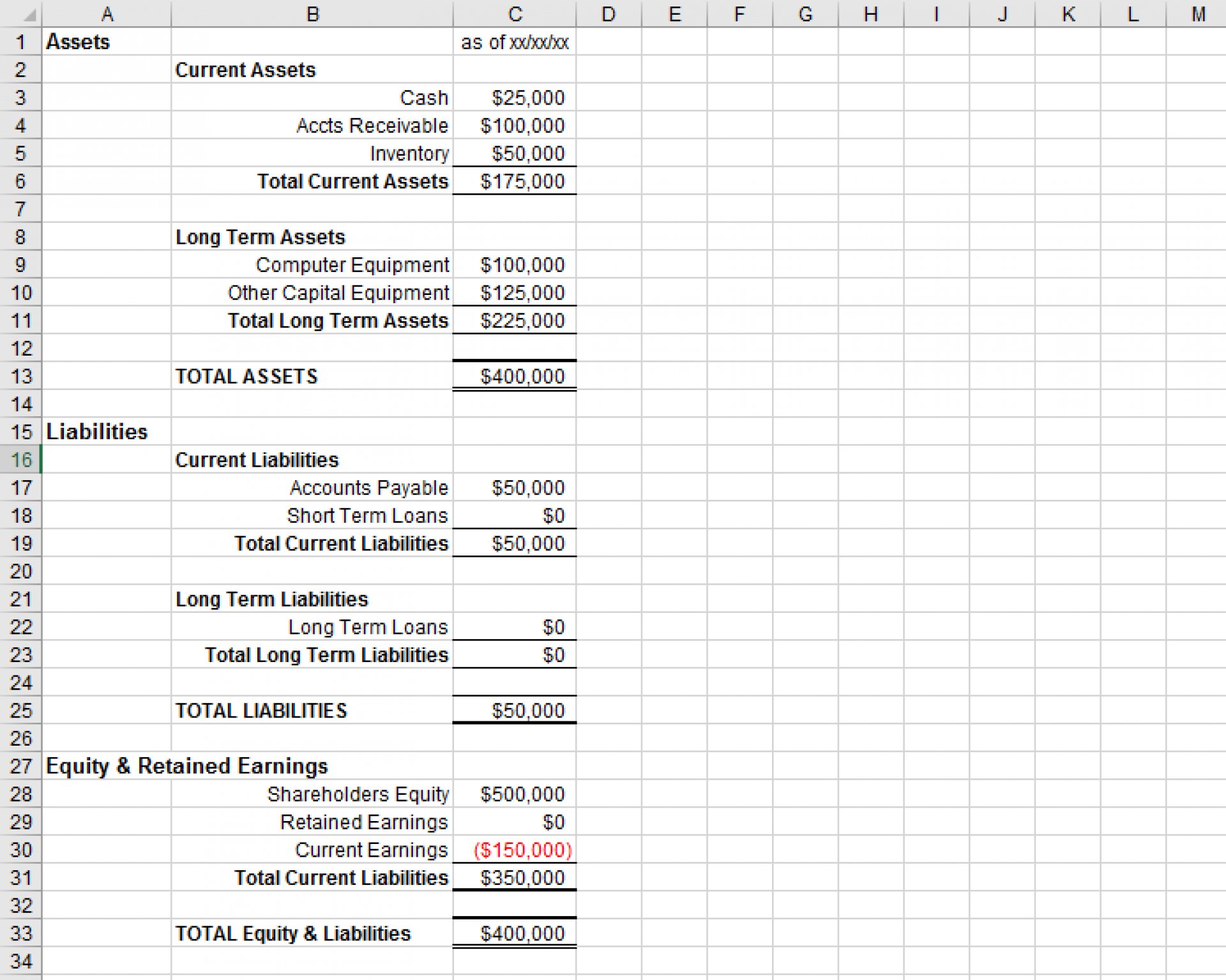

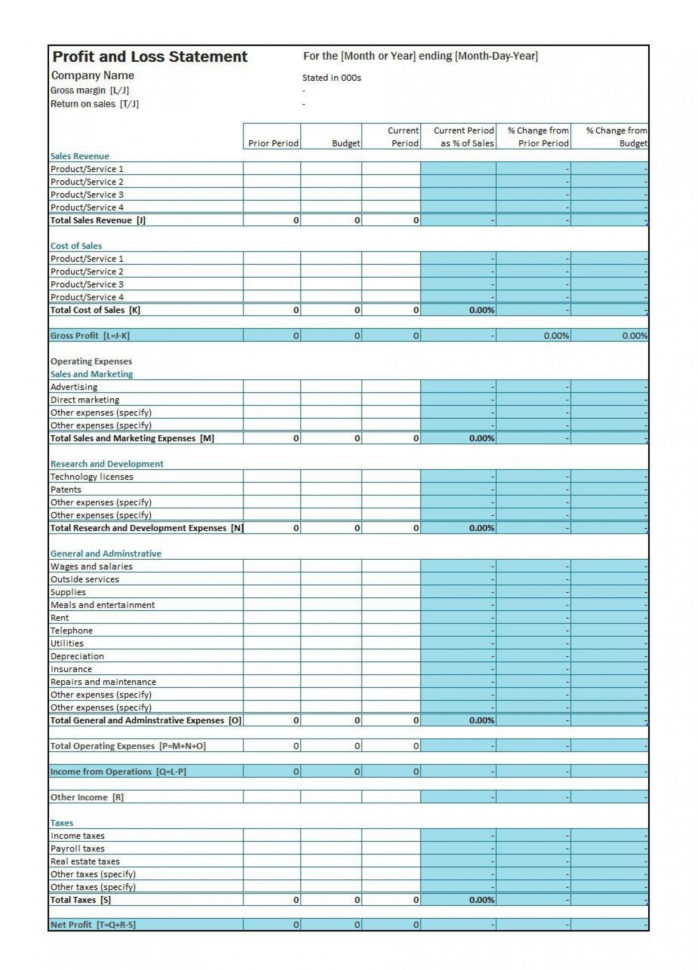

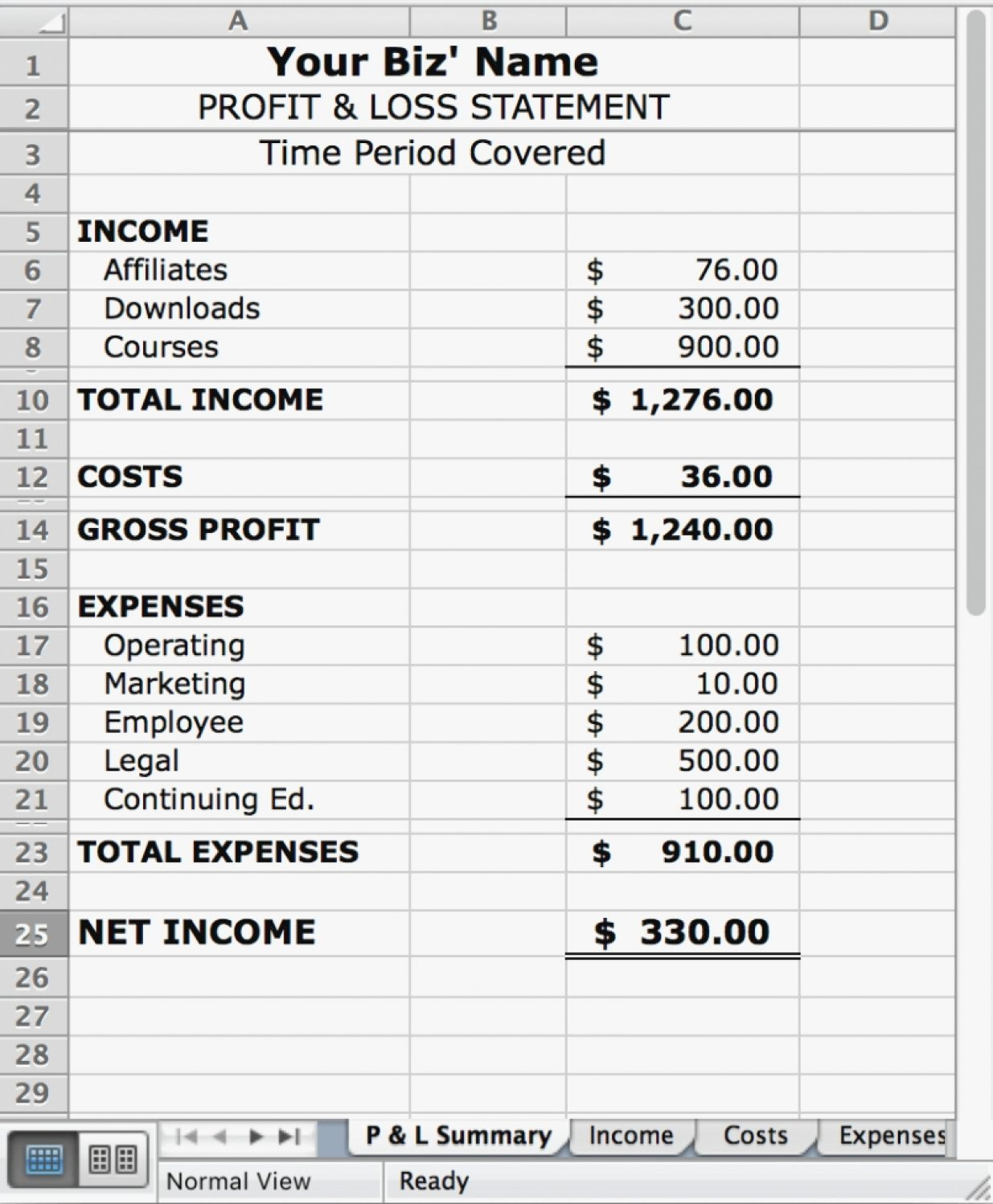

