Beautiful Tips About 50 20 30 Budget Template

Commissions do not affect our editors' opinions or.

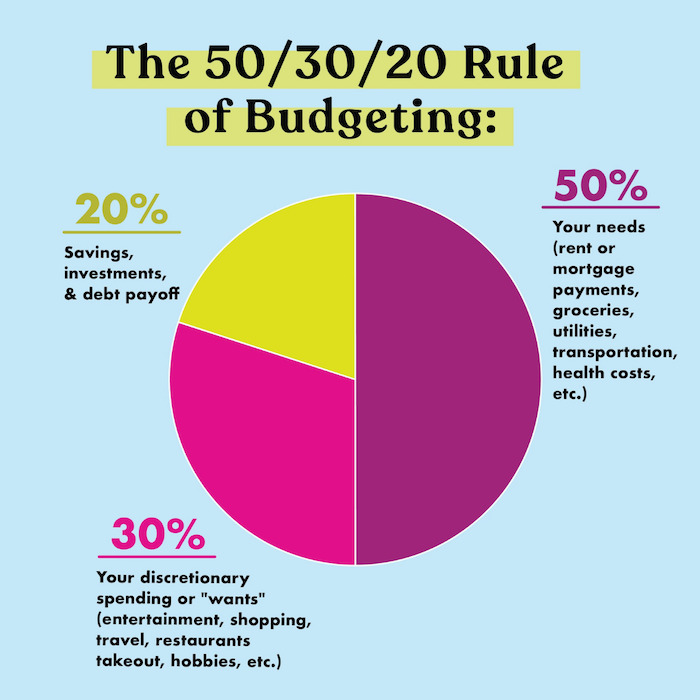

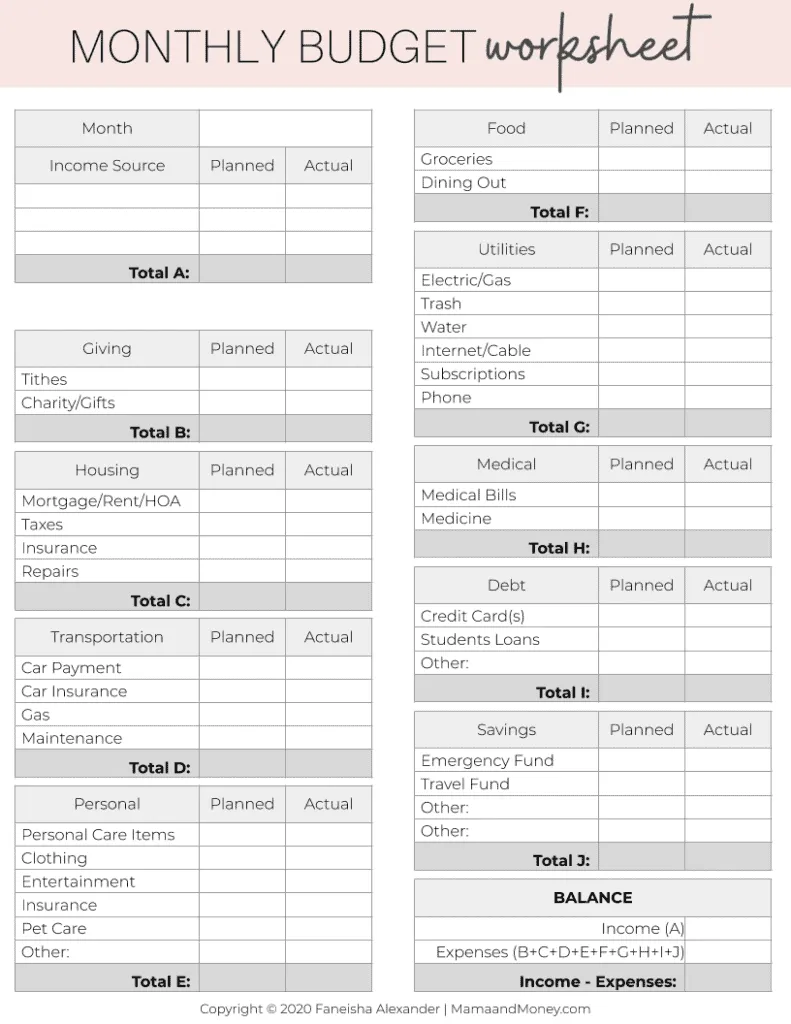

50 20 30 budget template. 50% for needs, 30% for wants, 20% for savings and debt. Use our free monthly budget template below to ensure that your monthly budget is set and spent according to the recommendations. They include expenses that you cannot avoid on a monthly basis.