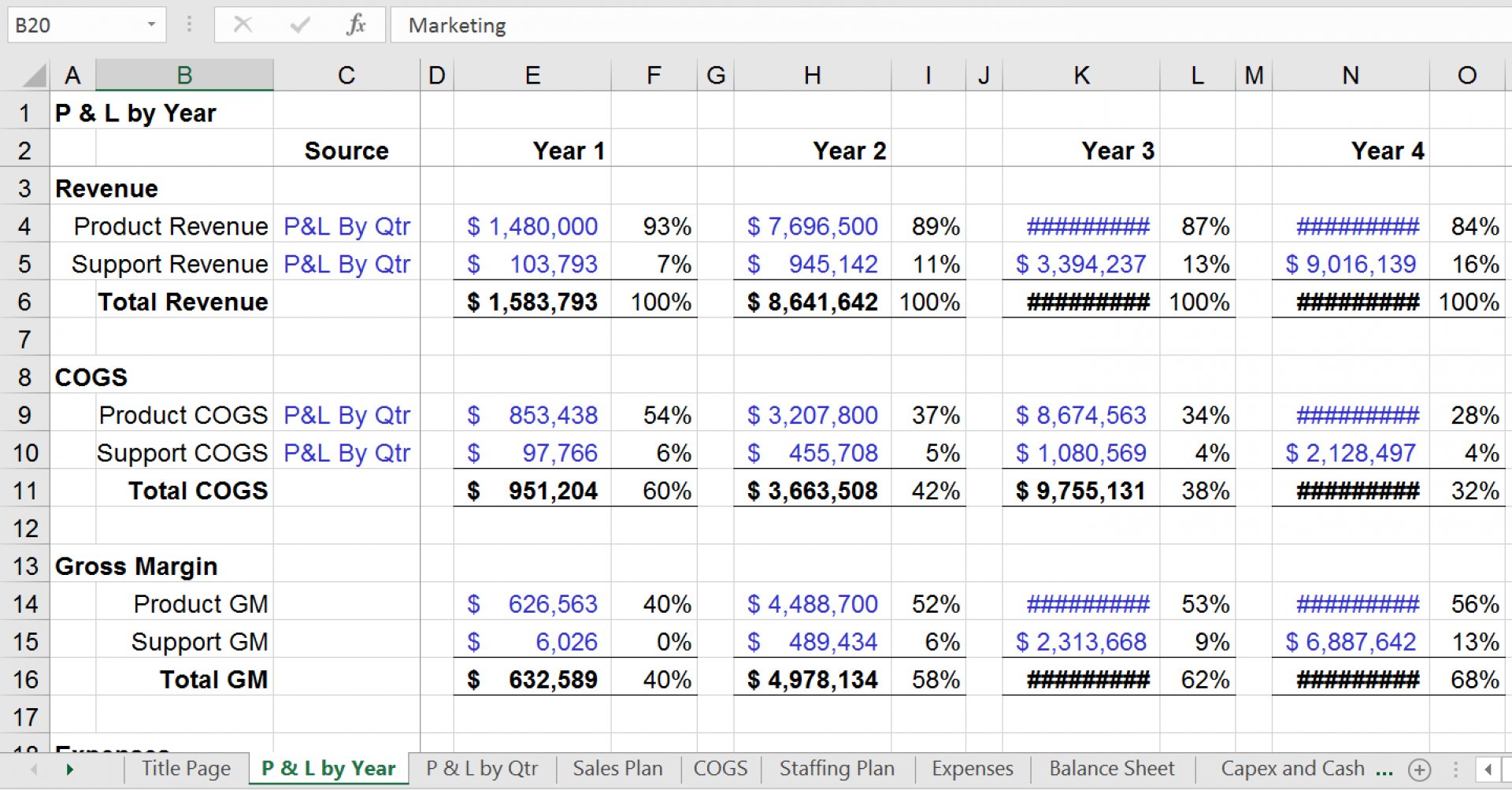

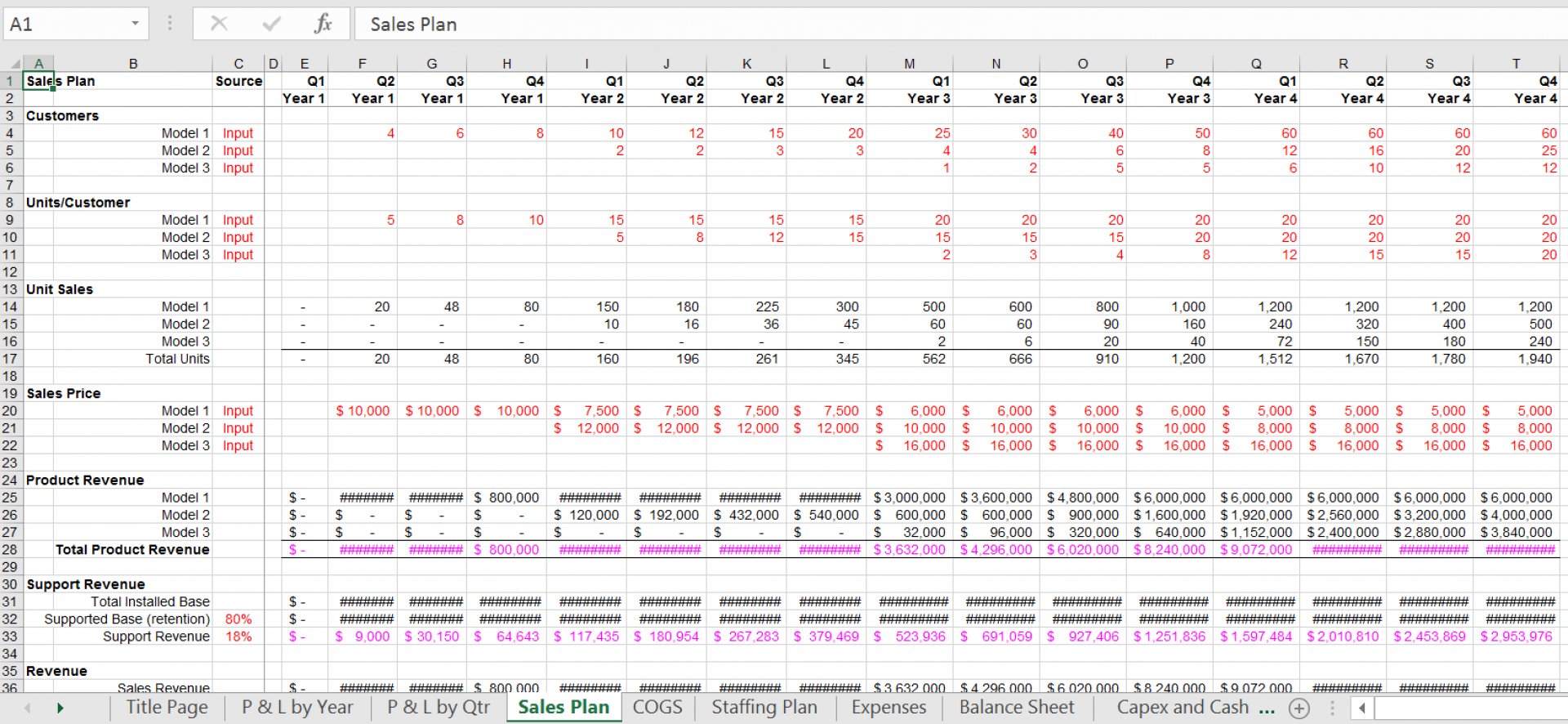

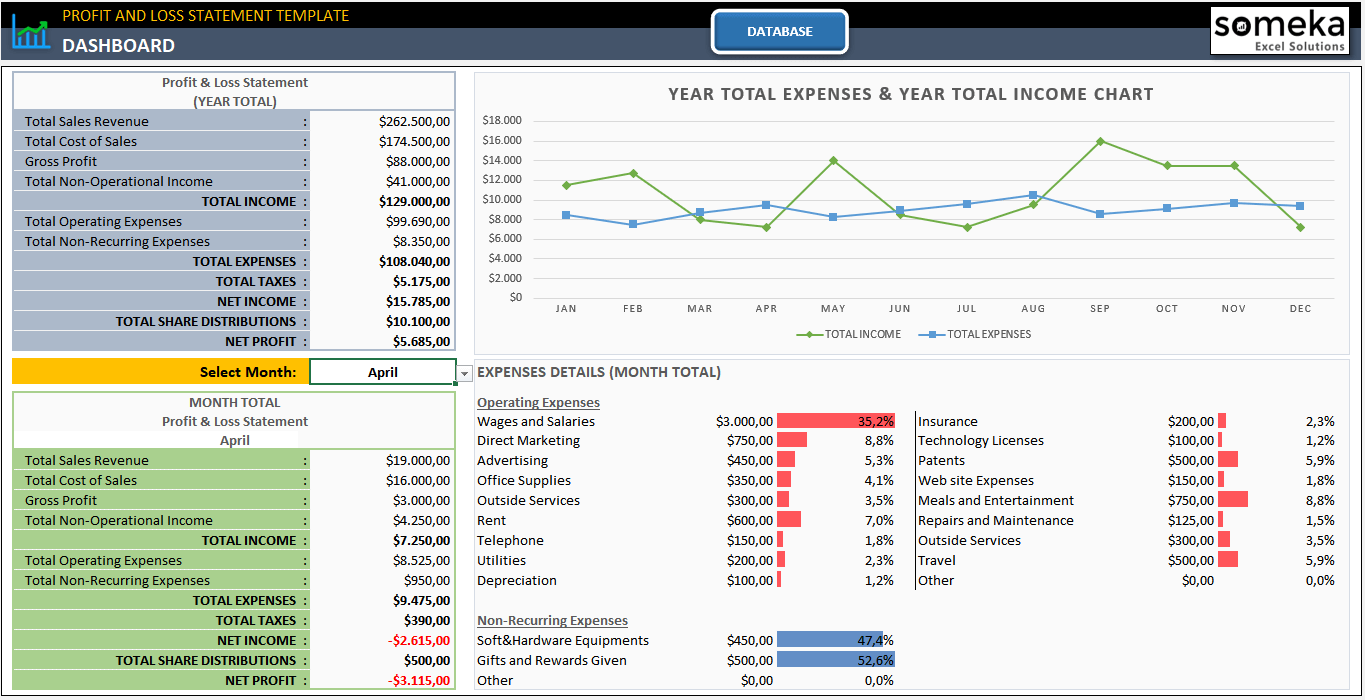

Profit and loss (p&l) statements are one of the three financial statements used to assess a company’s performance and financial position. Maintaining a profit and loss account in excel allows you to make informed business decisions that improve your chances of profitability over time. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and.

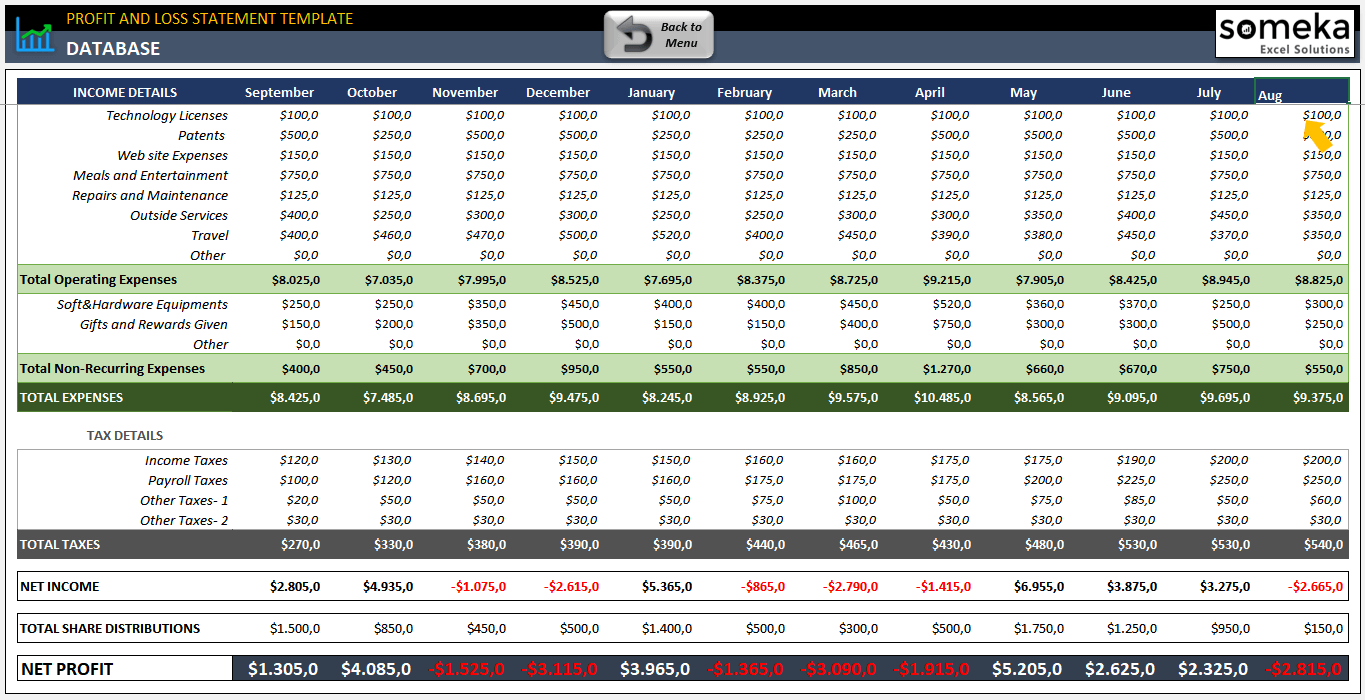

Introduction creating a profit and loss (p&l) statement is crucial for businesses to track their financial performance. 4.48 ( 29 reviews ) profit and loss statement template built in excel. Download template profit and loss (p&l) statement template key features provides detailed data on your business revenues and expenses including additional costs and.