The 50/30/20 budget in a nutshell. With that information, the worksheet shows how your finances compare with the 50/30/20 budget breakdown, which recommends that 50% of your income goes. 50% of your income on living expenses (rent, mortgage, groceries, bills transportation, etc.).

Let’s break down each category into additional details. Oct 26, 2023, 9:41am editorial note: Our free monthly budget sheet will show you.

Yes, a 401(k) can count as. You will first calculate what. 50% needs needs are expenses that are vital to living.

30% of your income on wants and. We earn a commission from partner links on forbes advisor. What’s the best way to get started with budgeting using the 50/30/20 method?

All 15 are 100% free! One of the reasons the 50/30/20 budget is popular is because it allows for 30% of a consumer’s income to go toward discretionary spending. Best yearly budget template:

The rule is a template that is intended to help individuals manage their money, to balance paying for necessities with saving for emergencies and retirement. These excel templates will help you. Calculate monthly income at the very beginning, we’ve to make an income section where the total monthly income will be mentioned.

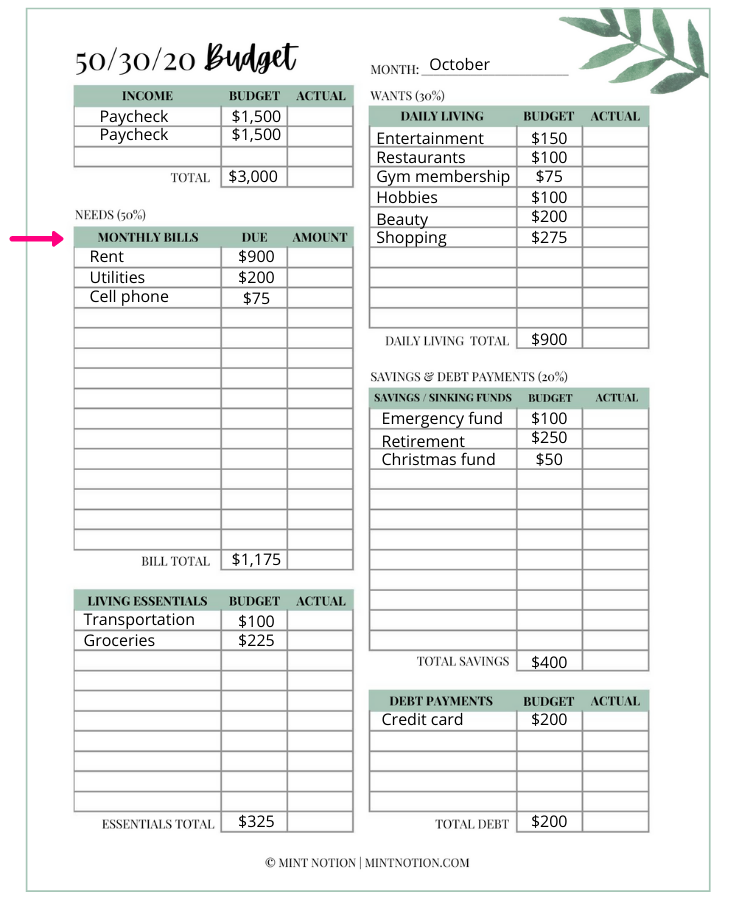

Examples of the 50/30/20 rule. 50 30 20 budget template. If you apply the 50/30/20 rule, you’d allocate:

Download the 50/30/20 budget template now for the fun part!