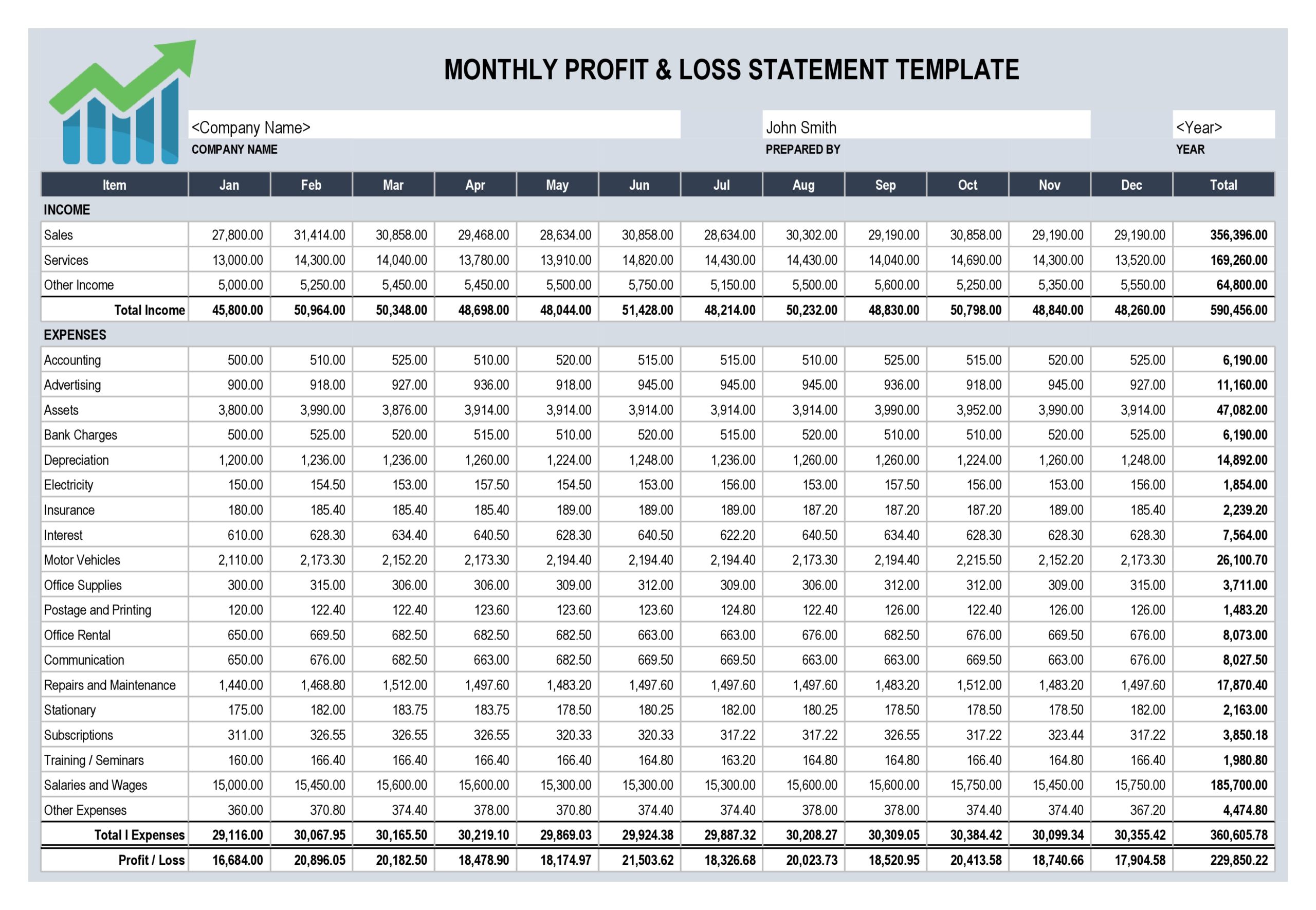

Statement maintenance is crucial to monitoring finance. What is a profit and loss statement? The following excel spreadsheet provides a template of a typical profit and loss statement (also known as a statement of income), which may be useful for your small business.

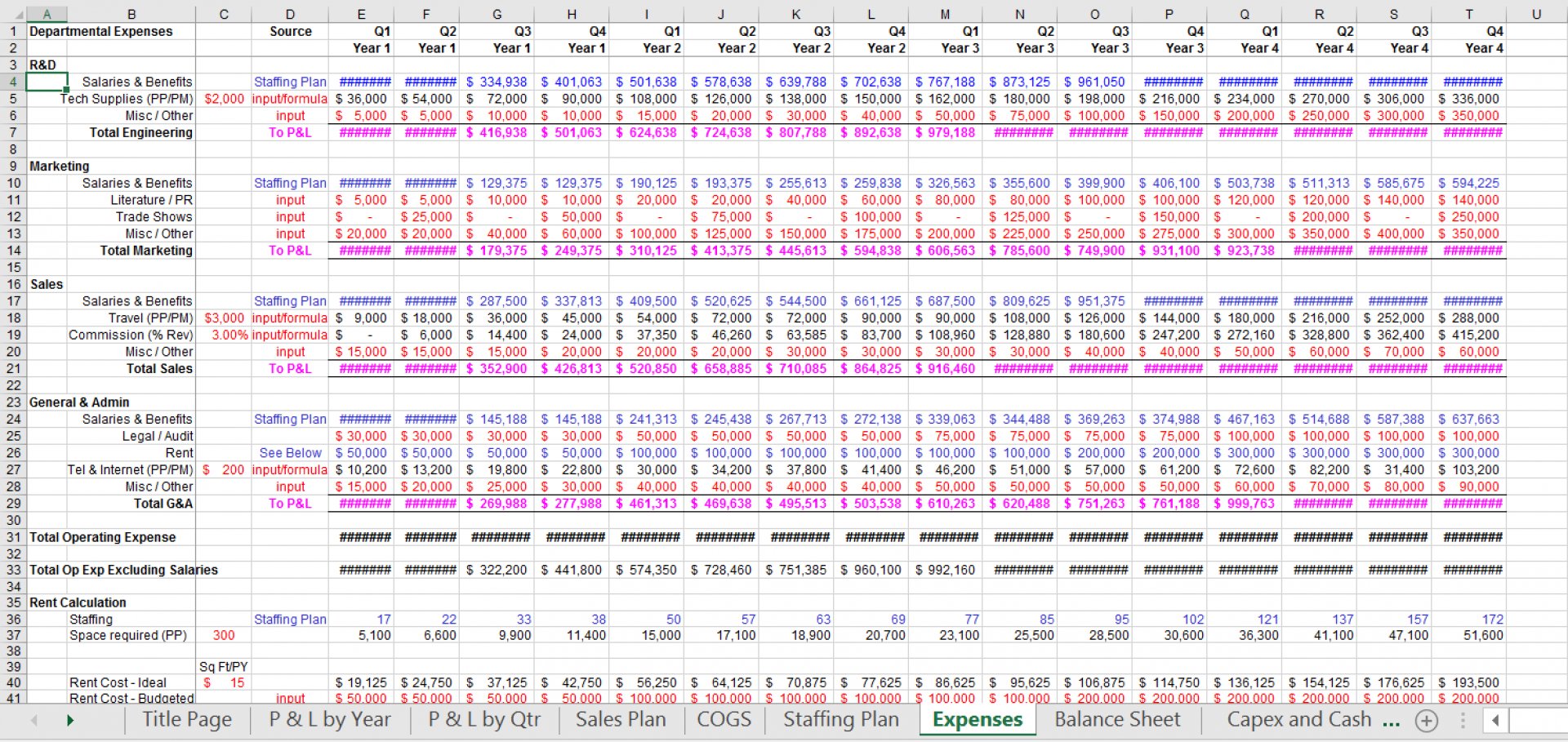

Data points like gross margins, margin % , operating profit and operating profit % will be calculated in pivot table using calculated field option. There are times when you want to view the whole year’s figures in one place, allowing you to see. Berikut adalah beberapa rumus excel penjumlahan dan cara menggunakannya:

It gives you a financial snapshot of how much money you’re making (or losing). Rumus excel sum adalah rumus penjumlahan. Profit and loss statement excel template.

This profit and loss (p&l) statement template summarizes a company’s income and expenses for a period of time to arrive at its net earnings for the period. Keep an extended record of each reporting period by creating a column for each month or quarter.